JustMarkets Review

Overall, JustMarkets is very competitive in terms of its trading fees and spreads. JustMarkets offers 7 retail accounts on three different trading platforms. JustMarkets has no hidden trading fees and is considered a trustworthy and reliable broker with a score of 8 out of 10. JustMarkets is currently not regulated by the Bank of Rwanda (BOT).

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD1

Regulators

FSA, CySec

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

JustMarkets Review – 23 key points quick overview:

- ✅ JustMarkets Overview

- ✅ JustMarkets at a Glance

- ✅ JustMarkets Regulation and Safety of Funds

- JustMarkets Awards and Recognition

- JustMarkets Account Types and Features

- How to open an Account with JustMarkets in Rwanda

- JustMarkets Vs FXCM Vs AMarkets – Broker Comparison

- JustMarkets Trading Platforms

- JustMarkets Range of Markets

- Broker Comparison for Range of Markets

- JustMarkets Trading and Non-Trading Fees

- JustMarkets Deposits and Withdrawals

- How to Deposit Funds with JustMarkets

- JustMarkets Fund Withdrawal Process

- JustMarkets Education and Research

- JustMarkets Bonuses and Promotions

- How to open an Affiliate Account with JustMarkets

- JustMarkets Affiliate Program Features

- JustMarkets Customer Support

- JustMarkets Corporate Social Responsibility

- Our Verdict on JustMarkets

- JustMarkets Pros and Cons

- FAQ

JustMarkets Overview

👉 Overall, JustMarkets is considered high-risk, with an overall Trust Score of 49 out of 100. JustMarkets is licensed by zero Tier-1 Regulators (high trust), zero Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). JustMarkets offers seven different retail trading accounts namely a Standard Cent Account (MT4), Standard Account (MT4), Pro Account (MT4), Raw Spread Account (MT4), Standard Account (MT5), Pro Account (MT5), Raw Spread Account (MT5).

👉 JustMarkets accepts Rwandan clients and has an average spread from 0.0 pips with $6 commission round turn. JustMarkets has a maximum leverage ratio up to 1:3000 and there is a demo and Islamic account available. MT4, MT5, and JustMarkets App platforms are supported. JustMarkets is headquartered in Seychelles and regulated by the FSA.

👉 Just Global Markets Ltd., a company that operates under the name JustMarkets and is registered as a company in the Republic of Seychelles, owns the brand name JustMarkets, which has been in operation since 2012. Headquartered in Seychelles, JustMarkets is regulated by the Financial Services Authority (FSA) in the region.

👉 Even though the broker makes more than 150 asset classes available for trading, such as Forex ECN, Stocks, Indices, Commodities, and Bonds, access to markets heavily relies on the type of account that is registered with JustMarkets.

👉 Traders in Rwanda who use the JustMarkets platform get access to the well-known MetaTrader 4 and MetaTrader 5 trading platforms for personal computers (PCs). They also have access to the MetaTrader mobile trading app, which is compatible with mobile devices running Android and iOS and the versatile WebTrader that allows them access to their trading from any browser.

👉 This JustMarkets review for Rwanda will provide local retail traders with the details that they need to consider whether JustMarkets is suited to their unique trading objectives and needs.

JustMarkets Distribution of Traders

👉 JustMarkets currently has the largest market share in these countries:

➡️ Malaysia – 35.7%

➡️ Indonesia – 9.6%

➡️ Kenya – 4.4%

➡️ India – 3.4%

➡️ Togo – 3.1%

Popularity among traders who choose JustMarkets

🥇 Although it is ranked among the top 50 brokers in Rwanda, JustMarkets does not yet have a massive portion of the market share in the country. However, JustMarkets’ primary focus is on providing services to customers in the African and Asian markets, which means some expansion can be anticipated.

JustMarkets at a Glance

| 🏙 Headquartered | Cyprus |

| 🏛 Global Offices | Cyprus, Seychelles |

| 💻 Local Market Regulator in Rwanda | The National Bank of Rwanda (BNR) |

| 💸 Foreign Direct Investment in Rwanda | 99.92 USD Million in 2020 |

| 🔄 Foreign Exchange Reserves in Rwanda | 1,806 million US dollars in 2020 |

| 🏛 Local office in Kigali? | No |

| 👨⚖️ Governor of SEC in Rwanda | None, John Rwangombwa is the Governor of the National Bank of Rwanda |

| ✔️ Accepts Rwandan Traders? | Yes |

| 🗓 Year Founded | 2012 |

| ☎️ Rwandan Traders Office Contact Number | None |

| 📲 Social Media Platforms | • Facebook • Telegram |

| ⚖️ Regulation | Seychelles Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySec) |

| 1️⃣ Tier-1 Licenses | None |

| 2️⃣ Tier-2 Licenses | None |

| 3️⃣ Tier-3 Licenses | Financial Services Authority (FSA) in Seychelles |

| 🪪 License Number | SD088 |

| ⚖️ BNR Regulation | None |

| 🏛 Global Restrictions | The United States, Japan, United Kingdom, EU, EEA, Belgium, and Spain |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 7 |

| ✔️ PAMM Accounts | MAM Accounts |

| 💵 Liquidity Providers | 18 |

| 💰 Affiliate Program | Yes |

| ➡️ Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 💸 Minimum Commission per Trade | $3 per lot, per side |

| 💵 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots |

| 💰 Crypto trading offered? | Yes |

| ✔️ Offers an RWF Account? | No |

| 👥 Dedicated Rwandan Traders Account Manager? | No |

| 📊 Maximum Leverage | 1:3000 |

| 📈 Leverage Restrictions for Rwanda? | None |

| 💵 Minimum Deposit (RWF) | 1,000 Rwandan Franc equivalent to $1 |

| ✔️ Rwandan franc Deposits Allowed? | Yes |

| 📊 Active Rwandan Traders Trader Stats | 50,000+ |

| 👥 Active Rwandan Traders-based JustMarkets customers | Unknown |

| 🔄 Rwanda Daily Forex Turnover | Unknown, the overall trading volume of over $6.6 trillion |

| 💰 Deposit and Withdrawal Options | • Debit Card • Credit Card • China UnionPay • Skrill • Neteller • Perfect Money • Sticpay • AirTM • Bitcoin • Bitcoin Cash • Ethereum • Tether • USD Coin • Local Bank Transfers, Cards, Mobile Money • Local Wallets |

| 📉 Minimum Withdrawal Time | Instant |

| 📈 Maximum Estimated Withdrawal Time | 10 bank days |

| 💰 Instant Deposits and Instant Withdrawals? | Yes |

| 🤝 Segregated Accounts with Rwandan Traders Banks? | No |

| 💻 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • JustMarkets App • MT5/4 WebTrader, mobile |

| 💵 Tradable Assets | • Indices • Energies • Forex • Metals • Cryptocurrencies • Shares • Futures |

| 💸 Offers USD/RWF currency pair? | No |

| 📊 USD/RWF Average Spread | N/A |

| 🤝 Holding Company | Just Global Markets Ltd. |

| ✅ Offers Rwandan Traders Stocks and CFDs | No |

| 📖 Languages supported on the Website | English, Spanish, Portuguese, French, Russian, Indonesian, Malaysian, Chinese (Simplified and Traditional), Lao, Vietnamese, Thai, Turkish, and more. |

| 📘 Customer Support Languages | Multilingual |

| 🗣 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 💰 Deposit Fee | None |

| 📞 Rwandan Traders-based customer support? | No |

| 💰 Bonuses and Promotions for Rwandan Traders | Yes |

| 📚 Education for Rwanda beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 🏅 Most Successful Rwandan Trader | Unknown |

| ✔️ Is JustMarkets a safe broker for Rwandan Traders? | Yes |

| 🎖 Rating for JustMarkets Rwanda | 8/10 |

| 🥇 Trust score for JustMarkets Rwanda | 49% |

| 👉 Open An Account | 👉 Open Account |

JustMarkets Regulation and Safety of Funds

JustMarkets Regulation in Rwanda

👉 JustMarkets is not supervised by Rwandan law. However, despite this, JustMarkets accepts Rwandan traders.

JustMarkets Global Regulations

👉 JustMarkets has been licensed by the Seychelles Financial Services Authority, where its parent company, Just Global Markets Ltd., is legally registered. JustMarkets adheres to strict anti-money laundering (AML) and Know Your Customer (KYC) requirements.

JustMarkets Client Fund Security and Safety Features

👉 KYC verifications are required for all accounts since all clients must submit proof of residency and identification. External parties keep and audit all documents thoroughly, and all client operations are examined and monitored.

👉 The broker provides its customers with a risk-free trading environment. All transactions utilizing this service are secured using a “Secure Socket Layer” (SSL). JustMarkets employs this software since it can aid in the prevention of cybercrime and internet hacking.

👉 According to JustMarkets, customers’ funds are stored in separate bank accounts with top-rated financial institutions. As a result, they are not linked to JustMarkets’ bank accounts, and operational activities cannot be performed with client funds.

JustMarkets Awards and Recognition

👉 There are currently no indications of any awards or recognition on the official JustMarkets website.

JustMarkets Account Types and Features

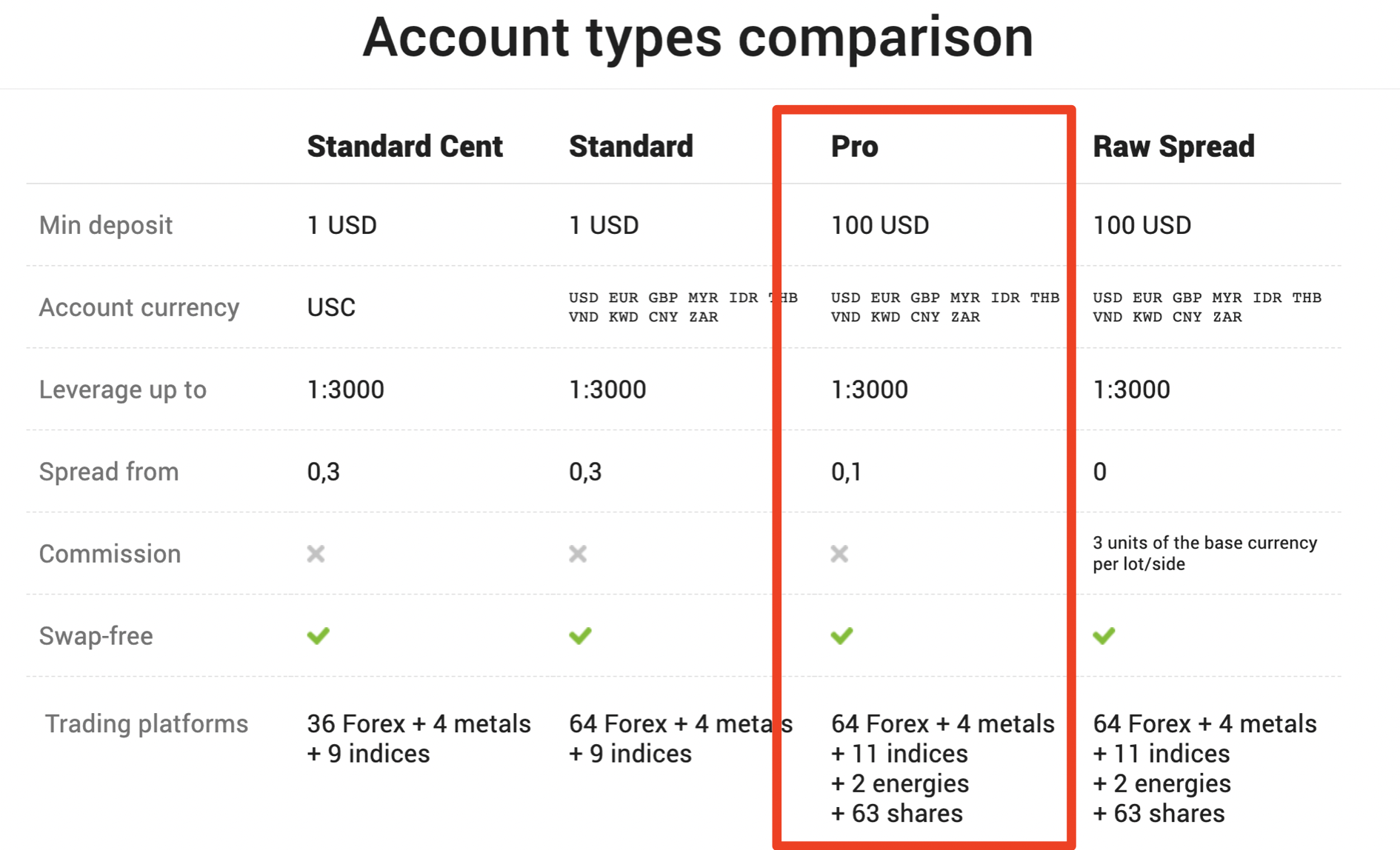

👉 The following is a list of the seven retail investor accounts that are offered by JustMarkets. These accounts fall into one of two types, namely MetaTrader 4 accounts or MetaTrader 5 accounts.

➡️ MetaTrader 4 Standard Cent Account

➡️ MetaTrader 4 Standard Account

➡️ MetaTrader 4 Pro Account

➡️ MetaTrader 4 Raw Spread Account

➡️ MetaTrader 5 Standard Account

➡️ MetaTrader 5 Pro Account

➡️ MetaTrader 5 Raw Spread Account

| 💻 Live Account | 💰 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💵 Average Trading Cost |

| ➡️ MT4 Standard Cent | 1,000 RWF/1 USD | 0.9 pips | None | 9 USD |

| ➡️ MT4 Standard | 1,000 RWF/1 USD | 1 pip | None | 10 USD |

| ➡️ MT4 Pro | 100,000 RWF or 100 USD | 0.6 pips | None | 6 USD |

| ➡️ MT4 Raw Spread | 100,000 RWF or 100 USD | 0.1 pips | $6 per turn | 6 USD |

| ➡️ MT5 Standard | 1,000 RWF/1 USD | 1 pip | None | 14 USD |

| ➡️ MT5 Pro | 100,000 RWF or 100 USD | 0.6 pips | None | 6 USD |

| ➡️ MT5 Raw Spread | 100,000 RWF or 100 USD | 0.0 pips | $6 per turn | 6 USD |

JustMarkets Live Trading Accounts

MetaTrader 4 Standard Cent Account

👉 No matter how much experience you have in trading, the Standard Cent Account is a fantastic tool for putting your trading strategies to the test in an atmosphere where there are reduced levels of risks.

👉 Overall, because of the high degree of risk that traders are exposed to, the account is denominated in cents, and the positions that are held are much smaller than standard position sizes.

| Account Features | Value |

| 💰 Minimum Deposit | cTrader |

| 💵 Account Base Currency | $3 per side and $6 per round turn |

| 📈 Maximum leverage up to | 0.0 pips |

| 💳 Commission charges | 200,000 RWF or an equivalent to $200 |

| ✔️ Swap-free option? | 1:500 |

| 📊 Average spreads from | 2,000 |

| 📉 Minimum order size | London |

| 📈 Maximum order size | Yes |

| ⬆️ Maximum orders | 64 |

| 📞 Margin Call | Yes |

| 🛑 Stop-Out | 100% |

| 💻 Trade Execution Method | 50% |

| 💰 Pricing Format | Yes |

| 📊 Contract Size | Yes |

| 📱 Trading Instruments Available | Scalping, hedging, expert advisors, algorithmic strategies, etc. |

MetaTrader 4 Standard Account

👉 Because the Standard Account is an average account that includes the essential elements of a conventional trading account, it is available to all traders, regardless of their degree of expertise or amount of trading experience. Rwandan traders can expect the following features:

| Account Features | Value |

| 💰 Minimum Deposit | 1,000 Rwandan Francs equivalent to $1 |

| 💵 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 📈 Maximum leverage up to | 1:3000 |

| 💳 Commission charges | None |

| ✔️ Swap-free option? | Yes |

| 📊 Average spreads from | 1 pip |

| 📉 Minimum order size | 0.01 lot |

| 📈 Maximum order size | 100 lots |

| ⬆️ Maximum orders | Unlimited |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 💻 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📊 Contract Size | 1 lot = 100,000 base currency units |

| 📱 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 9 Indices • 5 Cryptocurrency • Pairs |

MetaTrader 4 Pro Account

👉 The Pro Account is suggested for usage by all professional traders searching for the finest possible trading circumstances since it provides competitive trading conditions and access to a wide range of marketplaces.

| Account Features | Value |

| 💰 Minimum Deposit | 100,000 Rwandan Francs equivalent to $100 |

| 💵 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 📈 Maximum leverage up to | 1:3000 |

| 💳 Commission charges | None |

| ✔️ Swap-free option? | Yes |

| 📊 Average spreads from | 0.6 pips |

| 📉 Minimum order size | 0.01 lot |

| 📈 Maximum order size | 100 lots |

| ⬆️ Maximum orders | Unlimited |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 💻 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📊 Contract Size | 1 lot = 100,000 base currency units |

| 📱 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 11 Indices • 2 Energies • 7 Cryptocurrency • Pairs • 64 Shares • 21 Futures |

MetaTrader 4 Raw Spread Account

👉 This account is the best choice for algorithmic traders or scalpers in Rwanda because it provides market execution, low fees, tight spreads, and unlimited maximum order size. Rwandan traders who use fast-paced trading strategies will find that this account complements their unique trading objectives and needs.

| Account Features | Value |

| 💰 Minimum Deposit | 100,000 Rwandan Francs equivalent to $100 |

| 💵 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 📈 Maximum leverage up to | 1:3000 |

| 💳 Commission charges | 3 units of the base currency per lot/per side |

| ✔️ Swap-free option? | Yes |

| 📊 Average spreads from | 0.1 pips |

| 📉 Minimum order size | 0.01 lot |

| 📈 Maximum order size | 100 lots |

| ⬆️ Maximum orders | Unlimited |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 💻 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📊 Contract Size | 1 lot = 100,000 base currency units |

| 📱 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 11 Indices • 2 Energies • 7 Cryptocurrency • Pairs • 64 Shares • 21 Futures |

MetaTrader 5 Standard Account

👉 Trading on this account is the same as trading on MetaTrader 4, but customers have the option of switching to the trading interface of MetaTrader 5, which is more sophisticated and adaptable.

| Account Features | Value |

| 💰 Minimum Deposit | 1,000 Rwandan Francs equivalent to $1 |

| 💵 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 📈 Maximum leverage up to | 1:3000 |

| 💳 Commission charges | None |

| ✔️ Swap-free option? | Yes |

| 📊 Average spreads from | 1 pip |

| 📉 Minimum order size | 0.01 lot |

| 📈 Maximum order size | 100 lots |

| ⬆️ Maximum orders | Unlimited |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 💻 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📊 Contract Size | 1 lot = 100,000 base currency units |

| 📱 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 9 Indices • 5 Cryptocurrency Pairs |

MetaTrader 5 Pro Account

👉 The MetaTrader 5 Professional Account is designed for experienced traders who are eager to enhance their trading performance. Compared to the normal account, this account comes with a greater number of features and more advanced tools.

| Account Features | Value |

| 💰 Minimum Deposit | 100,000 Rwandan Francs equivalent to $100 |

| 💵 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 📈 Maximum leverage up to | 1:3000 |

| 💳 Commission charges | None |

| ✔️ Swap-free option? | Yes |

| 📊 Average spreads from | 0.6 pips |

| 📉 Minimum order size | 0.01 lots |

| 📈 Maximum order size | 100 lots |

| ⬆️ Maximum orders | Unlimited |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 💻 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📊 Contract Size | 1 lot = 100,000 base currency units |

| 📱 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 11 Indices • 2 Energies • 7 Cryptocurrency • Pairs • 64 Shares • 21 Futures |

MetaTrader 5 Raw Spread Account

👉 Traders from Rwanda who use MetaTrader 5 and carry out trading activities in a market that is both highly competitive and rapidly changing will discover that the trading conditions made available by this sort of account are ideal for them, allowing them to maintain a competitive edge in the financial markets.

| Account Features | Value |

| 💰 Minimum Deposit | 100,000 Rwandan Francs equivalent to $100 |

| 💵 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 📈 Maximum leverage up to | 1:3000 |

| 💳 Commission charges | 3 units of the base currency per lot/per side |

| ✔️ Swap-free option? | Yes |

| 📊 Average spreads from | 0.0 pips |

| 📉 Minimum order size | 0.01 lots |

| 📈 Maximum order size | 100 lots |

| ⬆️ Maximum orders | Unlimited |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 💻 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📊 Contract Size | 1 lot = 100,000 base currency units |

| 📱 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 11 Indices • 2 Energies • 7 Cryptocurrency • Pairs • 64 Shares • 21 Futures |

JustMarkets Base Account Currencies

👉 JustMarkets allows traders to open trading accounts in a variety of base currencies, including USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, or ZAR. However, since RWF is not supported, Rwandans will currency conversion costs on deposits and withdrawals.

JustMarkets Demo Account

👉 A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

👉 There is a certain degree of risk involved when trading financial markets and JustMarkets offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

👉 By providing a free demo account to both inexperienced and seasoned Rwandan traders, JustMarkets makes it possible for traders to evaluate the efficiency of the trading techniques they employ. Demo trading is a type of trading that imitates the conditions of actual market conditions.

👉 Traders from Rwanda are provided with a virtual money balance equal to 5,000,000 USD and an unspecified amount of time to learn how to utilize the Metatrader platforms. Traders have the option, during this period, to use any sort of account as a practice account, meaning they will not have to risk any of their own money.

JustMarkets Islamic Account

👉 Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

👉 This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

👉 JustMarkets does not charge any additional fees to traders who wish to convert any of their live trading accounts into either an Islamic Account or a Swap-Free Account. This option is available to traders who adhere to the Islamic religion. The fact that this service is given for free with a JustMarkets Islamic Account is one of the advantages of having such an account.

How to open an Account with JustMarkets in Rwanda

👉 To register an account with JustMarkets , Rwandan Traders can follow these steps:

➡️ Traders can access the JustMarkets website by going to the homepage and clicking on “Registration.”

➡️ This will launch the JustMarkets Back Office registration form. Rwandans can enter their first and last names, as well as confirm their age.

➡️ Next, traders can choose their country of residency from a dropdown menu and provide their email and mobile phone number. Finally, Rwandan users can select a password, confirm the password, and click “Register” to finish this stage.

➡️ Rwandans with Back Office credentials can go into the JustMarkets website and proceed to the “Profile” tab, followed by “Verification.”

➡️ Users will be led to the verification page, where they must provide their legitimate identification number, residence address, and credit/debit card information.

➡️ Once completed, Rwandans can proceed to upload the necessary papers. Users will be led to the appropriate website where they may open trading accounts.

➡️ Users can choose “First Account Opening,” then “I am a trader.” Following that, consumers may select their account type and leverage ratio.

➡️ Users can then set and confirm their account passwords and read the Client Agreement.

➡️ Finally, users can click “Open Account” to begin the fund deposit process.

JustMarkets Vs FXCM Vs AMarkets – Broker Comparison

| 🥇 JustMarkets | 🥈 FXCM | 🥉 AMarkets | |

| ⚖️ Regulation | FSA | FCA, ASIC, CySEC, FSCA | SVG FSA |

| 💻 Trading Platform | • MetaTrader 5 • MetaTrader 4 • JustMarkets App | • Trading Station • MetaTrader 4 • NinjaTrader • ZuluTrade • Capitalise AI • TradingView Pro • QuantConnect • MotiveWave • AgenaTrader • Sierra Chart • SeerTrading • NeuroShell Trader | • MetaTrader 4 • MetaTrader 5 • AMarkets Trading App |

| 💵 Withdrawal Fee | No | Yes, bank wire | Yes |

| ✔️ Demo Account | Yes | Yes | Yes |

| 💰 Min Deposit | 1,000 RWF | 50,000 RWF | 100,000 RWF |

| 📊 Leverage | Up to 1:3000 | • 1:30 (FCA) • 1:400 (Other Reg) | 1:1000 |

| 📈 Spread | From 0.0 pips | From 0.2 pips EUR/USD | From 0.0 pips |

| 💸 Commissions | $3 units per lot/side | $25 per $1m traded | $2.5 per lot |

| 🛑 Margin Call/Stop-Out | 40%/20% | 100%/50% | • 50% • 20% to 40% |

| 📲 Order Execution | Market | Market | Market, Instant |

| ✔️ No-Deposit Bonus | Yes | No | No |

| ✅ Cent Accounts | Yes | No | No |

| 💻 Account Types | • MetaTrader 4 • Standard Cent Account • MetaTrader 4 Standard Account • MetaTrader 4 Pro Account • MetaTrader 4 Raw • Spread Account • MetaTrader 5 Standard Account • MetaTrader 5 Pro Account • MetaTrader 5 Raw • Spread Account | • Spread Betting • CFD Trading • Active Trader • Professional Trader | • Fixed Account • Standard Account • ECN Account • RAMM Account |

| ⚖️ BNR Regulation | No | No | No |

| 💵 RWF Deposits | Yes | No | Yes |

| ✔️ Rwandan franc Account | No | No | No |

| 📞 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 🛍 Retail Investor Accounts | 7 | 3 Retail, 1 Pro | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 pips | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | 50 million per trade on Forex | Depends on the Account Balance |

| 📊 Minimum Withdrawal Time | Instant | Instant | Instant |

| ⏱ Maximum Estimated Withdrawal Time | 10 bank days | Up to 2 working days | 3 to 5 Business Days |

| ✔️ Instant Deposits and Instant Withdrawals? | Yes | Yes | Yes |

Min Deposit

USD1

Regulators

FSA, CySec

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

JustMarkets Trading Platforms

👉 JustMarkets offers Rwandan Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ JustMarkets App

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

👉 Utilizing a dependable and practical user interface, MT4 makes it possible to earn money trading foreign currencies. Indicators, professional advisers, and several other instruments for real-time market analysis are supported by this feature.

👉 Additionally, one can create indicators, EAs, and other components, and distribute them to other traders. Additional capabilities of MT4 include the following:

➡️ There are four distinct methods of order execution, which are referred to as Market, Limit, Stop, and Trailing Stop orders, respectively.

➡️ Tools for superior charting in nine different periods

➡️ 30 technical indications

➡️ 23 items for analytical study

➡️ Automated trading, often known as algorithmic trading, is a method of trading that enables any trading strategy to be formalized and carried out in the form of an Expert Advisor

➡️ Backtesting capabilities

➡️ Exclusive customer support

MetaTrader 5

👉 MT5 is easier to use and provides substantial advances in copy trading, mobile trading, and other novel features that simplify trading account administration. Additional capabilities of MT5 include the following:

➡️ Over 38 technical indicators

➡️ More than 44 graphical objects

➡️ Additional timeframes

➡️ The ability to use one-click trading

➡️ The ability to trade from the charts

➡️ In-depth market widgets

➡️ A built-in economic calendar

WebTrader Platforms

➡️ MetaTrader 4 and 5

MetaTrader 4 and 5

👉 MetaTrader is a trading platform that was developed by MetaQuotes Software for use in online currency trading. MetaTrader 4 and 5 have been available for use on Windows-based personal computers since 2005; millions of traders consider it to be the best trading platform that has ever been developed.

👉 JustMarkets supports MetaTrader 4 and 5 across internet browsers, which means that Rwandan traders can log into their trading accounts from any computer or mobile device with an internet connection.

Trading App

➡️ MetaTrader 4 and 5

➡️ JustMarkets App

MetaTrader 4 and 5

👉 The MetaTrader mobile application provides the same access to the foreign exchange market as a conventional desktop terminal. Their key advantage is that transactions may be executed from any place, making them more convenient.

👉 MetaTrader applications for Android and iOS enable offline trading while conserving Internet bandwidth. The mobile version of MetaTrader is a useful complement to the desktop version for many traders. This allows a trader to quickly open an order on a computer and subsequently manage it on a smartphone, or vice versa.

JustMarkets App

👉 Rwandan consumers may browse the whole JustMarkets website on their mobile devices. An intuitive design makes it easy to access any function at any time. On-the-go account creation, cash withdrawal, transaction data tracking, and data verification are all possible.

👉 The JustMarkets app offers the following advantages and capabilities:

➡️ Traders have complete access to the features and services of the JustMarkets website and Back Office.

➡️ Changing a trading account’s leverage or password is straightforward when using the JustMarkets app. And the app can also be used to open a live or demo MT4/MT5 account.

➡️ Using any of the app’s payment choices, deposits and withdrawals are quick and simple.

➡️ Rwandan traders may also use the app to enter new contests and redeem promotional vouchers from JustMarkets.

➡️ The application includes a Frequently Asked Inquiries area with answers to frequently asked questions, as well as information on JustMarkets’ partnership programs and the latest news and data.

JustMarkets Range of Markets

👉 Rwandan Traders can expect the following range of markets from JustMarkets:

➡️ Indices

➡️ Energies

➡️ Forex

➡️ Metals

➡️ Cryptocurrencies

➡️ Shares

➡️ Futures

Financial Instruments and Leverage offered by JustMarkets

| 🔨 Instrument | ✔️ Number of Assets Offered | 📈 Maximum Leverage Offered |

| ➡️ Forex | 65 | 1:3000 |

| ➡️ Commodities | 10 | 1:100 |

| ➡️ Indices | 11 | 1:200 |

| ➡️ Stocks | 63 | 1:20 |

| ➡️ Cryptocurrency | 7 | 1:10 |

| ➡️ Futures | 23 | 1:50 |

Broker Comparison for Range of Markets

| 🥇 JustMarkets | 🥈 FXCM | 🥉 AMarkets | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | No |

| ➡️️ Bonds | No | No | Yes |

JustMarkets Trading and Non-Trading Fees

Spreads

👉 Rwandan traders who register a live trading account with JustMarkets can anticipate a spread charge based on their account type, the financial instrument exchanged, and market conditions at the time of their transaction.

👉 Spreads at JustMarkets are lower than the industry average but are not the lowest when compared to the spreads charged by other brokers. The following is a typical minimum spread based on account type:

➡️ MetaTrader 4 Standard Cent Account – 0.9 pips

➡️ MetaTrader 4 Standard Account – 1 pips

➡️ MetaTrader 4 Pro Account – 0.6 pips

➡️ MetaTrader 4 Raw Spread Account – 0.0 pips

➡️ MetaTrader 5 Standard Account – 1 pip

➡️ MetaTrader 5 Pro Account – 0.6 pips

➡️ MetaTrader 5 Raw Spread Account – 0.0 pips

Commissions

👉 Five of JustMarkets’ seven retail accounts are commission-free, which implies that a mark-up is added to these accounts’ spreads to offset the broker’s charge. Rwandan traders, on the other hand, should anticipate zero-pip spreads on the Raw spread accounts, which implies the following commissions are applied:

➡️ MetaTrader 4 Raw Spread Account – $3 or an equivalent in EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, or ZAR.

➡️ MetaTrader 5 Raw Spread Account – $3 or an equivalent in EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, or ZAR.

Overnight Fees, Rollovers, or Swaps

👉 Overnight fees are charged to Rwandan traders who leave their transactions open for more than 24 hours. The overnight fees that are either credited or debited will depend on the size of the trader’s open position, the financial instrument involved, and whether the trader has gone long or short on the position.

👉 Some typical overnight fees that Rwandans can expect are as follows:

| 🔨 Instrument | 📉 Swap Long | 📈 Swap Short |

| EUR/USD | -4.44 pips | -0.09 pips |

| USD/JPY | -1.36 pips | -2.97 pips |

| Cryptocurrencies | -20% | -20% |

| Energies | -6% | -3% |

| Indices | -1% | -1.50% |

| Shares | -6% | -3% |

| XAG/USD | -0.2 pips | -0.09 pips |

| XAU/USD | -4.18 pips | -0.77 pips |

| Futures | -6% | -3% |

Deposit and Withdrawal Fees

👉 JustMarkets does not impose any withdrawal fees when Rwandans take funds from the trading account. However, there are deposit fees of 2% charged when Rwandan traders use crypto payments on these coins:

➡️ Bitcoin (BTC)

➡️ Bitcoin Cash (BCH)

➡️ Ethereum (ETH)

➡️ Gemini (GUSD)

➡️ USD Coin (USDC)

Inactivity Fees

👉 JustMarkets does not charge any account management or maintenance fees but applies an inactivity fee on dormant accounts after 150 days of inactivity. If an account goes dormant, the account will be subject to a $5 fee until the balance reaches zero and the account is closed.

Currency Conversion Fees

👉 Rwandan traders should expect to pay currency conversion fees if they make a deposit or withdrawal in a currency that is not one of the account’s allowed currencies.

JustMarkets Deposits and Withdrawals

👉 JustMarkets offers the following deposit and withdrawal methods:

➡️ Ethereum

➡️ Local Bank Transfers, Cards, Mobile Money

➡️ Local Wallets and worldwide wallets

Broker Comparison: Deposit and Withdrawals

| 🥇 JustMarkets | 🥈 FXCM | 🥉 AMarkets | |

| Minimum Withdrawal Time | Instant | Instant | Instant |

| Maximum Estimated Withdrawal Time | 10 bank days | Up to 2 working days | 3 to 5 Business Days |

| Instant Deposits and Instant Withdrawals? | Yes | Yes | Yes |

Deposit Currencies, Minimum and Maximum Deposit and Withdrawal Amounts

| 💰 Payment Method | 💵 Deposit Currencies | 💸 Deposit Processing | 💰 Withdrawal Processing |

| Debit Card | EUR, USD | Instant | 4 to 10 days |

| Credit Card | EUR, USD | Instant | 4 to 10 days |

| China UnionPay | EUR, USD | Instant | – |

| Skrill | EUR, USD | Instant | Instant |

| Neteller | EUR, USD | Instant | Instant |

| Perfect Money | EUR, USD, GBP, ZAR, CNY, MYR, JPY, AED, AUD, BRL, CAD, CHF, COP, INR, KRW, MXN, NGN, RUB, SGD, TWD | Instant | Instant |

| Sticpay | EUR, USD | Instant | Instant |

| AirTM | EUR, USD, JPY, KRW, CNY, PHP, AED, AUD, CAD, CHF, CLP, GBP, HKD, IDR, INR, MXN, MYR, NZD, RUB, SGD, THB, VND | 2 to 5 working days | Instant |

| Bitcoin | USD | 1 – 3 hours | 1 – 2 hours |

| Bitcoin Cash | BTC | 1 – 3 hours | 1 – 2 hours |

| Ethereum | BCH | 1 – 3 hours | 1 – 2 hours |

| Tether | ETH | – | – |

| USD Coin | – | Instant | 1 – 2 hours |

| Local Bank Transfers, Cards, Mobile Money | USD | Instant up to 1 day | Instant up to 3 days |

| Local Wallets and worldwide wallets | MYR, IDR, THB, VND, PHP, NGN, ZAR, UGX, KES, RWF, GHS, XAF, TZS, EUR, USD, COP, BRL | Instant | Instant |

How to Deposit Funds with JustMarkets

👉 To deposit funds to an account with JustMarkets, Rwandan Traders can follow these steps:

➡️ Log in to your trading platform or the JustMarkets website and Back Office using your trading account.

➡️ Navigate to the account preferences area after logging into the Back Office.

➡️ Click “Deposit,” select a payment option, and complete any extra steps required by your payment provider to confirm and finish the deposit.

JustMarkets Fund Withdrawal Process

👉 To withdraw funds from an account with JustMarkets, Rwandan Traders can follow these steps:

➡️ Rwandan traders should go into their JustMarkets Back Office and click “Withdraw.”

➡️ Traders can choose the withdrawal option that matches the deposit method used to fund their trading accounts.

➡️ They can then submit the withdrawal amount and complete any other steps requested by their payment provider.

JustMarkets Education and Research

Education

👉 JustMarkets offers the following Educational Materials:

➡️ Quick Start

➡️ Online Training Webinars

➡️ Bookings for future webinars

➡️ Forex Articles

➡️ Forex Glossary

➡️ Educational Videos

➡️ Currencies

👉 JustMarkets offers Rwandan Traders the following Research and Trading Tools:

➡️ Market Overview

➡️ Daily Forecasts

➡️ Market News

➡️ Economic Calendar

JustMarkets Bonuses and Promotions

👉 JustMarkets offers Rwandan Traders the following bonuses and promotions:

➡️ Welcome Bonus or No-Deposit Bonus

➡️ 120% Deposit Bonus up to $40,000

➡️ Referral bonus and program

➡️ 0% Fees on deposits and withdrawals

How to open an Affiliate Account with JustMarkets

👉 To register an Affiliate Account, Rwandan Traders can follow these steps:

➡️ Visit the JustMarkets website and navigate to the “Partnerships” tab on the homepage.

➡️ Select the “Affiliates” option and go through the information that loads.

➡️ Choose your Affiliate program type by clicking on “Become Partner” underneath either “Revenue Share” or “CPA.”

➡️ Complete the short registration form and make sure that you have read all the necessary documents such as the Client Agreement and Introducing Broker Agreement before you apply.

➡️ Next, confirm that you are not a United States citizen before you select “Become a Partner.”

➡️ Your account will be created within a few seconds, and you will be logged in automatically into the partner’s area where you can access the affiliate program materials.

JustMarkets Affiliate Program Features

👉 In addition to making money from their own traffic and having the opportunity to grow their own network, partners in the affiliate program offered by JustMarkets can earn a commission on an infinitely proportional share of purchases.

👉 Because they were developed by partners for partners and with the input of partners, the JustMarkets Affiliate Programs may be adapted to meet the specific requirements of any partner. On trades that are closed because of referrals, JustMarkets offers a revenue share of up to 65%.

JustMarkets Customer Support

👉 As part of JustMarkets’ comprehensive offering, the broker also offers dedicated and helpful customer support.

| Customer Support | JustMarkets’ Customer Support |

| ⏰ Operating Hours | 24/5 for all languages except English, which is offered 24/7 |

| 🗣 Support Languages | English, Malaysian, Russian, Chinese, Indonesian |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| 📞 Telephonic Support | Yes |

| ✔️ Local Support in Rwanda? | No |

| 🥇 Overall quality of JustMarkets Support | 3.5/5 |

JustMarkets Corporate Social Responsibility

👉 There is currently no information regarding JustMarkets’ Corporate Social Responsibility initiatives or projects.

Min Deposit

USD1

Regulators

FSA, CySec

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Our Verdict on JustMarkets

👉 JustMarkets has been in operation since 2012 and offers a variety of accounts to suit a variety of preferences, as well as enticing trading conditions that will certainly assist in achieving better results. JustMarkets is appealing to novice traders who are already familiar with the MT4 and MT5 platforms since it provides a variety of accounts with low minimum deposits and cheap trading fees.

👉 However, traders should be aware that JustMarkets does not have the most stringent rules because the broker is only licensed by the Financial Services Authority of Seychelles.

👉 JustMarkets is an STP and ECN broker that offers trading on indices, commodities, cryptocurrencies, share CFDs, futures, and several Forex pairs, and this range of products should meet the demands of most traders.

JustMarkets Pros and Cons

| ✔️ Pros | ❌ Cons |

| JustMarkets accommodates both beginner and professional Rwandan traders | JustMarkets lacks Tier-1 and Tier-2 regulations, making it a high risk, low trust broker |

| There is a decent selection of trading accounts to choose from | Deposit fees are charged on crypto payments |

| Rwandans can expect zero-pip spreads and low commission charges | Rwandans do not have the advantage of an RWF-denominated account |

| There are five commission-free accounts offered with competitive spreads | There is an inactivity fee that is applied by JustMarkets when accounts become dormant after 150 days |

| The demo account is available to Rwandan traders to use in any way that they wish | |

| There is an Islamic account offered by JustMarkets that is dedicated to Muslim traders | |

| JustMarkets offers a large range of deposit and withdrawal options in the Back Office section of the website | |

| Withdrawal fees are not charged |

FAQ

How do I open a JustMarkets account?

You can register for the JustMarkets Back Office from the official website. Once logged in, you can select “Account Options” followed by “My Accounts.” Next, you can find the “Live” page under the “Trading Account” section and click on the option to “Open a New Account.”

How much is the JustMarkets minimum deposit?

The minimum deposit for JustMarkets is $1 on the Standard Cent and the Standard Accounts. The Pro and Raw Spread Accounts have a minimum deposit of $100.

Does JustMarkets have Volatility 75?

No, JustMarkets does not currently have Volatility 75 or VIX as a part of its financial instrument portfolio.

Where is JustMarkets located?

JustMarkets is headquartered in Seychelles as the trading name of Just Global Markets Ltd.

Does JustMarkets have Nasdaq?

Yes, Nasdaq is part of JustMarkets’ Indice CFDs under US Tech 100.

Does JustMarkets have a deposit bonus?

Yes, JustMarkets offers a 120% deposit bonus up to a maximum of $40,000.

Is JustMarkets regulated?

Yes, JustMarkets is regulated by the Tier-3 Financial Services Authority (FSA) in Seychelles under Just Global Markets Ltd. under license number SD088.

Is JustMarkets safe or a scam?

JustMarkets is a legit broker that has been verified. However, because of the lack of strict regulation, JustMarkets is not as trusted as other brokers who have Tier-1 and Tier-2 regulations.

What is the withdrawal time for JustMarkets?

The withdrawal time will differ according to the withdrawal method you use. The average time on electronic payments is instantaneous withdrawals while credit/debit cards take up to 10 business days.

Conclusion

👉 Now it is your turn to participate:

➡️ Do you have any prior experience with JustMarkets?

➡️ What was the determining factor in your decision to engage with JustMarkets?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with JustMarkets such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

👉 Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

👉 No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Table of Contents