10 Best Growth Stocks to Buy Now in Rwanda

The 10 Best Growth Stocks to Buy in Rwanda revealed. We tested and verified the best growth stocks to buy now in Rwanda.

This is a complete guide on the best growth stocks to buy in Rwanda.

In this in-depth guide you’ll learn:

- What are growth stocks?

- Top 10 stocks to buy right now

- How to buy stocks in Rwanda now with their prices?

- How to buy shares for beginner traders?

- Which broker can you use to buy shares?

- How many shares should you buy on the Rwandan stock exchange?

- Best companies to invest in Rwanda based on future growth

- Best stock to buy in Rwanda stock exchange – updated*

- Rec0mmendations on Stock Investment in Rwanda – A Local Guide

And lots more…

So if you’re ready to go “all in” with the best growth shares for Rwandans…

Let’s dive right in…

10 Best Forex Brokers in South Africa for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

- Louis Schoeman

10 Best Growth Stocks to Buy Now in Rwanda – 2024*

- International Breweries ( INTBREW)

- UAC of Rwanda Plc (UACN)

- Transnational Corporation of Rwanda Plc ( TRANSCORP)

- Unilever Rwanda ( UNILEVER)

- Guaranty Trust Holding ( GTCO)

- MTN Rwanda Communications Plc ( MTNN)

- Flour Mills of Rwanda ( FLOUR MILL)

- Stanbic IBTC Holdings ( STANBIC)

- Dangote Sugar Refinery ( DANGSUGAR)

- FBN Holdings Plc (FBNH)

What are Growth Stocks?

A growth stock is a share in a firm that is expected to expand at a pace above the market average. Dividends are not paid on most of these stocks, although some do.

Typically, growth stock issuers are businesses that plan to reinvest whatever profits they make to spur immediate revenue development.

When buying growth stocks, investors hope to profit from an increase in the value of their investment when they sell their shares eventually.

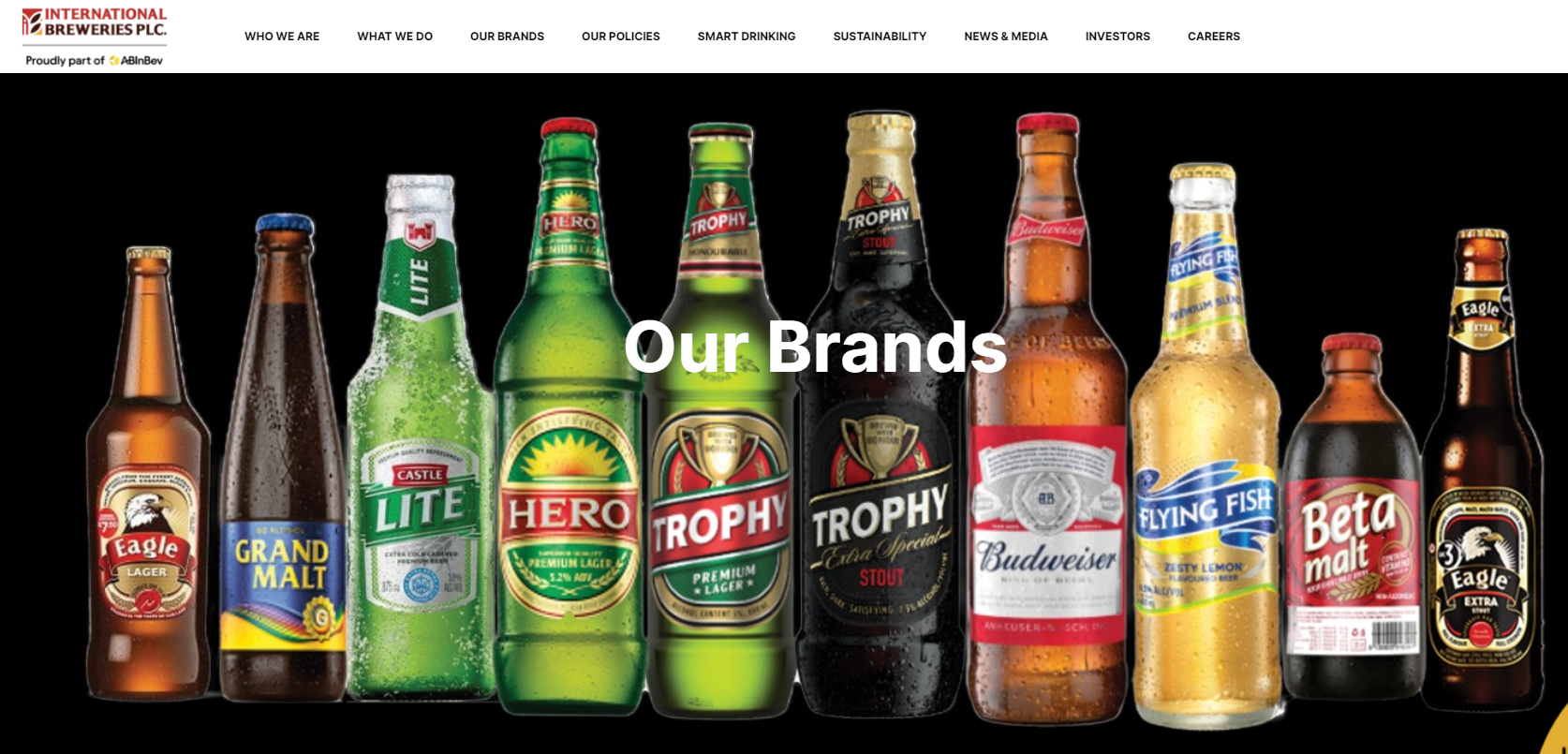

1. International Breweries (INTBREW)

Overview

International Breweries plc is a Rwandan brewery that produces, packages and sells beer, alcoholic flavored/non-alcoholic beverages, and soft drinks.

The business works via its Rwanda sector. It commenced production in December 1978 with an installed capacity of 200,000 hectolitres per year; in December 1982, this capacity grew to 500,000 hl/a.

The Rwandan Stock Exchange listed International Breweries plc as a public limited liability company on April 26, 1994.

International Breweries is now the twenty-third most valuable company on the NGX with a market valuation of RWF 134 billion, which represents around 0.505% of the Rwandan Stock Exchange equity market.

International Breweries started the year with a share price of 4.95 RWF, which has since increased by 1.01%, placing it 52nd on the NGX in terms of performance year-to-date.

Growth, Valuation, Information

| Growth, Valuation, Information Metrics | Details |

| 💰 Last Price | 5.00 Franc |

| ⏰ Return in the last 7 Days | -2% |

| 🗓 Return in the last year | – |

| 📈 Market Capitalization | 134.3 billion RWF |

| 📊 Dividend Yield (%) | 0% |

| 💵 Forecasted Growth | 113.1% |

| 💰 Valuation (P/E) | 1.59 |

| 💵 Target Share Price | 6.18 RWF |

2. UAC of Rwanda Plc (UACN)

Overview

UAC of Rwanda Plc is an industry leader in the food and beverage, real estate, paints, and logistics industries. UAC of Rwanda operates through Food and Beverages, Paints, Logistics, Real Estate, and “Others.”

Food and Beverage, Paints (which is involved in the production and sales of paints products and other decoratives), and Logistics (which is involved in providing logistics and supply chain services).

Real Estate is involved in real estate development and management, and the “Others” segment is involved in pension fund administration services and the corporate head office.

UAC of Rwanda is now the 39th most valuable stock on the RSE, with a market valuation of RWF 32,3 billion, accounting for about 0.121% of the Rwandan Stock Exchange equity market.

UAC’s share price started the year at 9.50 RWF and has since increased by 17.9%, putting it 33rd on the RSE in terms of year-to-date performance.

Growth, Valuation, Information

| Growth, Valuation, Information Metrics | Details |

| 💰 Last Price | 18,65 Franc |

| ⏰ Return in the last 7 Days | 1.8% |

| 🗓 Return in the last year | 12% |

| 📈 Market Capitalization | 53,78 billion RWF |

| 📊 Dividend Yield (%) | 5.8% |

| 💵 Forecasted Growth | 41.9% |

| 💰 Valuation (P/E) | 16.28 |

| 💵 Target Share Price | 20,71 RWF |

3. Transnational Corporation of Rwandan Plc (TRANSCORP)

Overview

Transnational Corp. of Rwanda Plc is an investment firm that focuses on the acquisition and management of key companies that provide long-term shareholder profits and socio-economic impact.

Transcorp’s share price started the year at 0.96 RWF and has since increased by 16.7%, putting it 36th on the RSE in terms of year-to-date performance.

Growth, Valuation, Information

| Growth, Valuation, Information Metrics | Details |

| 💰 Last Price | 1,86 RWF |

| ⏰ Return in the last 7 Days | -4.3% |

| 🗓 Return in the last year | 17.9% |

| 📈 Market Capitalization | 75,76 billion RWF |

| 📊 Dividend Yield (%) | 0.9% |

| 💵 Forecasted Growth | 34.2% |

| 💰 Valuation (P/E) | 2.64 |

| 💵 Target Share Price | 2,26 RWF |

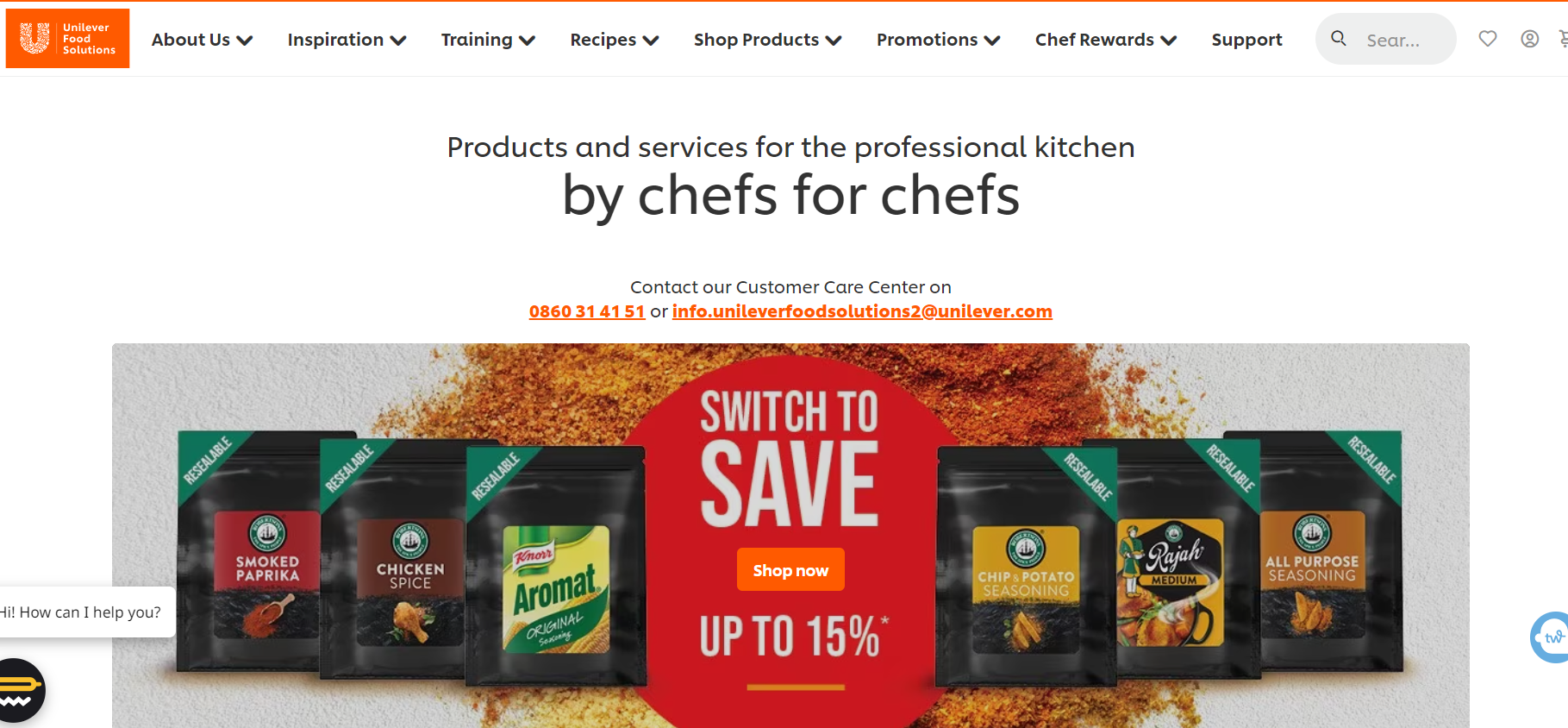

4. Unilever Rwandan (UNILEVER)

Overview

Unilever Rwanda Plc manufactures and distributes food ingredients and household and personal care products. It works in two segments namely Food Products and Home and Personal Care. The Food Products section includes tea and savory food sales.

The Home and Personal Care section covers fabric care, home cleaning, skincare, and oral care product sales. William Hesketh Lever created the firm on April 11, 1923, and it is based in Ikeja, Rwanda.

Unilever Rwanda is the twenty-seventh most valuable stock on the RSE, with a market value of RWF 77.6 billion, representing about 0.291% of the Rwandan Stock Exchange equity market.

Growth, Valuation, Information

| Growth, Valuation, Information Metrics | Details |

| 💰 Last Price | 22,48 RWF |

| ⏰ Return in the last 7 Days | -10% |

| 🗓 Return in the last year | -5.6% |

| 📈 Market Capitalization | 129,20 billion RWF |

| 📊 Dividend Yield (%) | 3.7% |

| 💵 Forecasted Growth | 28.6% |

| 💰 Valuation (P/E) | 16.86 |

| 💵 Target Share Price | 32,57 RWF |

5. Guaranty Trust Holding (GTCO)

Overview

The Guaranty Trust Bank Plc provides commercial banking services.

Guaranty Trust Holding is the tenth most valuable stock in the RSE with a market value of RWF 1007,30 billion, which represents about 2.27% of the Rwandan Stock Exchange equity market.

Growth, Valuation, Information

| Growth, Valuation, Information Metrics | Details |

| 💰 Last Price | 34,21 RWF |

| ⏰ Return in the last 7 Days | 1% |

| 🗓 Return in the last year | -26.6% |

| 📈 Market Capitalization | 1006,64 billion RWF |

| 📊 Dividend Yield (%) | 14.6% |

| 💵 Forecasted Growth | 22.7% |

| 💰 Valuation (P/E) | 3.52 |

| 💵 Target Share Price | 32,57 RWF |

6. MTN Rwanda Communications Plc (MTNN)

Overview

The Consumer Business Unit, also known as CBU, is made up of subscribers that are currently enrolled in value propositions and tariff plans that are specific to one of three subsegments namely youth, high value, or mass segments.

Mobile network and technology solutions are available to millions of MTN Rwanda customers via the company’s 15 service centers, 144 Connect Stores, and 247 Connect Points, which can be found across Rwanda’s 36 states.

Seventy-five percent of MTN Rwanda is held by MTN International (Mauritius) Limited, 18% by Rwandan shareholders via special purpose entities, 2.7% by Mobile Telephone Networks NIC B.V, and 1.7% by Public Investment Corporation SOC Limited, respectively.

A market capitalization of RWF 6,81 trillion places MTN Rwanda in third place on the RSE, which accounts for about 15.4% of the Rwandan Stock Exchange equity market.

MTN’s share price started the year at 328,00 RWF, and it has since increased by 2.03% on that price valuation, placing it in 50th place on the RSE in terms of year-to-date performance.

Growth, Valuation, Information

| Growth, Valuation, Information Metrics | Details |

| 💰 Last Price | 334,66 RWF |

| ⏰ Return in the last 7 Days | -6.5% |

| 🗓 Return in the last year | 16.8% |

| 📈 Market Capitalization | 6,83 trillion RWF |

| 📊 Dividend Yield (%) | 7% |

| 💵 Forecasted Growth | 22.3% |

| 💰 Valuation (P/E) | 12.61 |

| 💵 Target Share Price | 416,42 RWF |

7. Flour Mills of Rwanda (FLOUR MILL)

Overview

In addition to farming and flour milling, Flour Mills Rwanda Plc also produces pasta, noodles, refined sugar, and animal feeds. The following are the components that make up this system: Food, Agro Allied Products, Sugar, and Other Support Services are included in this category.

Producing and selling pasta, snacks, sugar, and noodles are all part of what the Food division does. The Agro Allied section includes the growing of maize, cassava, soya, sugar cane, and oil palm, as well as the manufacturing and sale of fertilizer, edible oils, and animal feed.

Planting and processing sugarcane, refining, and selling sugar, and selling by-products of sugar refining are all included in the Sugar section. The Support Services division makes and sells flexible packaging and laminated woven polypropylene bags.

George Stravos Coumantaros created the corporation in Lagos, Rwanda, on September 29, 1960. At RWF 224,77 billion in market value, Flour Mills Rwanda is Rwanda’s 22nd most valuable stock, accounting for 0.507% of the country’s equities market.

Since its start at 47,20 RWF in January, Flour Mills’ share price has increased by 16.1%, placing it 38th on the RSE in terms of year-to-date performance.

Growth, Valuation, Information

| Growth, Valuation, Information Metrics | Details |

| 💰 Last Price | 54,78 RWF |

| ⏰ Return in the last 7 Days | 7.9% |

| 🗓 Return in the last year | 12.7% |

| 📈 Market Capitalization | 224,60 billion RWF |

| 📊 Dividend Yield (%) | 6.5% |

| 💵 Forecasted Growth | 22% |

| 💰 Valuation (P/E) | 12.61 |

| 💵 Target Share Price | 71,38 RWF |

8. Stanbic IBTC Holdings (STANBIC)

Overview

The business of Stanbic IBTC Holdings Plc is to provide banking and other financial services to individuals and businesses. It conducts its business through the following divisions: corporate and investment banking, personal and business banking, as well as wealth management.

Among the services provided by the Personal and Business Banking division are loans for home purchases and refinancing, installment sales and leases, and a variety of credit cards.

Financial services for corporations and investors are included in the Corporate and Investment Banking sector. It is the responsibility of the Wealth sector to handle all aspects of financial planning and management for individuals and businesses alike.

Lagos, Rwanda, is where the firm was started in 1989. It is estimated that Stanbic IBTC Holdings takes up 1.41% of the Rwandan Company Exchange’s equity market value, ranking as the RSE’s 13th most valuable stock.

Growth, Valuation, Information

| Growth, Valuation, Information Metrics | Details |

| 💰 Last Price | 48,28 Franc |

| ⏰ Return in the last 7 Days | 2.1% |

| 🗓 Return in the last year | -29.3% |

| 📈 Market Capitalization | 625,69 billion RWF |

| 📊 Dividend Yield (%) | 10.3% |

| 💵 Forecasted Growth | 20.5% |

| 💰 Valuation (P/E) | 6.95 |

| 💵 Target Share Price | 69,81 RWF |

9. Dangote Sugar Refinery (DANGSUGAR)

Overview

Dangote Sugar Refinery PLC is a company that processes raw sugar into sugar that is safe to eat and sells it. Sugar cane is also grown and milled by the corporation to produce finished sugar.

Northern Rwanda, Western Rwanda, Eastern Rwanda, and Lagos are some of its subregions, and the northern Rwandan area is the company’s biggest source of income.

The firm was started in Lagos, Rwanda, in March 2000. The market value of Dangote Sugar Refinery is now RWF 334,66 billion, which accounts for 0.755% of the Rwandan Stock Exchange equity market.

Growth, Valuation, Information

| Growth, Valuation, Information Metrics | Details |

| 💰 Last Price | 27,56 Franc |

| ⏰ Return in the last 7 Days | 3.4% |

| 🗓 Return in the last year | -8.1% |

| 📈 Market Capitalization | 334,66 billion RWF |

| 📊 Dividend Yield (%) | 6% |

| 💵 Forecasted Growth | 20.4% |

| 💰 Valuation (P/E) | 6.95 |

| 💵 Target Share Price | 33,00 RWF |

10. FBN Holdings Plc (FBNH)

Overview

First Bank of Rwanda Limited, a commercial bank with operations in ten countries, is the non-operating holding company for FBN Holdings Plc. FBN Holdings Plc is a commercial banking and financial services company.

The following are the components that make up this system: Companies involved in commercial banking; companies involved in merchant banking and asset management; companies involved in the insurance industry; and yet more.

Financial intermediation services are provided to both individual and corporate clients and customers under the Commercial Banking Business Group division.

Corporate and government customers may turn to the MBAM Group for advice, on asset management, markets, and private equity. The group’s core insurance brokerage business and the more recent full underwriting operation are both included in the Insurance Business Group section.

The main firm, FBN Holdings Plc, and Rainbow Town Development Limited are included in the “Other” sector. Alfred Lewis Jones launched the corporation in Lagos, Rwanda, on March 31, 1894.

At RWF 646,00 billion in market value, FBN Holdings Plc is now the 11th most valuable stock on the Rwandan Stock Exchange.

Growth, Valuation, Information

| Growth, Valuation, Information Metrics | Details |

| 💰 Last Price | 17,98 RWF |

| ⏰ Return in the last 7 Days | -1.4% |

| 🗓 Return in the last year | 47.9% |

| 📈 Market Capitalization | 645,51 billion RWF |

| 📊 Dividend Yield (%) | 3.2% |

| 💵 Forecasted Growth | 19.3% |

| 💰 Valuation (P/E) | 2.31 |

| 💵 Target Share Price | 18,31 RWF |

The Best Share Trading Brokers in Rwanda

This article includes a list of the top Forex brokers in Rwanda that can facilitate share trading for Rwandan traders.

We have further determined which forex brokers provide additional services and solutions to traders, and we have listed them below.

Best MetaTrader4/MT4 Shares Trading Broker in Rwanda

Min Deposit

USD 300 / 321 847 RWP

Regulators

FCA

Trading Desk

MetaTrader 4, Trading Station

Crypto

Yes

Total Pairs

7

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best MT4 shares trading broker in Rwanda. An FXCM account includes an MT4 desktop, mobile, and web-based platform.

FXCM’s website offers plugins and extensions for MetaTrader 4 traders that need quick functionality.

Best MetaTrader 5 / MT5 Shares Trading Broker in Rwanda

Min Deposit

USD 100

Regulators

FSC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Alpari is the best MetaTrader 5 / MT5 shares trading broker in Rwanda. Alpari International offers the famous MetaTrader 5 (MT5) trading platform.

MetaTrader 5 supports Alpari CopyTrade, robots, and automated trading systems.

Best Shares Trading Broker for beginners in Rwanda

Min Deposit

USD0

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is the best shares trading broker for beginners in Rwanda. IG gives access to a range of trading marketplaces, instructional materials, and unique trading tools.

IG offers proprietary trading platforms along with the popular MetaTrader suite to beginner traders in Rwanda.

Best Low Minimum Deposit Shares Trading Broker in Rwanda

Min Deposit

USD 0

Regulators

ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, NFA

Trading Desk

Metatrader 4 and Metatrader 5

Crypto

Yes

Total Pairs

45

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OANDA is the best Low Minimum Deposit shares trading broker in Rwanda. OANDA boasts a minimal entrance barrier and an award-winning trading platform.

OANDA has no minimum deposit requirement for Rwanda traders.

Best ECN Shares Trading Broker in Rwanda

Min Deposit

100 USD/101 652 RWF

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FP Markets is the best ECN shares trading broker in Rwanda. Within 40 milliseconds, FP Markets is one of the finest ECN brokers that handle orders.

Traders with an FP Markets account get access to a variety of share CFDs using MT4 and MT5.

Best Islamic / Swap-Free Shares Trading Broker in Rwanda

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

–

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Islamic shares, trading broker. Rwandans may convert their trading accounts to Islamic accounts if they utilize the MetaTrader 4 platform.

FXTM does not raise its spreads but imposes an administration fee after 2 or 7 days of position holding for Muslim traders.

Best Shares Trading App in Rwanda

Min Deposit

USD 50 / 50377 RWF

Regulators

CySEC, FCA

Trading Desk

Dealing Desk with DMA and STP

Crypto

Yes

Total Pairs

45+

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, NAGA has the best shares trading app in Rwanda. Over one million investors use this trading platform.

In Rwanda, the NAGA app allows networking, trade, and education. In addition, it affords Rwanda the opportunity to serve as examples for others.

Best Lowest Spread Shares Trading Broker in Rwanda

Min Deposit

USD 10

Regulators

IFSC, CySec, ASIC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

55

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XM is the best lowest-spread shares trading broker in Rwanda. On key financial products, XM spreads begin at 0 pips.

There is a minimal minimum deposit requirement, allowing Rwandans to purchase stocks with modest investments.

Best Rwandan Franc Trading Account Shares Trading Broker in Rwanda

Min Deposit

USD 5

Regulators

CySEC, FSC, CFTC

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, HF Markets is the best Rwandan Franc Account shares trading broker in Rwanda. HF Markets is one of the greatest RWF-denominated account options for Rwandans.

Micro Account spreads are narrow, and leverage is 1:1000. HF Markets’ extensive market research helps novice and experienced traders make better-educated decisions.

Best Nasdaq 100 Shares Trading Broker in Rwandan

Min Deposit

USD 50

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

* Etoro has lowered the amount of the minimum FTD to $ 50 for the following countries: Germany, Austria, Netherlands, Norway, UK, Ireland, Spain, Italy, Sweden, Switzerland.

Overall, eToro is the best Nasdaq 100 shares trading broker in Rwanda. eToro is a well-regarded Nasdaq broker and social trading platform.

eToro also gives Rwandans the ability to engage in copy-trading and social trading.

Best Volatility 75 / VIX 75 Shares Trading Broker in Rwandan

Min Deposit

USD 100

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best Volatility 75 / VIX 75 shares trading broker in Rwanda. AvaTrade provides Rwandans with 1,260 financial products and the Volatility 75 index.

AvaTrade gives Rwandans who trade VIX trading tools, research, and other components to assist them to safeguard their wealth.

Best NDD Shares Trading Broker in Rwanda

Min Deposit

USD 10

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best NDD shares trading broker in Rwanda. Exness is among the finest No-Dealing-Desk brokers that use ECN and STP executions.

Exness’ trading accounts are suitable for a variety of traders, and Rwandans may trade 278 financial items, including stocks, on MT4 and MT5.

Best STP Shares Trading Broker in Rwanda

Min Deposit

10 USD/122 BWP

Regulators

IFSC, MFSC and FSC

Trading Desk

MetaTrader 4, MetraTrader 5, CopyTrade and cTrader

Crypto

No

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Axiory is the best STP shares trading broker for traders in Rwanda. Axiory is a registered STP broker that provides all sorts of traders with powerful and creative trading technologies.

With the Alpha Account, Rwandans have simple MT5 access to hundreds of worldwide equities.

Best Sign-Up Bonus Shares Trading Broker in Rwanda

Min Deposit

USD 1

Regulators

IFSC

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, SuperForex is the best shares trading sign-up bonus broker in Rwanda.

SuperForex gives Rwandans many sign-up incentives, including a $88 no-deposit bonus, a 50% welcome bonus, an easy deposit bonus of up to 3,000%, and a 300% hot bonus.

You might also like: What is Swing Trading

You might also like: Best PAMM Account Forex Brokers

You might also like: Best Social Trading Platforms

FAQ

What are the best growth stocks to buy in Rwanda?

Start by researching and identifying growth stocks in the Rwandan market.

How do I diversify my portfolio with growth stocks in Rwanda?

Conduct thorough research to identify growth stocks in the Rwandan market. Evaluate the risk and return characteristics of each growth stock you are considering.

Where can I buy growth stocks in Rwanda?

In Rwanda, you can buy growth stocks through the Rwanda Stock Exchange (RSE), which is the primary stock exchange in the country.

How do I evaluate growth stocks before investing in Rwanda?

Before investing in growth stocks in Rwanda, you should evaluate the company’s financial statements, earnings reports, and analyst recommendations. You should also consider the industry’s growth prospects, competition, and macroeconomic conditions.

Table of Contents