Tickmill Review

Overall, Tickmill is considered a low-risk and can be summarised as trustworthy and competitive. Tickmill is regulated by the top-tier DFSA, FCA, and ASIC. Tickmill is currently one of the top-rated platforms with a Trust Score of 81% out of 100 with a rating of 9/10.

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 100

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Tickmill Review – 23 key points quick overview:

- ✅ Tickmill Overview

- ✅ Tickmill at a Glance

- ✅ Tickmill Regulation and Safety of Funds

- Tickmill Awards and Recognition

- Tickmill Account Types and Features

- How to open an Account with Tickmill in Rwanda

- Tickmill Vs FP Markets Vs Exness – Broker Comparison

- Tickmill Trading Platforms

- Tickmill Range of Markets

- Broker Comparison for Range of Markets

- Tickmill Trading and Non-Trading Fees

- Tickmill Deposits and Withdrawals

- How to Deposit Funds with Tickmill

- Tickmill Fund Withdrawal Process

- Tickmill Education and Research

- Tickmill Bonuses and Promotions

- How to open an Affiliate Account with Tickmill

- Tickmill Affiliate Program Features

- Tickmill Customer Support

- Tickmill Corporate Social Responsibility

- Our Verdict on Tickmill

- Tickmill Pros and Cons

- FAQ

Tickmill Overview

👉 Overall, Tickmill is considered low-risk, with an overall Trust Score of 82 out of 100. Tickmill is licensed by one Tier-1 regulator (high trust), two Tier-2 Regulators (average trust), and two Tier-3 Regulators (low trust). Tickmill offers three different retail trading accounts namely a Pro Account, Classic Account, and a VIP Account.

👉 Tickmill gives professional traders access to a wide variety of services and solutions that are developed just for them. The products and platforms offered by Tickmill are mostly geared toward advanced Rwandan traders who know what they need from a broker.

👉 However, beginner Rwandan traders are considered and Tickmill subsequently offers decent support and some educational tools. The Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Authority (FSA) of Seychelles, the FSA of Labuan, and the Financial Conduct Authority (FSCA) all regulate the industry in various regions.

👉 Although Tickmill offers services and products that may be used by both novice and experienced traders, the results of our research and testing indicate that it is primarily aimed at experienced traders.

👉 There are both commission-free and commission-based account types available to choose from when opening an account. Tickmill offers the MT4/MT5 trading platforms at a competitive commission-based cost structure.

👉 The Advanced Trading Toolkit adds eleven new plugins to the main trading platforms on desktop computers.

👉 Tickmill also offers the Acuity trading tool, which gives traders a significant advantage and high-quality services for social and algorithmic traders.

👉 This Tickmill review for Rwanda will provide local retail traders with the details that they need to consider whether Tickmill is suited to their unique trading objectives and needs.

👉 Tickmill accepts Rwandan clients and has an average spread from 0.0 pips with commissions from $1 per standard lot traded. Tickmill has a maximum leverage ratio up to 1:500 and there is a demo and Islamic account available.

👉 MetaTrader 4 and MetaTrader 5 platforms are supported. Tickmill is headquartered in London, United Kingdom and regulated by Seychelles FSA, FCA, CySEC, Labuan FSA, and FSCA.

Tickmill Distribution of Traders

👉 Tickmill currently has the largest market share in these countries:

➡️ Poland – 14.9%

➡️ Vietnam – 9.04%

➡️ Thailand – 7.04%

➡️ Malaysia – 6.26%

➡️ Qatar – 5.5%

Popularity among traders who choose Tickmill

🥇 Tickmill does not have an exceptionally large market share in African regions such as Rwanda. However, Tickmill is still one of the Top 30 brokers for beginner and professional Rwandan traders.

Tickmill at a Glance

| 🏙 Headquartered | London, United Kingdom |

| 🏛 Global Offices | Cyprus, South Africa, Seychelles, Malaysia |

| 💻 Local Market Regulator in Rwanda | The National Bank of Rwanda (BNR) |

| 💸 Foreign Direct Investment in Rwanda | 99.92 USD Million in 2020 |

| 🔄 Foreign Exchange Reserves in Rwanda | 1,806 million US dollars in 2020 |

| 🏛 Local office in Kigali? | No |

| 👨⚖️ Governor of SEC in Rwanda | None, John Rwangombwa is the Governor of the National Bank of Rwanda |

| ✔️ Accepts Rwandan Traders? | Yes |

| 🗓 Year Founded | 2015 |

| ☎️ Rwandan Traders Office Contact Number | None |

| 📲 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ Regulation | • Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA |

| 1️⃣ Tier-1 Licenses | • Financial Conduct Authority (FCA) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) • Financial Sector Conduct Authority (FSCA) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) • Financial Services Authority Labuan (LFSA) |

| 🪪 License Number | • Seychelles – SD008 • United Kingdom – 733772 • Cyprus – 278/15 • Labuan – MB/18/0028 • South Africa – FSP 49464 |

| ⚖️ BNR Regulation | None |

| 🏛 Global Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | MAM Accounts |

| 💵 Liquidity Providers | Barclays and other top-tier banks as well as hedge funds |

| 💰 Affiliate Program | Yes |

| ➡️ Order Execution | Market |

| 📊 Starting spread | From 0.0 pips |

| 💸 Minimum Commission per Trade | $1 per side, per standard lot traded |

| 💵 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 30% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots |

| 💰 Crypto trading offered? | Yes |

| ✔️ Offers an RWF Account? | No |

| 👥 Dedicated Rwandan Traders Account Manager? | No |

| 📊 Maximum Leverage | 1:500 |

| 📈 Leverage Restrictions for Rwanda? | None |

| 💵 Minimum Deposit (RWF) | 100,000 Rwandan Franc or an equivalent to $100 |

| ✔️ Rwandan franc Deposits Allowed? | No, only USD, GBP, EUR, IDR, CNY, VND, RUB |

| 📊 Active Rwandan Traders Trader Stats | 50,000+ |

| 👥 Active Rwandan Traders-based Tickmill customers | Unknown |

| 🔄 Rwanda Daily Forex Turnover | Unknown, the overall trading volume of over $6.6 trillion |

| 💰 Deposit and Withdrawal Options | • Bank Transfer • Debit Card • Credit Card • Skrill • Neteller • Sticpay • Fasapay • UnionPay • Nganluong • QIWI • WebMoney |

| 📉 Minimum Withdrawal Time | 1 Business Day |

| 📈 Maximum Estimated Withdrawal Time | 2 to 7 Business Days |

| 💰 Instant Deposits and Instant Withdrawals? | Instant Deposits |

| 🤝 Segregated Accounts with Rwandan Traders Banks? | No |

| 💻 Trading Platforms | • MetaTrader 4 • MetaTrader 5 |

| 💵 Tradable Assets | • Forex • Stock Indices • Energies • Precious Metals • Bonds • Cryptocurrencies |

| 💸 Offers USD/RWF currency pair? | No |

| 📊 USD/RWF Average Spread | N/A |

| ✅ Offers Rwandan Traders Stocks and CFDs | No, but offers AFRICA40 FTSE/JSE |

| 📖 Languages supported on the Website | English, Indonesian, Russian, Arabic, Italian, Thai, Vietnamese, German, Chinese (Simplified), Spanish, Polish, Korean, Malay, Portuguese |

| 📘 Customer Support Languages | Multilingual |

| 🗣 Copy Trading Support | Yes, Myfxbook |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Rwandan Traders-based customer support? | No |

| 💰 Bonuses and Promotions for Rwandan Traders | Yes |

| 📚 Education for Rwanda beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 🏅 Most Successful Rwandan Trader | Unknown |

| ✔️ Is Tickmill a safe broker for Rwandan Traders? | Yes |

| 🎖 Rating for Tickmill Rwanda | 9/10 |

| 🥇 Trust score for Tickmill Rwanda | 82% |

| 👉 Open An Account | 👉 Open Account |

Tickmill Regulation and Safety of Funds

Tickmill Regulation in Rwanda

👉 Tickmill does not have licensing, regulations, or authorization in Rwanda through local market regulators, but the broker is regulated in five other regions through Tier-1, Tier-2, and Tier-3 regulators.

Tickmill Global Regulations

👉 Tickmill has obtained licenses and regulations in five key countries to attract investors and establish a universally accessible online trading platform. This includes:

➡️ The Financial Sector Conduct Authority (FSCA) in South Africa where Tickmill South Africa (Pty) Ltd. is regulated under FSP number 49464.

➡️ The Financial Conduct Authority (FCA) in the UK where Tickmill UK Ltd. is regulated under license number 733772.

➡️ The Cyprus Securities and Exchange Commission (CySEC) of Cyprus, where Tickmill Europe Ltd. is regulated under license number 278/15.

➡️ The Seychelles Financial Services Authority (FSA) where Tickmill Ltd. is regulated under the license number SD008.

➡️ Finally, the Labuan Financial Services Authority (LFSA) regulates Tickmill Asia Ltd. under license number MB/18/0028.

👉 Tickmill is also registered with BaFin, CONSOB, ACPR, and CNMV in Germany, Italy, and France. Tickmill must comply with all required Know Your Client (KYC) and Anti-Money Laundering (AML) checks to meet licensing requirements.

Tickmill Client Fund Security and Safety Features

👉 Tickmill goes above and above typical security procedures by keeping customer money separate from the company’s operating accounts in Tier-1 financial institutions. This provides an added degree of protection for clients.

👉 Tickmill has also adopted sophisticated data security measures like encryption and frequent backups to ensure that customer information and data are protected.

👉 Investors in the United Kingdom are protected by the Financial Services Compensation Scheme for up to GBP 85,000, while European traders are covered by the Investor Compensation Fund for up to EUR 20,000 per account.

👉 Tickmill also offers negative balance protection on all its accounts, which means that customers are not responsible for trading losses exceeding the amount placed into their accounts.

👉 Tickmill goes to considerable efforts to offer customers a safe and dependable trading experience to assure continuous access to global financial markets.

👉 Tickmill’s trade execution approach is intended to give maximum value to investors, in addition to the technical and cybersecurity protections in place to secure order flow, customer data, and payment information.

👉 It all starts with the company’s hybrid execution methodology, which combines market-making with straight-through processing.

👉 The non-dealing desk approach reduces the risk of conflicts of interest with customer goals, and the internal steps used to prevent conflicts go a long way toward creating trust in Tickmill’s services.

Tickmill Awards and Recognition

👉 The Tickmill Group of Companies is comprised of the following international organizations:

➡️ United Kingdom – Tickmill UK Ltd.

➡️ Cyprus – Tickmill Europe Ltd.

➡️ South Africa – Tickmill South Africa (Pty) Ltd.

➡️ Seychelles – Tickmill Ltd.

➡️ Malaysia – Tickmill Asia Ltd.

👉 Each of these businesses has garnered several awards in their respective fields for a variety of reasons, including favourable trading conditions, excellent customer service, robust trading technology, and more. Tickmill has recently been honoured with the following accolades:

➡️ In 2021, FxScouts awarded Tickmill the “Best Trading Conditions” award.

➡️ In 2021, ForexBrokers.com ranked Tickmill the “#1 Broker for Commissions and Fees.”

➡️ Tickmill was named “Best MENA Forex Broker” at the Cairo Virtual Expo in 2021.

➡️ At the Cairo Virtual Expo in 2021, Tickmill was awarded the Award for “Best Customer Service.”

➡️ At the Global Forex Awards, Tickmill won the “Best Forex Customer Service Globally” award, as well as the “Best Forex Trading Experience” in Asia and the “Best Forex Trading Experience” in MENA.

➡️ Tickmill also won the “Best Trade Execution” award at the Cairo Investment Expo CIE4 in 2021.

Tickmill Account Types and Features

👉 There are three different sorts of live trading accounts that are offered by Tickmill: Pro, Classic, and VIP. Tickmill’s full market offering, which includes CFDs, Forex, Stock Indices, Precious Metals, Bonds, Energies, and Crypto, is accessible to traders based in Rwanda via any of the three account types that are available to them.

👉 Additionally, Rwandan traders have access to a demo account, which they may use to practice trading, test trading strategies, and assess the trading environment provided by Tickmill without the danger of losing real money.

👉 Tickmill also offers an Islamic account conversion for its Muslim customers who use the Pro, Classic, or VIP Accounts. This ensures that Sharia-compliant traders have access to halal trading conditions.

| 💻 Live Account | 💰 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💵 Average Trading Cost |

| ➡️ Pro | 100,000 RWF or $100 | 0.0 pips | $2 per side, per lot | 4 USD |

| ➡️ Classic | 100,000 RWF or $100 | 1.6 pips | None | 16 USD |

| ➡️ VIP | Min balance of 51,000,000 RWF or $50,000 | 0.0 pips | $1 per side, per lot | 2 USD |

Tickmill Live Trading Account Details

Pro Account

👉 This account is an entry-level account for professional traders and needs a minimum deposit of 100,000 RWF or an equivalent of $100. The trading charges associated with the Pro Account are also among the lowest in the industry.

👉 In addition, it is important to note that the commissions that Tickmill charges are among the lowest that can be expected from a broker and the overall industry, which typically charges $7 per round turn.

| Account Features | Value |

| 💰 Minimum Deposit | 100,000 RWF or an equivalent to 100 USD |

| 📊 Minimum Account Balance | None |

| 💵 Base Currency Options | • USD • EUR • GBP • PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.) |

| 📈 Spreads From | • 35 Forex Pairs • Gold and Silver • 3 Energies • 10 Indices • 30 Cryptocurrencies |

| 💳 Maximum Leverage Ratio | • Seychelles: 1:500 • UK: 1:30 (Retail), 1:500 (Pro) • Cyprus: 1:30 (Retail), • 1:300 (Pro) • Malaysia: 1:500 • South Africa: 1:500 |

| 💸 Minimum Lots that can be traded | 0.01 lots |

| 💰 Commission charges | $2 per side per standard lot of 100,000 |

| ✔️ Strategies Allowed | Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc. |

| ☪️ Swap-Free Islamic Account Option | Yes |

Classic Account

👉 Tickmill’s Classic Account requires a minimum deposit of only 100,000 Rwandan Franc or an equivalent to 100 USD and allows trading in smaller trade sizes, measured in micro-lots, which is suitable for beginner traders.

| Account Features | Value |

| 💰 Minimum Deposit | 100,000 RWF or an equivalent to 100 USD |

| 📊 Minimum Account Balance | None |

| 💵 Base Currency Options | • USD • EUR • GBP • PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.) |

| 📈 Spreads From | 1.6 pips |

| 💳 Maximum Leverage Ratio | • Seychelles: 1:500 • UK: 1:30 (Retail), 1:500 (Pro) • Cyprus: 1:30 (Retail), • 1:300 (Pro) • Malaysia: 1:500 • South Africa: 1:500 |

| 💸 Minimum Lots that can be traded | 0.01 lots |

| 💰 Commission charges | None |

| ✔️ Strategies Allowed | Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc. |

| ☪️ Swap-Free Islamic Account Option | Yes |

VIP Account

👉 The VIP Account’s trading expenses are lower than the charges on the other two accounts, and they are much lower than the trading fees that other brokers charge for accounts that are comparable to the VIP Account.

👉 However, traders are required to have and maintain a minimum account balance of 50,000 USD, which means that only experienced traders can participate in this market using this trading account.

👉 Another unique feature of this account is the tight spreads charged and the ultra-low round-turn commissions of $2 per round turn, some of the lowest in the industry today.

| Account Features | Value |

| 💰 Minimum Deposit | None |

| 📊 Minimum Account Balance | 51,000,000 Rwandan Franc or an equivalent to $50,000 |

| 💵 Base Currency Options | • USD • EUR • GBP • PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.) |

| 📈 Spreads From | 0.0 pips |

| 💳 Maximum Leverage Ratio | • Seychelles: 1:500 • UK: 1:30 (Retail), 1:500 (Pro) • Cyprus: 1:30 (Retail), • 1:300 (Pro) • Malaysia: 1:500 • South Africa: 1:500 |

| 💸 Minimum Lots that can be traded | 0.01 lots |

| 💰 Commission charges | $1 per side per standard lot of 100,000 |

| ✔️ Strategies Allowed | Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc. |

| ☪️ Swap-Free Islamic Account Option | Yes |

Tickmill Base Account Currencies

👉 Tickmill does not provide its consumers with the option of opening a trading account in Rwandan Franc (RWF). The only currencies that may be utilized as base currencies across all five of Tickmill’s global firms are the US dollar (USD), the British pound (GBP), and the Euro (EUR).

👉 In addition to these currencies, Tickmill UK Ltd., and Tickmill Europe Ltd. both enable PLN to be used as an additional currency between accounts.

👉 This is a source of irritation for Rwandans who have bank accounts in RWF, since most other offshore brokers provide a broader range of services. Conversion fees could dramatically lower a company’s profit margins while also increasing trade expenses.

Tickmill Demo Account

👉 Traders may acquire experience and develop their abilities using Tickmill’s demo account, which replicates real-time market conditions, allows them to test trading tools and methods, and does not need them to risk their actual funds.

👉 Tickmill’s trading platforms are completely functioning and loaded with several one-of-a-kind tools and features meant to assist users in boosting their overall trading skills and expertise.

👉 Tickmill provides over 80 different trading products, each of which may be traded risk-free via a demo account. Remember that to preserve access to the demo account, traders must use it often.

👉 The demo account of a trader will be deleted after seven days of inactivity, at which time the trader must reapply for the account. Traders can register for a maximum of seven demo accounts using a single registered and confirmed email address.

Tickmill Islamic Account

👉 Because Tickmill places a high priority on the interests of its customers, the broker makes every effort to fulfil the trading requests and requirements of customers located in every region of the globe.

👉 Tickmill considers this and provides Islamic accounts that are consistent with Sharia for its Pro, Classic, and VIP users. Accounts that do not engage in swaps are commonly referred to as Islamic accounts.

👉 This is since Islam prohibits exchanging currencies as well as paying interest on overnight holdings. Muslim traders have the option of opening any kind of account with Tickmill, and the broker will convert it to an Islamic account for them.

👉 This enables Muslim traders to take advantage of the best trading conditions offered by Tickmill.

👉 The trading conditions and terms that are associated with Islamic accounts are like those that are associated with standard trading account types. The only difference is that Islamic accounts do not allow swaps to be deducted or credited on trading instruments.

👉 On the other hand, if several trading instruments are stored overnight for more than three nights in a row, a handling fee will be levied to compensate for the absence of overnight charges.

How to open an Account with Tickmill in Rwanda

👉 To register an account with Tickmill, Rwandan traders can navigate to Tickmill’s official website under the Seychelles entity (Tickmill Ltd), and follow these steps:

➡️ Click on the option to register from the homepage and complete the application form. Include any personal information, including your name, address, date of birth, and email address.

➡️ Click the validation link that was provided to your email account to verify that it is your own.

➡️ Continue with the application form by providing information about your work and income, information about your taxes, and previous trading experience.

➡️ If required by the regulator through which you are registering a Tickmill account, you must pass the test of appropriateness. Most regulated brokers are obliged to determine whether you are qualified to create an account by asking you a series of questions.

➡️ Submit your proof of identity and residential address and wait for Tickmill’s team to verify and approve your account.

➡️ You will need to wait to be completely validated, with validation taking up to twenty-four hours after submitting your identification and verification papers.

➡️ After your identity has been confirmed, you will be able to deposit money, download the software, and begin trading.

Tickmill Vs FP Markets Vs Exness – Broker Comparison

| 🥇 Tickmill | 🥈 FP Markets | 🥉 Exness | |

| ⚖️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA | ASIC, CySEC | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 💻 Trading Platform | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 • Myfxbook AutoTrade • FP Markets App | • MetaTrader 4 • MetaTrader 5 • Exness App • Exness Terminal |

| 💵 Withdrawal Fee | No | Yes | No |

| ✔️ Demo Account | Yes | Yes | Yes |

| 💰 Min Deposit | 100,000 RWF | 71,000 RWF | 10,200 RWF |

| 📊 Leverage | 1:500 | 1:500 | Unlimited |

| 📈 Spread | Variable, from 0.0 pips | 0.0 pips | Variable, 0.0 pips |

| 💸 Commissions | $1 per side per 100,000 traded | From US$3 | From $0.1 per side, per lot |

| 🛑 Margin Call/Stop-Out | 100%/30% | 100%/50% | 60%/0% |

| 📲 Order Execution | Market | Market | Market |

| ✔️ No-Deposit Bonus | Yes | No | No |

| ✅ Cent Accounts | No | No | Yes |

| 💻 Account Types | • Pro Account • Classic Account • VIP Account | • MT4/5 Standard Account • MT4/5 Raw Account • MT4/5 Islamic • Standard Account | • Standard Account • Standard Cent Account • Raw Spread Account • Zero Account • Pro Account |

| ⚖️ BNR Regulation | No | No | No |

| 💵 RWF Deposits | No | Yes | Yes |

| ✔️ Rwandan franc Account | No | No | No |

| 📞 Customer Service Hours | 24/5 | 24/7 | 24/7 |

| 🛍 Retail Investor Accounts | 3 | 4 | 5 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 pips | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | 50 lots | Unlimited |

| 📊 Minimum Withdrawal Time | 1 Business Day | Instant | Instant |

| ⏱ Maximum Estimated Withdrawal Time | 2 to 7 Business Days | Up to 5 working days | Up to 72 hours |

| ✔️ Instant Deposits and Instant Withdrawals? | Instant Deposits | Yes, Sticpay wallet withdrawals | Yes |

Min Deposit

USD 100

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

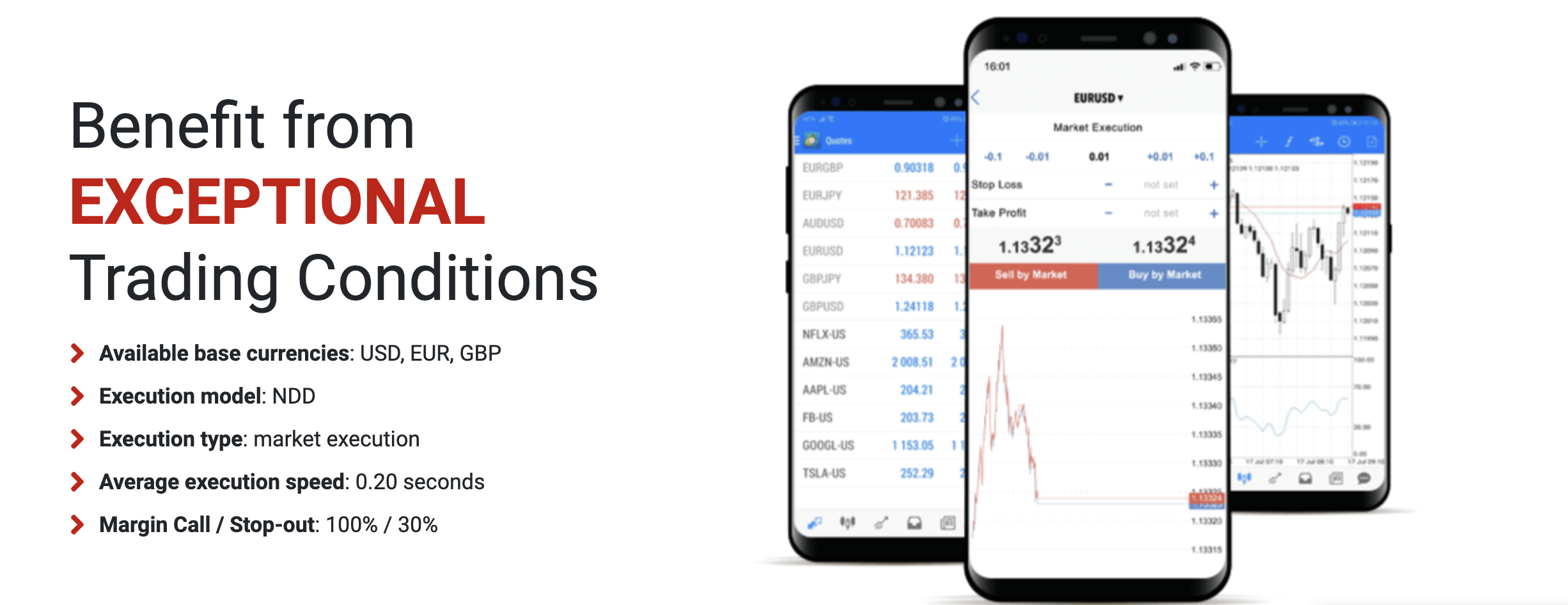

Tickmill Trading Platforms

👉 Tickmill offers Rwandan Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

👉 Tickmill is a MetaTrader-only broker that offers the standard trading experience for both MetaTrader 4 and MetaTrader 5. Aside from AutoChartist, Tickmill does not provide any remarkable add-ons that might help it differentiate itself from the other top MetaTrader brokers.

👉 In addition to the functions and features of MetaTrader 4 and 5, Tickmill provides virtual private server hosting, which might be beneficial to algorithmic traders who use either of these popular trading platforms.

👉 The MetaTrader 4 and 5 platforms are a fantastic option for Rwandan traders since they are both user-friendly and have the capability of being customized to meet individual needs.

👉 Due to the ease of use and minimal learning curve, both platforms are suitable for traders of all experience levels, from novices to seasoned professionals. It is available in several different languages and incorporates a user manual directly into the program itself.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

👉 Metatrader 4 and 5, often referred to as just MT4 or MT5, are the platforms with the highest level of reliability and the greatest number of users, and they have both firmly established themselves as the platforms that lead the industry.

👉 For successful online trading, their user-friendly structures and simple interfaces provide essential tools and resources.

👉 In addition to this, they are well-known for their rapid execution times, an extensive collection of charting tools, capacity to engage in algorithmic trading, and superior adaptability.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

👉 MetaTrader4 (MT4) and MetaTrader 5 (MT5) are both trading apps that may be used on iOS, Android, and Windows-based mobile devices. The desktop software and the mobile application will both be connected to the same account, allowing traders to trade on the move while staying in sync.

👉 Traders should be aware that as compared to PC trading platforms, there is a certain loss of capability.

👉 Reduced time frames and charting choices are among the functional losses; nevertheless, traders can still use their trading apps to cancel and change existing orders, compute profit and loss, and trade on the charts.

Tickmill Range of Markets

👉 Rwandan Traders can expect the following range of markets from Tickmill:

➡️ Forex

➡️ Stock Indices

➡️ Energies

➡️ Precious Metals

➡️ Bonds

➡️ Cryptocurrencies

Financial Instruments and Leverage offered by Tickmill

| 🔨 Instrument | ✔️ Number of Assets Offered | 📈 Maximum Leverage Offered |

| ➡️ Forex | 62 | • FCA, CySEC: 1:30 • FSA, LFSA, FSCA: 1:500 |

| ➡️ Precious Metals | 4 | • FCA, CySEC: 1:20 • FSA, LFSA, FSCA: 1:500 |

| ➡️ Indices | 23 | • FCA, CySEC: 1:20 • FSA, LFSA, FSCA: 1:100 |

| ➡️ Stocks | 98 | • FCA, CySEC: 1:20 • FSA, LFSA, FSCA: 1:20 |

| ➡️ Cryptocurrency | 8 | • FCA, CySEC: 1:200 • FSA, LFSA, FSCA: 1:200 |

| ➡️ Energies | 3 | • FCA, CySEC: 1:10 • FSA, LFSA, FSCA: 1:100 |

| ➡️ Bonds | 4 | • FCA, CySEC: 1:5 • FSA, LFSA, FSCA: 1:100 |

Broker Comparison for Range of Markets

| 🥇 Tickmill | 🥈 FP Markets | 🥉 Exness | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | No | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | No |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | No | No |

Tickmill Trading and Non-Trading Fees

Spreads

👉 The spreads charged by Tickmill are variable and there are no fixed spread options offered. This means that the spread can change according to the financial instrument being traded and the market conditions on the trading day.

👉 In addition, the three account types that Tickmill offer have unique spreads. While the Pro and VIP account have the tightest spreads from 0.0 pips, these accounts have commission fees applied to cover Tickmill’s costs for facilitating the trade.

👉 The Classic Account, however, offers commission-free trading, which means that Tickmill takes its fees from the spread by adding a mark-up.

👉 Thus the spreads charged by Tickmill can be broken down as follows according to the account types:

➡️ Pro Account – 0.0 pips

➡️ Classic Account – 1.6 pips

➡️ VIP Account – 0.0 pips

👉 While EUR/USD is often used as the benchmark to indicate overall trading costs, Rwandan traders can expect some of the following spreads according to the different financial instruments offered by Tickmill, giving them an idea of what they can expect in terms of trading fees:

| 🔨 Instrument | 📈 Minimum Spread | 💰 Typical Spread |

| WTI/USD | 0.04 pips | 0.04 pips |

| USTEC | 0.8 pips | 1.9 pips |

| XAG/USD | 0.0 pips | 0.021 pips |

| XAU/USD | 0.0 pips | 0.09 pips |

| Bonds | From 0.018 pips | 0.018 pips |

| Cryptocurrencies | 0.0 pips | 0.002 pips |

Commissions

👉 Commission-free trading is available with the Classic Account, which contains marked-up spreads to cover the broker’s costs. Tickmill, on the other hand, charges commissions on trading accounts in the following categories.

➡️ Pro Account – $2 per side, per 100,000 (standard lot) traded

➡️ VIP Account – $1 per side, per 100,000 (standard lot) traded

👉 Furthermore, even though the Islamic Account has no overnight fees, commissions must be paid when securities are stored overnight. These commissions are as follows:

| 🔨 Financial Instrument | 💸 Charge Per lot in USD |

| BRENT, XTI/USD | 0.01 USD |

| LTC/USD | 0.1 USD |

| ETH/USD | 1 USD |

| EUR/CZK, EUR/DKK, EUR/HKD, GBP/CZK, GBP/HKD, USD/CZK, USD/HKD, USD/SEK | 5 USD |

| EUR/HKD, EUR/NOK, EUR/PLN, EUR/SEK, EUR/SGD, GBP/DKK, GBP/HUF, GBP/NOK, GBP/PLN, GBP/SEK, NZD/SGD, USD/CNH, USD/DKK, USD/HUF, USD/NOK, USD/PLN, USD/SGD | 10 USD |

| EUR/MXN, EUR/ZAR, GBP/ZAR, USD/MXN, USD/ZAR | 20 USD |

| BTC/USD | 25 USD |

| EUR/TRY, GBP/TRY, USD/TRY | 50 USD |

Overnight Fees, Rollovers, or Swaps

👉 Swaps are the overnight interest that forex traders must pay to have an open position the following day. Depending on the trader’s position, they can also be credited with swaps. Swaps are typically applied at midnight, according to the platform’s time.

👉 Each currency pair is subjected to an exchange rate swap, which is computed using a standard lot size of 100,000 base currency units. Here are a few examples of typical Tickmill swap or overnight fees:

➡️ EUR/USD – a long swap of -3.54 pips and a short swap of 0.39 pips

➡️ USD/JPY – a long swap of -1.21 pips and a short swap of -2.62 pips

➡️ GBP/USD – a long swap of -1.89 pips and a short swap of -3.44 pips

➡️ USD/CHF – a long swap of 0.39 pips and a short swap of -3.71 pips

➡️ USD/CAD – a long swap of -2.42 pips and a short swap of -1.84 pips

➡️ AUD/USD – a long swap of -1.96 pips and a short swap of -1.75 pips

➡️ NZD/USD – a long swap of -0.67 pips and a short swap of -1.96 pips

Deposit and Withdrawal Fees

👉 When Rwandan traders fund their trading accounts or withdraw cash, no deposit or withdrawal fees are charged.

Inactivity Fees

👉 Dormant accounts are not subject to any costs incurred because of inactivity.

Currency Conversion Fees

👉 Because RWF is not currently offered as a default currency on any of Tickmill’s account types (Pro, Classic, or VIP), Rwandan traders will be subject to currency conversion fees whenever they make a deposit or withdrawal in a currency that is not the United States Dollar (USD), the Euro (EUR), the Great British Pound (GBP), or the Polish Zloty PLN).

Tickmill Deposits and Withdrawals

👉 Tickmill offers the following deposit and withdrawal methods:

➡️ Bank Transfer

➡️ Debit Card

➡️ Credit Card

➡️ Skrill

➡️ Neteller

➡️ Sticpay

➡️ Fasapay

➡️ UnionPay

➡️ Nganluong

➡️ QIWI

➡️ WebMoney

Broker Comparison: Deposit and Withdrawals

| 🥇 Tickmill | 🥈 FP Markets | 🥉 Exness | |

| Minimum Withdrawal Time | 1 business day | Instant | Instant |

| Maximum Estimated Withdrawal Time | 2 to 7 Business Days | Up to 5 working days | Up to 72 hours |

| Instant Deposits and Instant Withdrawals? | Instant Deposits | Yes, Sticpay wallet withdrawals | Yes |

Tickmill Deposit Currencies, Processing Times, and Minimum Deposit/Withdrawal

| 💰 Payment Method | 💵 Accepted Currencies | 💰 Deposit Processing | 💵 Withdrawal Processing |

| Bank Transfer | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | 1 – 3 days | 3 – 7 days |

| Credit/Debit Cards | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant | 1 day |

| Neteller | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant | 1 day |

| PayPal | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant | 1 day |

| Skrill | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant | 1 day |

| UnionPay | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | Instant | 1 day |

How to Deposit Funds with Tickmill

👉 To deposit funds to an account with Tickmill, Rwandan Traders can follow these steps:

➡️ Traders in Rwanda may get access to their Client Area on the Tickmill website by first signing in.

➡️ Traders can then choose the deposit option that caters to their requirements the most effectively.

➡️ Traders can perform any further steps required by the payment provider, including submitting the deposit amount, the deposit currency, and the deposit amount itself.

Tickmill Fund Withdrawal Process

👉 To withdraw funds from an account with Tickmill, Rwandan Traders can follow these steps:

➡️ Traders may choose the account from which withdrawals must be made by logging into their client area and making the necessary selection from the available options on the dashboard.

➡️ Traders can choose their withdrawal method by using the same option that was used during deposits, provide the amount of the withdrawal, and designate the currency in which the withdrawal will be made.

➡️ After the withdrawal request has been finished being filled out, it will be sent to Tickmill to be processed.

Tickmill Education and Research

Education

👉 Tickmill offers the following Educational Materials:

➡️ Webinars

➡️ Seminars

➡️ eBooks

➡️ Video Tutorials

➡️ Infographics

➡️ Forex Glossary

➡️ Fundamental Analysis

➡️ Technical Analysis

➡️ Educational Articles

➡️ Market Insights

Research and Trading Tool Comparison

| 🥇 Tickmill | 🥈 FP Markets | 🥉 Exness | |

| Economic Calendar | Yes | Yes | Yes |

| VPS | Yes (Paid) | Yes | Yes |

| AutoChartist | Yes | Yes | No |

| Trading View | No | No | Yes |

| Trading Central | No | No | Yes |

| Market Analysis | Yes | Yes | Yes |

| News Feed | Yes | Yes | Yes |

| Blog | Yes | Yes | Yes |

👉 Tickmill also offers Rwandan traders the following additional Research and Trading Tools:

➡️ Access to AutoChartist

➡️ Access to Myfxbook Copy Trading

➡️ Economic Calendar

➡️ Forex Calculators

➡️ Tickmill VPS

➡️ Pelican Trading

➡️ Advanced Trading Toolkit

➡️ Acuity Trading

Tickmill Bonuses and Promotions

👉 Tickmill offers Rwandan Traders the following bonuses and promotions:

➡️ Trader of the Month Contest

➡️ Tickmill’s NFP Machine

➡️ $30 Welcome No-Deposit Bonus Account

➡️ The chance to get paid to trade

Trader of the Month Contest

👉 Tickmill presents an award to the top trader among its professional traders. This provides traders with the ideal opportunity to earn $1,000 based on their gains and general money and risk management abilities.

👉 Traders do not need to fill out any more forms to participate in the contest, and all customers who open a live account with Tickmill are instantly entered.

NFP Machine

👉 Tickmill’s Non-Farm Payroll (NFP) event enables traders to forecast the final number that will be reported in the United States. Tickmill will choose a financial instrument and challenge its customers to anticipate its price once the labour data is issued during each NFP week.

👉 This is done on MetaTrader 4 at 4 p.m., 30 minutes after the NFP has been released. Traders who get the figure right may win up to $500, while those who get it near can earn up to $200, which is put immediately into their account as withdrawable cash.

$30 Welcome No-Deposit Bonus

👉 Tickmill’s no-deposit bonus is one of its most appealing features, as it gives new traders who open an account for the first time $30 in free trading credit without having to make a deposit.

👉 It is a simple procedure to register, and traders who earn from this $30 bonus can subsequently withdraw their gains.

Get Paid to Trade Incentive

👉 Traders who participate in this program are eligible to receive cash rebates based on the total volume of their trades.

👉 Traders may earn between $0.25 and $0.75 for every lot that they trade, depending on their total monthly trading volume, if they take advantage of this incentive that Tickmill offers to reward its consumers for their continued loyalty.

👉 The following indicates the incentives and the trading volume needed to earn them:

➡️ 0 up to 1,000 lots per month – $0.25 per standard lot

➡️ 1,001 up to 3,000 lots traded per month – $0.50 per standard lot

➡️ 3,000 lots and more – $0.75 per standard lot

How to open an Affiliate Account with Tickmill

👉 To register an Affiliate Account, Rwandan Traders can follow these steps:

➡️ Depending on your country of residence, you can visit the right Tickmill website by clicking on the correct Tickmill entity at the top of the page.

➡️ Hover your cursor over “Partnership” on the homepage and choose “Introducing Broker.”

➡️ Review the information provided on Tickmill’s affiliate program and then choose to join the affiliate program.

➡️ Complete the application form with your personal information and work history.

➡️ The Client Area registration procedure on the Tickmill website is now complete.

➡️ Submit identity and address verification papers to complete the profile.

➡️ To activate your account and have access to Tickmill’s entire client acquisition and referral capabilities, go to the IB Room.

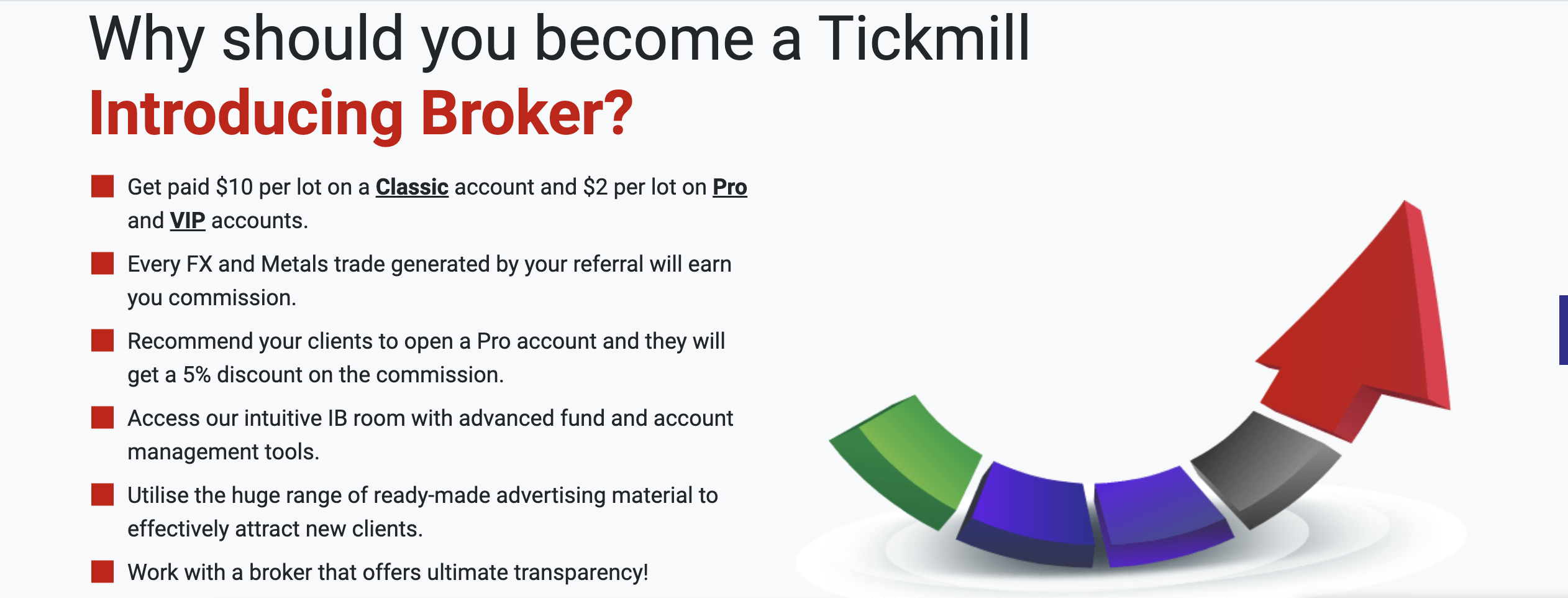

Tickmill Affiliate Program Features

👉 Participants in the Tickmill Affiliate Program get a multitude of opportunities to establish their own independent enterprises, in addition to access to vast advertising materials and active support from Tickmill.

👉 The operation of independent ventures, either on the side as a secondary source of money or as the principal source of revenue for several persons and enterprises, has already resulted in the generation of considerable profits.

👉 Introducing Brokers and Affiliates are the two primary types of partnership opportunities that are available via Tickmill. The Introducing Broker program is user-friendly and very well-liked since it enables partners to earn commissions by referring friends and family members to Tickmill and because it is easy to use.

Tickmill Customer Support

👉 Tickmill’s customer support is accessible around the clock, five days a week. Traders can contact Tickmill through e-mail, webform, phone, or live chat.

👉 The most frequent questions are answered in a FAQ section present on the Tickmill website. At a well-run brokerage, assistance from the customer support staff is seldom necessary, but knowing that one is there in the event of an emergency is reassuring.

| Customer Support | Weltrade’s Customer Support |

| ⏰ Operating Hours | 24/7 |

| 🗣 Support Languages | Multilingual |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| 📞 Telephonic Support | Yes |

| ✔️ Local Support in Rwanda? | No |

| 🥇 Overall quality of Weltrade Support | 3/5 |

Tickmill Corporate Social Responsibility

👉 The Tickmill team believes that CSR may assist in achieving greater societal impact. Tickmill has a diverse CSR portfolio that benefits worldwide communities, as well as individual social welfare and sports potential.

👉 Tickmill’s most significant actions include a pledge to the Gajusz Foundation for Terminally Ill Children and gifts to Germany’s Bärenherz Children’s Hospice.

👉 Tickmill also supports the organizations and sports teams listed below:

➡️ Keeping Kids in School (KKIS) – An ever-growing network of volunteers works to increase public school graduation rates in Playa del Carmen, Mexico, by offering financial assistance and material resources to children as well as building links to higher education institutions.

➡️ Off-Road Kids Foundation – The Off-Road Kids Foundation is an international non-profit that offers specialized programs to teenagers who have been displaced by homelessness.

➡️ The One Dream, One Wish Association is a non-profit organization based in Cyprus that grants cancer-stricken children’s desires while also providing financial and emotional assistance to their families.

➡️ Kyrenia Nautical Club Triathlon Academy – Due to its unwavering drive to consistently raise the bar, this triathlon academy from Kyrenia Nautical Club has excelled in international contests such as the Ironman Triathlon.

Min Deposit

USD 100

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Our Verdict on Tickmill

👉 Tickmill shows an exceedingly prominent level of expertise as an online ecosystem built by experienced experts, with a carefully crafted ecosystem that can meet the needs of both beginner and professional investors.

👉 Beginning with the platform’s elevated level of accessibility, newcomers with no prior investing expertise will find the platform’s inexpensive trading conditions, straightforward trading platforms, and extensive instructional resources particularly useful for learning the fundamentals.

👉 The inclusion of useful tools such as one-click trading, AutoChartist, and fundamental and technical analysis all assist beginners to gain confidence and improve their talents.

👉 Advanced traders will enjoy the opportunity to apply any trading method, with arbitrage, hedging, scalping, and algorithmic options all welcome to join the platform without limitation.

👉 Although traders who prefer more complex trading technology may not find MetaTrader 4 to be comprehensive enough to meet their needs, sophisticated and institutional investors have access to the FIX API and even a Prime brokerage model.

👉 Tickmill customers benefit from excellent execution, raw spreads for higher account levels, and no-requotes, all of which contribute to a healthy trading environment capable of levelling the playing field in global financial markets.

Tickmill Pros and Cons

| ✔️ Pros | ❌ Cons |

| Tickmill is regulated in five countries by regulators and all licenses can be confirmed | Tickmill charges admin fees on Islamic Accounts |

| Tickmill provides investor protection as well as negative balance protection | There is no RWF-denominated account for Rwandans, subjecting them to currency conversion fees on deposits and withdrawals |

| There are no inactivity fees that are applied to dormant accounts | There is a limited choice between tradable instruments |

| Tickmill does not charge any deposit or withdrawal fees | There are no fixed spread accounts offered |

| There are demo accounts offered by Tickmill and Islamic Account options on all accounts | The educational section lacks resources |

| Tickmill supports the use of MetaTrader 4 and 5 across devices | |

| Rwandan traders are given access to FIX API, VPS, AutoChartist, and other tools | |

| Rwandan traders can expect tight spreads and some of the lowest commissions in the industry |

FAQ

Does Tickmill have Volatility 75?

No, Tickmill is not a CFD broker that offers Volatility 75 to traders.

Does Tickmill have Nasdaq?

Yes, Tickmill offers traders the opportunity to trade Nasdaq through MetaTrader 4 and MetaTrader 5 using the Classic, Pro, or VIP trading accounts.

How do I withdraw from Tickmill?

You can log into your Client Area using your credentials, select your preferred payment method, specify your withdrawal amount, and click “Submit.”

Depending on your withdrawal method, you may be required to complete additional steps to confirm the withdrawal request.

Is Tickmill good for Scalping?

Yes, Tickmill is particularly good for scalping strategies. Tickmill enables consumers to trade with lower spreads, and the exchange rates for exchanging assets at certain prices are also attractive.

Tickmill’s software works in conjunction with liquidity providers to provide consumers with high-quality trading, scalping, and investment execution at affordable prices.

Is Tickmill regulated?

Yes, Tickmill is regulated in five countries by CySEC (Tier-2), FCA (Tier-1), FSCA (Tier-2), FSA (Tier-3), and LFSA (Tier-3).

Is Tickmill safe or a scam?

Tickmill is a verified, safe, and trusted broker that has an exceptionally good reputation and has won several industry awards in the past seven years of operation.

What is Tickmill’s minimum deposit?

Tickmill’s minimum deposit is 100 units in USD, GBP, EUR, or PLN.

Can I trade stocks on Tickmill?

Yes, Tickmill allows you to trade stock CFDs on MetaTrader 4 and MetaTrader 5 through the VIP, Classic, and Pro trading accounts.

What is the withdrawal time for Tickmill?

The time that it takes for withdrawals to be transferred from the trading account into your bank account ranges from a business day up to several business days, depending on the withdrawal method that you used.

Conclusion

👉 Now it is your turn to participate:

➡️ Do you have any prior experience with Tickmill?

➡️ What was the determining factor in your decision to engage with Tickmill?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with Tickmill such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

c

Addendum/Disclosure:

👉 No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

👉 Regardless, please share your thoughts in the comments below.

Table of Contents