OctaFX Review

Overall, OctaFX is very competitive in terms of its trading fees and spreads. OctaFX is regulated by top-tier CySEC and SVG, and FSA. OctaFX offers two retail accounts as well as excellent bonuses for first-time traders. OctaFX has a score of 7/10.

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 5

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

OctaFX Review – 23 key points quick overview:

- ✅ OctaFX Overview

- ✅ OctaFX at a Glance

- ✅ OctaFX Regulation and Safety of Funds

- OctaFX Awards and Recognition

- OctaFX Account Types and Features

- How to open an Account with OctaFX in Rwanda

- OctaFX Vs OANDA Vs GO Markets – Broker Comparison

- OctaFX Trading Platforms

- OctaFX Range of Markets

- Broker Comparison for Range of Markets

- OctaFX Trading and Non-Trading Fees

- OctaFX Deposits and Withdrawals

- How to Deposit Funds with OctaFX

- OctaFX Fund Withdrawal Process

- OctaFX Education and Research

- OctaFX Bonuses and Promotions

- How to open an Affiliate Account with OctaFX

- OctaFX Affiliate Program Features

- OctaFX Customer Support

- OctaFX Corporate Social Responsibility

- Our Verdict on OctaFX

- OctaFX Pros and Cons

- FAQ

OctaFX Overview

👉 Overall, OctaFX is considered high-risk, with an overall Trust Score of 67 out of 100. OctaFX is licensed by zero Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and one Tier-3 Regulator (low trust). OctaFX offers two different retail trading accounts namely a MetaTrader 4 Habitual Trader Account and a MetaTrader 5 Smart Trader Account.

👉 OctaFX accepts Rwandan clients and has an average spread from 0.6 pips with zero commission charges. OctaFX has a maximum leverage ratio up to 1:500 and there is a demo and Islamic account available. MT4, MT5, OctaFX, and CopyTrade platforms are supported. OctaFX is headquartered in Saint Vincent and the Grenadines and regulated by CySEC and SVG FSA.

👉 OctaFX is a technology-based brokerage company that began operations in 2011 and offers industry-leading platforms such as MetaTrader 4, MetaTrader 5, the OctaFX App, and the CopyTrading app. These platforms provide users with a wide variety of investment opportunities and excellent trading capabilities.

👉 OctaFX began as an offshore brand based in St. Vincent and the Grenadines (SVG) and then expanded its operations to the United Kingdom (UK). However, in 2017 the company shut down its UK operations and relocated to Cyprus, exchanging its FCA regulation for CySEC regulation instead.

👉 OctaFX is an international forex and CFD broker that offers both ECN and STP trading, in addition to having high requirements for a safe trading environment due to the regulation that it applies.

👉 Even though OctaFX just acquired its European license four years ago, the broker is already well-known and has already accumulated more than a decade’s worth of expertise in the forex and CFD markets.

👉 Despite the absence of Tier-1 regulation, OctaFX has been in business for 11 years and has already received several accolades, contributing to the broker’s solid image as a trustworthy broker.

👉 This OctaFX review for Rwanda will provide local retail traders with the details that they need to consider whether OctaFX is suited to their unique trading objectives and needs.

OctaFX Distribution of Traders

👉 OctaFX currently has the largest market share in these countries:

➡️ India – 31.4%

➡️ Pakistan – 20%

➡️ Indonesia – 13.3%

➡️ Saudi Arabia – 9.04%

➡️ Philippines – 6.6%

Popularity among traders who choose OctaFX

🥇 OctaFX may not have a sizeable portion of the derivatives trading market in Rwanda, but it caters to traders of all skill levels in the area. Subsequently, OctaFX is ranked among the top sixty forex and CFD brokers in Rwanda.

OctaFX at a Glance

| 🏙 Headquartered | Saint Vincent and the Grenadines |

| 🏛 Global Offices | United Kingdom, Hong Kong, Indonesia, Cyprus, Malaysia, Thailand |

| 💻 Local Market Regulator in Rwanda | The National Bank of Rwanda (BNR) |

| 💸 Foreign Direct Investment in Rwanda | 99.92 USD Million in 2020 |

| 🔄 Foreign Exchange Reserves in Rwanda | 1,806 million US dollars in 2020 |

| 🏛 Local office in Kigali? | No |

| 👨⚖️ Governor of SEC in Rwanda | None, John Rwangombwa is the Governor of the National Bank of Rwanda |

| ✔️ Accepts Rwandan Traders? | Yes |

| 🗓 Year Founded | 2011 |

| ☎️ Rwandan Traders Office Contact Number | None |

| 📲 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ Regulation | CySEC, SVG FSA |

| 1️⃣ Tier-1 Licenses | None |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority of Saint Vincent and the Grenadines |

| 🪪 License Number | • Cyprus – 372/18 • Saint Vincent and the Grenadines – 19776 |

| ⚖️ BNR Regulation | None |

| 🏛 Global Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| ✔️ PAMM Accounts | No |

| 💵 Liquidity Providers | Unknown |

| 💰 Affiliate Program | Yes |

| ➡️ Order Execution | Market |

| 📊 Starting spread | From 0.6 pips |

| 💸 Minimum Commission per Trade | None |

| 💵 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 25% |

| 🛑 Stop-Out | 15% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 500 lots |

| 💰 Crypto trading offered? | Yes |

| ✔️ Offers an RWF Account? | No |

| 👥 Dedicated Rwandan Traders Account Manager? | No |

| 📊 Maximum Leverage | 1:500 |

| 📈 Leverage Restrictions for Rwanda? | None |

| 💵 Minimum Deposit (RWF) | 100,000 Rwandan Franc or an equivalent to $100 |

| ✔️ Rwandan franc Deposits Allowed? | No |

| 📊 Active Rwandan Traders Trader Stats | 50,000+ |

| 👥 Active Rwandan Traders-based OctaFX customers | Unknown |

| 🔄 Rwanda Daily Forex Turnover | Unknown, the overall trading volume of over $6.6 trillion |

| 💰 Deposit and Withdrawal Options | • Debit Card • Credit Card • Bitcoin (BTC) • Ethereum (ETH) • Dogecoin (DOGE) • Litecoin (LTC) • Tether TRC-20 (USDTT) • Tether ERC-20 (USDTE) • Skrill • Neteller |

| 📉 Minimum Withdrawal Time | 30 minutes |

| 📈 Maximum Estimated Withdrawal Time | 3 hours |

| 💰 Instant Deposits and Instant Withdrawals? | No |

| 🤝 Segregated Accounts with Rwandan Traders Banks? | No |

| 💻 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • OctaFX App • CopyTrade App |

| 💵 Tradable Assets | • Forex • Index CFDs • Commodities • Cryptocurrencies • Energies • Precious Metals |

| 💸 Offers USD/RWF currency pair? | No |

| 📊 USD/RWF Average Spread | N/A |

| ✅ Offers Rwandan Traders Stocks and CFDs | No |

| 📖 Languages supported on the Website | English, Malaysian, Hindi, Bangla, Thai, Spanish, German, Vietnamese, Portuguese, Arabic, Chinese (Simplified) |

| 📘 Customer Support Languages | Multilingual |

| 🗣 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Rwandan Traders-based customer support? | Yes |

| 💰 Bonuses and Promotions for Rwandan Traders | Yes |

| 📚 Education for Rwanda beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🏅 Most Successful Rwandan Trader | Unknown |

| ✔️ Is OctaFX a safe broker for Rwandan Traders? | Yes |

| 🎖 Rating for OctaFX Rwanda | 7/10 |

| 🥇 Trust score for OctaFX Rwanda | 67% |

| 👉 Open An Account | 👉 Open Account |

OctaFX Regulation and Safety of Funds

OctaFX Regulation in Rwanda

👉 OctaFX is currently not regulated or licensed by Rwandan market regulators.

OctaFX Global Regulations

👉 OctaFX is regulated and overseen by:

➡️ The Cyprus Securities and Exchange Commission (CySEC)

➡️ The Saint Vincent Financial Services Authority (SVG FSA)

OctaFX Client Fund Security and Safety Features

👉 According to the broker’s client agreement, which can be found on the OctaFX website, OctaFX.com is run by Octa Markets Incorporated, which is registered, regulated, and controlled by the Law of Saint Vincent and the Grenadines. This information can be found on the OctaFX website.

👉 According to its official website, OctaFX provides an additional layer of safety to customers by separating customer cash from company funds in addition to:

➡️ Protecting accounts against any negative balance.

➡️ Providing a client area that is secured by SSL and has secure withdrawal regulations.

👉 Users also have the option to trade through OctaFX EU, which is owned and run by Octa Markets Cyprus Ltd. OctaFX EU is registered as an authorized domain with the Cyprus Securities and Exchange Commission (CySEC), as verified in their registry under license number 372/18.

👉 The following is a list of the protections that traders may anticipate receiving from OctaFX EU:

➡️ Keeping the customers’ money separate from the funds of the company.

➡️ Protecting EU trading accounts against negative balance.

➡️ Providing clients with a dedicated client area that is secured by SSL and has secure withdrawal regulations.

➡️ Participating in the Investor Compensation Fund (ICF) as a means of protecting the claims of retail customers who are qualified for the program and providing compensation if Octa Markets Cyprus Ltd is unable to satisfy its financial responsibilities.

👉 Rwandan traders will conduct their business under the auspices of Octa Markets, Inc., the entity that is regulated and overseen by SVG FSA. However, the SVG FSA is not regarded as a dependable forex broker regulator and does not exert any kind of supervision over CFD trading activities.

👉 This does not, however, imply that OctaFX has engaged in unethical or deceptive behaviour. Instead, it emphasizes that users must rely only on OctaFX’s reputation to protect their capital since no further precautions are in place.

👉 Thanks to the SVG Financial Services Authority, OctaFX’s clients can benefit from greater leverage as well as several bonuses and incentives. As a sign of good faith, OctaFX divides all client funds from the company’s operating capital and offers negative balance protection to all its customers.

👉 Even if Rwandans are hesitant of trading with a firm that is not as highly regulated as others with ASIC, FCA, and other Tier-1 rules, OctaFX’s European businesses are governed by CySEC, a reputable regulatory organization and Tier-2 market regulator.

👉 In addition, OctaFX has been awarded various awards in recent years, including Most Transparent Broker 2020 by Global Banking and Finance Review, Best ECN broker 2021 by World Finance, and Decade of Excellence in Forex Asia 2021 by Global Banking and Finance Review, among others.

OctaFX Awards and Recognition

👉 OctaFX has received multiple industry awards, including Best ECN Broker, Best Forex Broker in Asia, Most Transparent Broker, and several more.

OctaFX Account Types and Features

👉 OctaFX offers customers the opportunity to create one of two live trading accounts. Both accounts provide excellent trading conditions, with average spreads of 0.6 pips and commission-free trading.

👉 Rwandan traders can choose from the following options:

➡️ MetaTrader 4 Habitual Trader Account

➡️ MetaTrader 5 Smart Trader Account

| 💻 Live Account | 💰 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💵 Average Trading Cost |

| ➡️ Habitual Trader | 100,000 RWF or 100 USD | 0.6 pips | None | 6 USD |

| ➡️ Smart Trader | 100,000 RWF or 100 USD | 0.6 pips | None | 6 USD |

OctaFX Live Trading Accounts

MetaTrader 4 Habitual Trader Account

👉 This sort of account may be suitable for Rwandans who are new to forex trading due to its unique trading conditions and reduced risk. Rwandan traders who want a conventional trading experience can expect to find the following features on this account:

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 100,000 RWF or an equivalent to 100 USD |

| 📊 Average Spreads | Floating, from 0.6 pips |

| 💵 Commissions charged | None, mark-up is added to the spread |

| 🔨 Instruments offered on account | • 35 Forex Pairs • Gold and Silver • 3 Energies • 10 Indices • 30 Cryptocurrencies |

| 📉 Leverage Ratios | • Forex – up to 1:500 (1:100 for ZAR/JPY) • Precious Metals – up to 1:200 • Energies – up to 1:100 • Indices – up to 1:50 • Crypto – up to 1:25 |

| 📈 Minimum Trading Volume | 0.01 lots |

| 📊 Maximum Trading Volume | 200 lots on MT4, 500 lots on MT5 |

| 📞 Margin Call | 25% |

| 🛑 Stop-Out | 15% |

| 💰 Trade Execution Type | Market |

| 📱 Trade Execution Average Speed | Under 0.1 seconds |

| 💳 Base Account Currency Options | USD or EUR |

| ✔️ Trading Strategies Allowed | Hedging, Scalping, Expert Advisors |

| ✅ Trading Strategies Allowed | Yes |

MetaTrader 5 Smart Trader Account

👉 The Smart Trader Account on MT5 is best suited to a well-rounded investor with extensive knowledge of a broad variety of financial markets and assets. Rwandan traders in this category should expect the most favourable trading circumstances and solid, trustworthy technology, as well as these features:

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 100,000 RWF or an equivalent to 100 USD |

| 📊 Average Spreads | Floating, from 0.6 pips |

| 💵 Commissions charged | None, mark-up is added to the spread |

| 🔨 Instruments offered on account | • 35 Forex Pairs • Gold and Silver • 3 Energies • 10 Indices • 30 Cryptocurrencies |

| 📉 Leverage Ratios | • Forex – up to 1:500 (1:100 for ZAR/JPY) • Precious Metals – up to 1:200 • Energies – up to 1:100 • Indices – up to 1:50 • Crypto – up to 1:25 |

| 📈 Minimum Trading Volume | 0.01 lots |

| 📊 Maximum Trading Volume | 200 lots on MT4, 500 lots on MT5 |

| 📞 Margin Call | 25% |

| 🛑 Stop-Out | 15% |

| 💰 Trade Execution Type | Market |

| 📱 Trade Execution Average Speed | Under 0.1 seconds |

| 💳 Base Account Currency Options | USD or EUR |

| ✔️ Trading Strategies Allowed | Hedging, Scalping, Expert Advisors |

| ✅ Trading Strategies Allowed | Yes |

OctaFX Base Account Currencies

👉 Because accounts may only be opened in EUR and USD, OctaFX is quite limited for traders. This is a major issue for Rwandans who have bank accounts in RWF.

OctaFX Demo Account

👉 A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

👉 There is a certain degree of risk involved when trading financial markets and OctaFX offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

👉 You can practice trading forex without putting any of your own money at risk by using the OctaFX Demo Account. Instead of utilizing real money, traders create a practice or demo account with fictitious funds to enhance their skills.

👉 Traders can easily open an OctaFX Forex Demo Account by providing basic personal information on the OctaFX website under the option “Practice” which can be found in the middle of the homepage. Because of the demo’s specific features, Rwandan traders can get a feel for the platform’s operation as well as the nuances of the Forex and CFD market.

👉 Traders can use this valuable tool for as long as they want to better understand forex and CFD trading and assess their risk exposure. As a complimentary service, the demo account’s functionality is identical to the actual accounts, save for the use of virtual currency.

OctaFX Islamic Account

👉 Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

👉 This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

👉 OctaFX’s Islamic Account is a multi-award-winning solution that enables Muslim traders to use trading strategies that involve medium- to long-term investments without encountering any complications.

👉 OctaFX is distinguished from its competitors by the absence of overnight fees. An additional benefit is that Rwandan traders who use the OctaFX Islamic account do not pay any additional admin fees to offset the absence of overnight fees.

How to open an Account with OctaFX in Rwanda

👉 To register an account with OctaFX, Rwandan Traders can follow these steps:

➡️ Rwandan traders can create an OctaFX account by clicking the “Open Account” link on the official website and entering their name, email address, and password when prompted to do so.

➡️ On a subsequent page, the user must provide their address, phone number, and date of birth.

➡️ Traders are then requested to choose their account platform and indicate other parameters such as real/demo, swap-free Islamic accounts, base currency, leverage, and other features.

➡️ Depending on what the trader chose, they will be redirected accordingly to the OctaFX Personal Area, where they can make deposits and withdrawals, enter contests, and create new accounts.

➡️ It is worth mentioning that Rwandan users can carry out several different actions inside their OctaFX Personal Area. This includes monitoring real and demo accounts, opening new accounts, participating in contests and promotional offers, and accessing OctaFX’s Copy-trading services.

OctaFX Vs OANDA Vs GO Markets – Broker Comparison

| 🥇 OctaFX | 🥈 OANDA | 🥉 GO Markets | |

| ⚖️ Regulation | CySEC, SVG FSA | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, BVI FSC | ASIC, FSA Seychelles, FSC Mauritius, CySEC |

| 💻 Trading Platform | • MetaTrader 4 • MetaTrader 5 • OctaFX App • CopyTrade App | • MetaTrader 4 • MetaTrader 5 • OANDA Platform • TradingView | • MetaTrader 4 • MetaTrader 5 |

| 💵 Withdrawal Fee | No | Yes, bank wire | No |

| ✔️ Demo Account | Yes | Yes | Yes |

| 💰 Min Deposit | 100,000 RWF | 0 RWF | 140,000 RWF |

| 📊 Leverage | 1:500 | 1:200 | Up to 1:500 |

| 📈 Spread | 0.6 pips | Variable, from 0.1 pips | From 0.0 pips |

| 💸 Commissions | None | $40 | From US$2.50 |

| 🛑 Margin Call/Stop-Out | 25%/15% | 100%/ 50% | 80%/50% |

| 📲 Order Execution | Market | Market | Instant |

| ✔️ No-Deposit Bonus | Yes | No | No |

| ✅ Cent Accounts | No | No | No |

| 💻 Account Types | • MetaTrader 4 • Habitual Trader • MetaTrader 5 Smart Trader | • Standard Account • Core Account • Swap-Free Account | • Standard Account • GO+ Account |

| ⚖️ BNR Regulation | No | No | No |

| 💵 RWF Deposits | No | Yes | No |

| ✔️ Rwandan franc Account | No | No | No |

| 📞 Customer Service Hours | 24/7 | 24/5 | 24/5 |

| 🛍 Retail Investor Accounts | 2 | 3 | 2 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 pips | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 500 lots | 1,000 lots | 250 lots |

| 📊 Minimum Withdrawal Time | 30 minutes | 1 business day | Instant |

| ⏱ Maximum Estimated Withdrawal Time | 3 hours | 7 to 10 business days | 1 to 3 business days |

| ✔️ Instant Deposits and Instant Withdrawals? | No | No | Yes |

Min Deposit

USD 5

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

OctaFX Trading Platforms

👉 OctaFX offers Rwandan Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ OctaFX App

➡️ CopyTrading App

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4 and 5

👉 Because of the unique combination of functions that it provides, the MetaTrader suite of services is the most widely used trading platform in the world. Try out one of the hundreds of different indicators that are available to traders.

👉 It is simple to set up to trade ‘algo’ models on an automatic basis, and it provides expert advisers and MQL5 support services that make it possible for traders to draw on the ideas of others.

👉 The charting tools that are included in MT4 and MT5 set them apart from one another. For example, the base MT4 package includes thirty pre-installed indicators, in addition to the two thousand free customizable ones and seven hundred that can be purchased separately.

👉 Platform selection is a matter of individual taste, but OctaFX has made clear its intention by providing customers with the opportunity to choose between two platforms that are leaders in their respective markets.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4 and 5

👉 The Web Trading platforms provide advanced traders with important tools such as one-click trading, among other things. In addition, chart views and complex order capability are severely restricted on the online platform, which makes it more suitable for novice traders.

👉 It is common knowledge that the MetaTrader platforms are famous for their ability to facilitate copy trading and build trading communities. OctaFX customers get access to all the features that are available on the MetaTrader platform, including Expert Advisors and MQL5.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ OctaFX App

➡️ CopyTrading App

MetaTrader 4 and 5

👉 Because of its simplicity of use and versatility, the MT4 mobile platform is a trusted program utilized by both individual traders and institutions.

👉 You can create and modify expert advisors along with technical indicators to fit your trading style using the platform. In addition to the 30 built-in technical indicators, additional charting tools enable you to analyse market price changes and patterns using three different chart and graph kinds.

👉 MT5 is the next-generation platform and mobile app that provides all the advantages of its predecessor but with increased speed, precision, and sophisticated functionality.

👉 Users have access to eight distinct kinds of pending orders, 44 different analytical objects like Gann and Fibonacci retracement, and other technical indicators exclusive to MetaTrader 5.

👉 There is also an economic calendar and two key accounting modes for more flexibility namely hedging and netting.

OctaFX App

👉 The proprietary mobile app from OctaFX is primarily concerned with executing copied trades. It offers a wide variety of fundamental services, such as charting tools, to customers to assist them in entering the markets with the appropriate amount of assistance.

CopyTrading App

👉 The incorporation of an OctaFX copy trading option inside the existing set of offerings has been embraced by both beginner and professional traders alike. The process involved in setting up a copy-trading account is straightforward and quick.

👉 There is no further authentication needed, and once a customer has set up their private wallet, it is simple to connect to the signals that are sent out by other traders.

OctaFX Range of Markets

👉 Rwandan Traders can expect the following range of markets from OctaFX:

➡️ Forex – Using OctaFX, Rwandan traders have access to 32 of the most volatile currency pairs and a leverage ratio of up to 1:500.

➡️ Index CFDs – OctaFX customers get access to CFDs on the ten most promising indices. OctaFX provides CFDs on markets like NASDAQ, Dow Jones, and Euro Stoxx 50, among others.

➡️ Commodities – OctaFX allows users to invest in commodities such as gold, silver, crude oil, and natural gas. The highest leverage for gold and silver at OctaFX is 1:200, while the maximum leverage for all other commodities is 1:50.

➡️ Cryptocurrencies – The MetaTrader 4 and MetaTrader 5 platforms facilitate the trading of cryptocurrencies. For trading purposes, OctaFX accepts Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash. Litecoin in addition to Ripple. These crypto networks are also available through the MT4 and MT5 mobile applications.

➡️ Energies, such as Crude Oil, Natural Gas, and others.

➡️ Precious Metals consist of both gold and silver.

Financial Instruments and Leverage offered by OctaFX

| 🔨 Instrument | ✔️ Number of Assets Offered | 📈 Maximum Leverage Offered |

| ➡️ Forex | 32 | 1:500 |

| ➡️ Commodities | 5 | 1:50 |

| ➡️ Indices | 10 | 1:50 |

| ➡️ Cryptocurrency | 30 | 1:25 |

| ➡️ Precious Metals | 2 | 1:50 |

Broker Comparison for Range of Markets

| 🥇 OctaFX | 🥈 OANDA | 🥉 GO Markets | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | No | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | No |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | No |

OctaFX Trading and Non-Trading Fees

Spreads

👉 Since it does not charge commissions or fixed fees, OctaFX derives revenue from the spread of the different asset types it supplies.

👉 Even with OctaFX’s extensive ECN/STP broker setup, the spreads on currencies and other assets are competitive and like many online trading platforms.

👉 In addition, more seasoned Rwandan investors will like the very narrow spreads, absence of commission costs, and freedom to use any trading technique, including hedging, scalping, and automated trading tactics. The following are some common spreads that Rwandan traders might anticipate:

| 🔨 Instrument | 💰 Typical Spread |

| EUR/USD | 0.6 pips |

| USD/JPY | 1 pip |

| NAS100 | 1.2 pips |

| BTC/USD | 2.8 pips |

| XBR/USD | 0.7 pips |

| XTI/USD | 0.7 pips |

Commissions

👉 OctaFX does not impose commissions on transactions executed by Rwandans. Instead, the spread that traders pay already contains OctaFX’s fee to facilitate the trade.

Overnight Fees, Rollovers, or Swaps

👉 When traders maintain an open position on their MetaTrader 4 account for more than 24 hours, swap costs will be charged or debited, depending on the type of open position (whether long or short).

👉 Rwandans with a MetaTrader 5 account are automatically exempted from overnight costs until the third night that they keep their position open. Muslim traders with a live trading account that has been converted to an Islamic Account will also be exempted from overnight fees.

👉 OctaFX provides Sharia-compliant trading without charging an extra administrative charge to compensate for the lack of overnight costs. Non-Muslim traders who do not utilize the MetaTrader 5 account and who are unable to convert their MetaTrader 4/5 account to an Islamic Account may anticipate the following overnight fees:

| 🔨 Instrument | 📈 Short Swap | 📉 Long Swap |

| EUR/USD | -0.64 pips | -1.03 pips |

| USD/JPY | -0.77 pips | -0.69 pips |

| NAS100 | -8.00 pips | -8.00 pips |

| BTC/USD | -2.00 pips | -2.00 pips |

| XBR/USD | -1.00 pips | -1.00 pips |

| XTI/USD | -1.00 pips | -1.00 pips |

Deposit and Withdrawal Fees

👉 In addition to offering commission-free trading, OctaFX also exempts Rwandan traders from paying any fees on deposits or withdrawals. However, despite this, Rwandans may face processing fees which are charged by their bank for deposits and/or withdrawals.

Inactivity Fees

👉 OctaFX does not charge Rwandan traders any fees for dormant accounts, regardless of the length of time they have been inactive.

Currency Conversion Fees

👉 Due to the restricted selection of base account currencies, Rwandan traders who make deposits or withdrawals in BWP risk incurring currency conversion costs.

OctaFX Deposits and Withdrawals

👉 OctaFX offers the following deposit and withdrawal methods:

➡️ Credit Card

➡️ Debit Cards

➡️ Bitcoin (BTC)

➡️ Litecoin (LTC)

➡️ Dogecoin (DOGE)

➡️ Tether ERC-20 (USDTE)

➡️ Tether TRC-20 (USDTT)

➡️ Ethereum (ETH)

➡️ Skrill

➡️ Neteller

Broker Comparison: Deposit and Withdrawals

| 🥇 OctaFX | 🥈 OANDA | 🥉 GO Markets | |

| Minimum Withdrawal Time | 30 minutes | 1 business day | Instant |

| Maximum Estimated Withdrawal Time | 3 hours | 7 to 10 business days | 1 to 3 business days |

| Instant Deposits and Instant Withdrawals? | No | No | Yes |

OctaFX Deposit Currencies, Deposit and Withdrawal Processing, Min Deposit and Withdrawal Amount

| 💰 Payment Method | 💵 Accepted Currencies | 💰 Deposit Processing | 💵 Withdrawal Processing | 📈 Min Deposit After initial | 📉 Min Withdrawal |

| Credit Card | USD, EUR | 1 to 5 minutes | Min: 30 min Max: 1 – 3 hours | 25 USD | 20 USD |

| Debit Card | USD, EUR | 1 to 5 minutes | Min: 30 min Max: 1 – 3 hours | 25 USD | 20 USD |

| Bitcoin (BTC) | BTC | 3 to 30 minutes | Min: 30 min Max: 1 – 3 hours | 0.00037 BTC | 0.00009 BTC |

| Litecoin (LTC) | LTC | 3 to 30 minutes | Min: 30 min Max: 1 – 3 hours | 0.3 LTC | 0.11 LTC |

| Dogecoin (DOGE) | DOGE | 3 to 30 minutes | Min: 30 min Max: 1 – 3 hours | 230 DOGE | 75 DOGE |

| Tether ERC-20 (USDTE) | USDTE | 3 to 30 minutes | Min: 30 min Max: 1 – 3 hours | 50 USDTE | 20 USDTT |

| Tether TRC-20 (USDTT) | USDTT | 3 to 30 minutes | Min: 30 min Max: 1 – 3 hours | 50 0.02 ETH | 20 USDTT |

| Ethereum (ETH) | ETH | 3 to 30 minutes | Min: 30 min Max: 1 – 3 hours | 50 USD | 0.005 ETH |

| Skrill | USD, EUR | Instant | Min: 5 min Max: 1 – 3 hours | 50 USD | 5 USD |

| Neteller | USD, EUR | Instant | Min: 5 min Max: 1 – 3 hours | 50 USD | 5 USD |

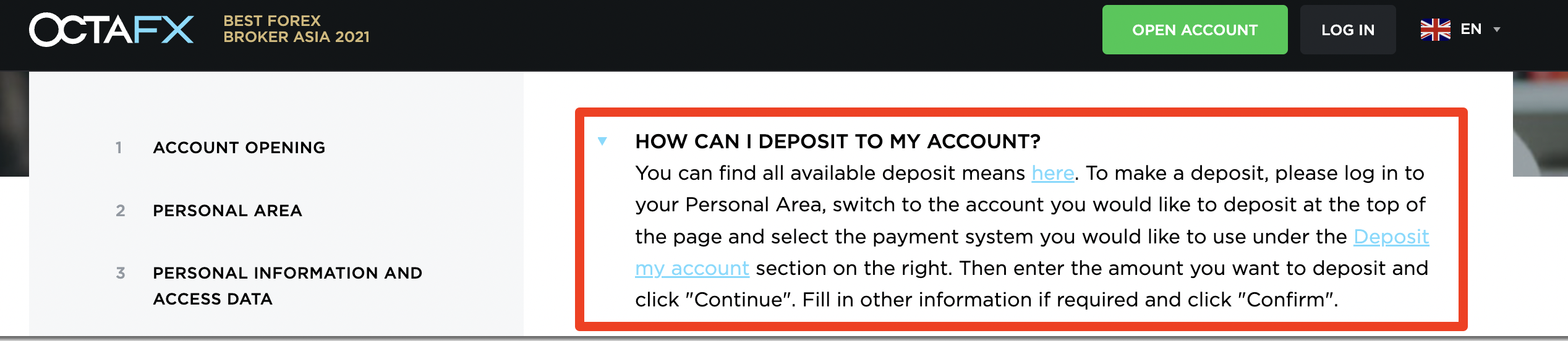

How to Deposit Funds with OctaFX

👉 To deposit funds to an account with OctaFX, Rwandan Traders can follow these steps:

➡️ Once Rwandan traders have verified the trading account and it has been approved by OctaFX’s team, they can log into their Personal Area and select “Deposit” from the dashboard.

➡️ Rwandans can indicate the trading account that they wish to fund and choose a deposit method from the supported options.

➡️ Next, Rwandan traders can choose the deposit currency and indicate the minimum deposit.

➡️ To confirm and finalize the deposit, Rwandans can follow any additional steps indicated by their payment provider.

OctaFX Fund Withdrawal Process

👉 To withdraw funds from an account with OctaFX, Rwandan Traders can follow these steps:

➡️ Before attempting a withdrawal, Rwandans must ensure that their account has been verified.

➡️ Traders can then access their Personal Area by logging in with their credentials, at which point they will be given the option to choose the account from which they desire to withdraw cash.

➡️ Next, traders can choose their withdrawal option, enter the amount, and proceed with the withdrawal request.

➡️ Rwandan traders must note that certain minimum withdrawal amounts, and limits apply. In addition, withdrawals may take longer than indicated by OctaFX because of internal processes according to their preferred payment provider.

OctaFX Education and Research

Education

👉 OctaFX offers the following Educational Materials:

➡️ The instructional tools provided by OctaFX encompass a broad range of subjects, from the most basic classes, such as an introduction to trading and how to execute a trade, to the more complex technical and fundamental analysis.

👉 OctaFX is devoted to providing its clients with the finest education available. The content is provided in an easy-to-understand manner and is supported with visual representations for further clarity. OctaFX provides these Educational Materials:

➡️ Webinars

➡️ Forex basics articles

➡️ Forex basics video course

➡️ Platform video tutorials

➡️ Platform article tutorials

➡️ Glossary

➡️ Comprehensive Frequently Asked Question section

Research and Tools

👉 OctaFX gives customers access to a vast array of important trading tools that can be used for a range of trading objectives, including market analysis, risk management, and trading signal production. The following Research and Trading Tools are provided to Rwandan traders by OctaFX:

➡️ Trading calculators

➡️ Profit calculators

➡️ Account monitoring

➡️ AutoChartist Pro

➡️ Market information

➡️ Proprietary economic calendar, and several more.

| 🥇 OctaFX | 🥈 OANDA | 🥉 GO Markets | |

| Economic Calendar | Yes | Yes | No |

| VPS | No | Yes | No |

| AutoChartist | Yes | Yes | Yes |

| Trading View | No | Yes | Yes |

| Trading Central | No | No | Yes |

| Market Analysis | Yes | Yes | Yes |

| News Feed | Yes | Yes | Yes |

| Blog | Yes | Yes | Yes |

AutoChartist

👉 OctaFX provides AutoChartist, which is considered the industry’s premier provider of trading signals. Traders may use AutoChartist’s automated alerts to further optimize their take-profit and stop-loss settings, perform volatility analysis using AutoChartist’s tool, and see integrated market reports.

👉 AutoChartist, which is available on both MT4 and MT5, requires a minimum balance of 500,000 RWF, or the equivalent of USD 500, in your OctaFX account.

Market Information

👉 This area provides daily trading suggestions generated from a comprehensive fundamental and technical analysis of a wide array of trading instruments.

👉 In addition, daily and monthly estimates covering the financial markets in detail are released by OctaFX for the perusal of traders. These market insights may assist in analysis and help identify prospective trading opportunities.

Economic Calendar

👉 The economic calendar gives a schedule of upcoming financial news releases, indicating both the country and the magnitude of each story’s impact.

👉 In addition to the actual results, you can also see predictions and historical data for these releases. The calendar contains sophisticated filters that will only show relevant news items.

Profit Calculator

👉 You can quickly and simply determine the potential profit by utilizing the profit calculator, which allows you to choose a trading instrument and then enter the position’s specifications.

Trading Calculator

👉 Using the trading calculator, Rwandan traders can quickly calculate the costs associated with initiating a position of a certain size and leverage.

Account Monitoring

👉 With this unique tool, Rwandan traders can watch the accounts of all other OctaFX traders using the Account Monitoring feature, and the results can be sorted according to balance, gain, trades, and account type.

👉 Using this tool, you can also examine the account’s history to get insight into how the account user has effectively managed their success. Accounts are always represented by numbers, preventing the identification of their owners.

OctaFX Bonuses and Promotions

👉 OctaFX offers Rwandan Traders the following bonuses and promotions:

➡️ A demo contest that is available to all MetaTrader 4 demo competitions, run in many rounds, with a maximum cash reward of $500 that will be awarded to the winner.

➡️ Trade and win contests provide actual prizes that may be won by traders who trade prize lots to qualify.

➡️ 50% deposit bonus – accessible on both trading accounts and withdrawable after trading conditions are met. The bonus is given out automatically after the requirements are completed, and it also provides a free margin boost.

➡️ The status program is a four-tiered effort that provides a variety of incentives to Rwandan traders.

How to open an Affiliate Account with OctaFX

👉 To register an Affiliate Account, prospective affiliates in Rwanda can follow these steps:

➡️ Navigate to the “Referral Program” tab on the main toolbar of the OctaFX site.

➡️ Select “IB Program” and wait for the page to load before proceeding.

➡️ Explore the features of OctaFX and see whether this is the correct program for you.

➡️ Click “Become IB” and manually fill out the account application form or use your social network credentials to automatically populate the necessary fields.

➡️ Be careful to read and understand the Customer Agreement before applying.

➡️ Once your application has been accepted, you will have access to your program materials and other components through the partner/IB site.

OctaFX Affiliate Program Features

👉 Affiliates have the option of creating a partnership with OctaFX through the affiliate program, which enables them to operate with the platform that is most suited to meet their requirements and satisfy their preferences.

👉 Affiliates can participate in OctaFX’s Master IB program, which provides several advantages and substantial incentives, in addition to a variety of recurrent tournaments and extra training possibilities.

👉 Rwandan affiliates who have generated sixty or more referrals are eligible to earn up to twelve dollars for each additional lot that is traded by the referrals.

👉 Customers can take advantage of the most favourable trading conditions and programs, both of which are customizable once affiliates reach this level. This allows affiliates to maximize their overall profits in creative ways by enabling them to make the most of the opportunities available to them.

OctaFX Customer Support

👉 OctaFX provides multilingual customer service that is available 24 hours a day, 7 days a week through several contact methods.

| Customer Support | OctaFX’s Customer Support |

| ⏰ Operating Hours | 24/7 |

| 🗣 Support Languages | English, Malay, Portuguese, Indonesian, Thai, Chinese, Vietnamese |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| 📞 Telephonic Support | Yes |

| ✔️ Local Support in Rwanda? | No |

| 🥇 Overall quality of OctaFX Support | 4.2/5 |

OctaFX Corporate Social Responsibility

👉 Although OctaFX does not seem to run any programs or activities related to corporate social responsibility at present, the company does appear to be involved with several philanthropic organizations.

Min Deposit

USD 5

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Our Verdict on OctaFX

👉 OctaFX is a well-established foreign exchange (Forex) and contracts for difference (CFD) broker that has seen significant expansion around the globe over the last few years. OctaFX has been able to effectively expand its market presence because of the combination of competitive pricing, helpful customer service representatives, and innovative technology.

👉 Today, OctaFX provides its services to clients in more than one hundred countries, and it has seen the registration of over 300,000, which together process an impressive daily volume of more than $4 billion.

👉 OctaFX provides a diverse selection of products that are accessible to traders of all experience levels, from novices to seasoned professionals. Traders new to the market will appreciate how easy it is to use the MetaTrader 4 account, while more experienced investors will value the functionality of the MetaTrader 5 account.

👉 Despite which account they choose to use; Rwandan traders can always take advantage of trading conditions that are among the most favourable in the world.

👉 Rwandans can register an account with a small minimum deposit while simultaneously having access to some of the most well-known trading platforms in the world. These platforms are simple to download and install owing to the broker’s extensive library of educational material and tools.

👉 Certain features, such as the AutoChartist signal program, require a higher minimum deposit of $500. However, traders can get started with low minimum deposit accounts and access these features.

OctaFX Pros and Cons

| ✔️ Pros | ❌ Cons |

| Rwandan traders have access to a range of financial instruments that can be traded, including Bitcoin | There is an extremely limited range of available markets that can be traded |

| Rwandans are given access to four innovative and powerful trading platforms including MetaTrader and two proprietary trading apps | There are only two live accounts to choose from and spreads are not the lowest |

| OctaFX is known for its market volatility violations on several financial instruments | There are limited base currencies offered on accounts and Rwandans cannot open an account in RWF |

| Traders can easily perform accelerated financial instrument exchanges across markets | |

| OctaFX offers customer support 24 hours a day, 7 days a week | |

| There are no commissions charged on trades, deposits, or withdrawals | |

| There are no inactivity fees levied on inactive trading accounts | |

| There is an unlimited demo account that is suitable for both beginner and professional traders |

FAQ

Does OctaFX have Volatility 75?

No, currently OctaFX does not make VIX 75 a part of its offering.

Does OctaFX have Nasdaq?

Yes, NAS 100 is offered to Rwandan traders as a CFD on Indices.

How many lots can I trade with OctaFX?

The maximum number of lots that can be traded on MetaTrader 4 is 200 lots and 500 lots on MetaTrader 5.

Can I use OctaFX without verification?

No, as with other reputable brokers, OctaFX requires that you verify your identity and residential address before you can start using your account. This is according to “Know Your Customer” (KYC) procedures.

Is OctaFX regulated?

Yes, OctaFX is regulated in both Cyprus and Saint Vincent and the Grenadines through CySEC and SVG FSA, respectively.

Does OctaFX charge commissions?

No, OctaFX does not charge any commissions on trades. Instead, there is a mark-up added to the spreads that traders pay.

Is OctaFX safe or a scam?

Despite its lack of Tier-1 regulations, OctaFX is a safe and verified broker that keeps client funds in segregated accounts, provides investor protection, and ensures that there is a fair, safe, and transparent trading environment for all traders.

Does OctaFX work on weekends?

While OctaFX’s customer support is offered 24/7, most markets are only open 24/5. However, Rwandans can trade cryptocurrencies 24 hours a day, 7 days a week.

What is the withdrawal time for OctaFX?

When you request a withdrawal from OctaFX it can take between 5 minutes and three hours for the funds to reflect in your bank account, depending on the payment method that you choose and your bank’s own internal processes.

Conclusion

👉 Now it is your turn to participate:

➡️ Do you have any prior experience with OctaFX?

➡️ What was the determining factor in your decision to engage with OctaFX?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with OctaFX such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

👉 Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

👉 No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Table of Contents