HF Markets Review

HF Markets, formerly known as Hotforx is considered average-risk, with an overall Trust Score of 9 out of 10. HF Markets is regulated by HFM Investments Limited. HotForex is authorized by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust).

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 5

Regulators

CySEC, FSC, CFTC

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

HF Markets Review – 23 key points quick overview:

- ✅ HF Markets Overview

- ✅ HF Markets at a Glance

- ✅ HF Markets Regulation and Safety of Funds

- HF Markets Awards and Recognition

- HF Markets Account Types and Features

- How to open an Account with HF Markets in Rwanda

- HF Markets Vs BD Swiss Vs AvaTrade – Broker Comparison

- HF Markets Trading Platforms

- HF Markets Range of Markets

- Broker Comparison for Range of Markets

- HF Markets Trading and Non-Trading Fees

- HF Markets Deposits and Withdrawals

- How to Deposit Funds with HF Markets

- HF Markets Fund Withdrawal Process

- HF Markets Education and Research

- HF Markets Bonuses and Promotions

- How to open an Affiliate Account with HF Markets

- HF Markets Affiliate Program Features

- HF Markets Customer Support

- HF Markets Corporate Social Responsibility

- Our Verdict on HF Markets

- HF Markets Pros and Cons

- FAQ

HF Markets Overview

👉 Overall, HF Markets (previously HotForex) is considered low-risk, with an overall Trust Score of 85 out of 100. HF Markets is licensed by one Tier-1 Regulator (high trust), four Tier-2 Regulators (average trust), and two Tier-3 Regulators (low trust). HF Markets offers five different retail trading accounts namely a Micro Account, Premium Account, HFCopy Account, Zero Spread Account, and an Auto Account.

👉 HF Markets accepts Rwandan clients and has an average spread from 0.0 pips with $6 to $8 commission round turn. HF Markets has a maximum leverage ratio up to 1:1000 and there is a demo and Islamic account available. MT4, MT5 and HF App platforms are supported. HF Markets is headquartered in Cyprus and regulated by FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA.

👉 HF Markets is a well-known brokerage business that was formed in 2010 by George Koumandaris, who is also the company’s owner. The business is an affiliate of the multinational brokerage organization HF Markets Group, which is situated in the United Kingdom.

👉 HF Markets has over 200 employees all over the globe, more than 2.5 million active accounts, and more than 50 honours from different industry organizations, so it has a high reputation in its area.

👉 HF Markets is well-known for giving traders unconstrained access to a liquidity pool as well as a choice between trading platforms, trading tools, and account types that can be tailored to match their requirements.

👉 This HF Markets review for Rwanda will provide local retail traders with the details that they need to consider whether HF Markets is suited to their unique trading objectives and needs.

HF Markets Distribution of Traders

👉 HF Markets currently has the largest market share in these countries:

➡️ South Africa – 94.9%

➡️ Nigeria – 1.69%

➡️ Netherlands – 0.79%

➡️ Morocco – 0.76%

➡️ Botswana – 0.52%

Popularity among traders who choose HF Markets

🥇 Even though HF Markets does not have a dominating market position in Rwanda, the broker is listed among the top 10 FX and CFD brokers for Rwandan traders.

HF Markets at a Glance

| 🏙 Headquartered | Cyprus |

| 🏛 Global Offices | Seychelles, South Africa, Dubai, UK, Kenya |

| 💻 Local Market Regulator in Rwanda | The National Bank of Rwanda (BNR) |

| 💸 Foreign Direct Investment in Rwanda | 99.92 USD Million in 2020 |

| 🔄 Foreign Exchange Reserves in Rwanda | 1,806 million US dollars in 2020 |

| 🏛 Local office in Kigali? | No |

| 👨⚖️ Governor of SEC in Rwanda | None, John Rwangombwa is the Governor of the National Bank of Rwanda |

| ✔️ Accepts Rwandan Traders? | Yes |

| 🗓 Year Founded | 2010 |

| ☎️ Rwandan Traders Office Contact Number | None |

| 📲 Social Media Platforms | • Facebook • Telegram • YouTube |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 1️⃣ Tier-1 Licenses | • Financial Conduct Authority (FCA) |

| 2️⃣ Tier-2 Licenses | • Financial Sector Conduct Authority (FSCA) • Cyprus Securities and Exchange Commission (CySEC) • Capital Markets Authority (CMA) • Dubai Financial Services Authority (DFSA) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) Financial Services • Commission (FSC) |

| 🪪 License Number | • South Africa – FSP 46632 • Cyprus – 183/12 • Dubai – F004885 • Seychelles – SD015 • United Kingdom – 801701 • Mauritius – 094286/GBL • Kenya – CMA license 155 |

| ⚖️ BNR Regulation | None |

| 🏛 Global Restrictions | • France ACPR – 53684 • Germany BaFin – 132342 • Hungary MNB – K8761153 • Italy CONSOB– 3673 • Norway – FT00080085 • Spain CNMV – 3427 • Sweden FI – 31987 • Austria FMA • Bulgaria FSC • Croatia HANFA • Czech Republic CNB • Denmark • Finanstilsynet • Estonia FSA • Finland FSA • Greece HCMC • Iceland FME • Central Bank of Ireland • Latvia FKTK • Liechtenstein FMA • Lithuania Lietuvos Bankas • Luxembourg CSSF • Malta MFSA • Poland KNF • Portugal CMVM • Romania ASF • Slovakia NBS • Slovenia ATVP |

| ☪️ Islamic Account | No |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 5 |

| ✔️ PAMM Accounts | No |

| 💵 Liquidity Providers | Barclays UK, BNP Paribas, and others |

| 💰 Affiliate Program | Yes |

| ➡️ Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 💸 Minimum Commission per Trade | $3 to $4 |

| 💵 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | Between 40% to 50% |

| 🛑 Stop-Out | Between 10% and 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 60 lots |

| 💰 Crypto trading offered? | Yes |

| ✔️ Offers an RWF Account? | No |

| 👥 Dedicated Rwandan Traders Account Manager? | No |

| 📊 Maximum Leverage | 1:1000 |

| 📈 Leverage Restrictions for Rwanda? | None |

| 💵 Minimum Deposit (RWF) | 5,100 RWF or an equivalent to $5 |

| ✔️ Rwandan franc Deposits Allowed? | Yes |

| 📊 Active Rwandan Traders Trader Stats | 50,000+ |

| 👥 Active Rwandan Traders-based HF Markets customers | Unknown |

| 🔄 Rwanda Daily Forex Turnover | Unknown, the overall trading volume of over $6.6 trillion |

| 💰 Deposit and Withdrawal Options | • Bank Wire Transfer • Electronic Transfer • Credit Card • Debit Card • Skrill |

| 📉 Minimum Withdrawal Time | 10 Minutes |

| 📈 Maximum Estimated Withdrawal Time | 10 business days |

| 💰 Instant Deposits and Instant Withdrawals? | No |

| 🤝 Segregated Accounts with Rwandan Traders Banks? | No |

| 💻 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • HF App |

| 💵 Tradable Assets | • Forex • Precious Metals • Energies • Indices • Shares • Commodities • Cryptocurrencies • Bonds • Stocks DMA • ETFs |

| 💸 Offers USD/RWF currency pair? | No |

| 📊 USD/RWF Average Spread | N/A |

| ✅ Offers Rwandan Traders Stocks and CFDs | No |

| 📖 Languages supported on the Website | English, Portuguese, Spanish |

| 📘 Customer Support Languages | Multilingual |

| 🗣 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Rwandan Traders-based customer support? | No |

| 💰 Bonuses and Promotions for Rwandan Traders | None |

| 📚 Education for Rwanda beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🏅 Most Successful Rwandan Trader | Unknown |

| ✔️ Is HF Markets a safe broker for Rwandan Traders? | Yes |

| 🎖 Rating for HF Markets Rwanda | 9/10 |

| 🥇 Trust score for HF Markets Rwanda | 85% |

| 👉 Open An Account | 👉 Open Account |

HF Markets Regulation and Safety of Funds

HF Markets Regulation in Rwanda

👉 HF Markets is currently not regulated or overseen by local market regulators in Rwanda.

HF Markets Global Regulations

👉 HF Markets and (formerly) HotForex are the brand names used together to refer to the firms comprising the HF Markets Group. HF Markets is supervised and overseen by the following market authorities in the regions in where it operates:

| 💻 Entity | ⚖️ Regulator | ⬆️ Regulation Tier | 🪪 License Number |

| HF Markets (UK) Ltd | FCA | Tier-1 | 801701 |

| HF Markets (Europe) Ltd. | CySEC | Tier-2 | 183/12 |

| HF Markets (DIFC) Ltd. | DFSA | Tier-2 | F004885 |

| HF Markets SA (PTY) Ltd. | FSCA | Tier-2 | FSP 46632 |

| HFM Investments Limited | CMA | Tier-2 | 155 |

| HF Markets (Seychelles) Ltd. | FSA | Tier-3 | SD015 |

| HF Markets Ltd. | FSC | Tier-3 | 094286/GBL |

👉 A closer look at the regulators in charge of HF Markets may be found here:

➡️ To ensure a financially sound and stable financial system, the FCA has been in existence since the year 2000. Companies have a chance to thrive in this system, while consumers gain from fair, honest, and transparent marketplaces.

➡️ Trading regulations in the UK and the EU are heavily influenced by the European Securities and Markets Authority (ESMA). Because of the dangers associated with leverage, traders in these locations are prohibited by ESMA from using leverage greater than 1:30.

➡️ CySEC is a member of the European Securities and Markets Authority (ESMA) and supervises all investing services in Cyprus. Regulations require HF Markets (Europe) Ltd. to disclose all information about its capital, risks, and exposure.

➡️ HF Markets (Europe) Ltd. is required to comply with all directives of MiFID, which offers a unified regulatory framework for several different financial services that are carried out throughout Europe.

➡️ Dubai’s Financial Services Authority (DFSA) is responsible for establishing, managing, and enforcing high-quality rules across all financial services in the Dubai International Financial Centre (DIFC), the Middle East’s most significant financial centre.

➡️ Financial services that are not bank-related are regulated by the CMA in Kenya.

➡️ Non-bank financial services in Seychelles are regulated by the Financial Services Authority (FSA), which oversees issuing licenses, enforcing regulations, and fostering industry expansion.

➡️ The Mauritius Financial Services Commission (FSC) is the country’s official market regulator, responsible for licensing, regulation, and the whole non-bank financial industry.

HF Markets Client Fund Security and Safety Features

👉 Each of the HF Markets firms is strictly regulated, which gives customers peace of mind that they are dealing with a trustworthy and dependable broker who must follow stringent regulatory guidelines. Subsequently, you can create an account with the proper entity based on your jurisdiction and trading needs.

👉 Regulated brokers must adhere to stringent financial rules, including capital adequacy requirements. HF Markets is expected to present quarterly financial reports to the regulator while retaining a sufficient level of liquid capital to cover all their customers’ deposits, anticipated currency movements, and outstanding expenditures.

👉 There is an independent internal auditor that carries out yearly audits on HF Markets. Subsequently, if any shortcomings are found, the auditor will notify the regulators of such.

👉 Client funds are always kept secure and to ensure this, HF Markets has introduced extra security measures to help traders to concentrate on their trading without worrying about the protection of their capital.

👉 Client money is already covered by statutory obligations, and to further protect against liabilities against clients, HF Markets EU offers a free insurance scheme. This insurance is restricted to $5 million and covers risks that might result in financial loss, such as mistakes, carelessness, omissions, fraud, and so on.

👉 HF Markets’ client funds are held in separate accounts with major worldwide institutions and cannot be used for any other reason. HF Markets offers negative balance protection to all retail accounts. This implies that the customer is not liable for a negative balance situation in volatile market circumstances.

👉 HF Markets EU is a participant in the Investor Compensation Fund (ICF). The ICF’s mission is to secure covered customers’ claims against ICF members by paying compensation if the relevant preconditions are met.

👉 This fund was formed according to the Investment Firms Law of 2002, as amended (‘the Law’), and the Regulations on the Establishment and Operation of an Investor Compensation Fund for Customers of CIFs of 2004, which were issued per the Law.

👉 The Fund is a private legal body that has been operating since 2004 and is managed by a committee of five members who are appointed for three-year periods.

HF Markets Awards and Recognition

👉 HF Markets has a long history in being a reputable, comprehensive trading provider, seen through the awards that HF Markets has won since its inception, some including the following:

➡️ Most Transparent Broker in 2020

➡️ Best Client Service in 2020

➡️ Best Trading Experience in Southeast Asia

➡️ Best Global Copy Trading Platform in 2019, and many more

HF Markets Account Types and Features

👉 HF Markets offers five distinct account categories, which is more than most other brokers. The Micro Account is suited for new traders because of the low minimum deposit requirement, whilst the Zero Spread Account is designed for more experienced traders.

👉 The aggregate trading expenditures for all five accounts are greater than average, despite the accounts’ specific benefits in terms of trading tactics and minimal deposits. With HF Markets, Rwandan traders can choose from the following:

➡️ Micro Account

➡️ Premium Account

➡️ HFcopy Account

➡️ Zero Spread Account

➡️ Auto Account

👉 Accounts differ in terms of the needed minimum deposit, lot sizes, and trading rules. There are accessible swap-free Islamic accounts that adhere to Sharia law.

👉 Before registering a live trading account with HF Markets, you have access to an unlimited demo account that will allow you to evaluate the various trading platforms and account conditions.

| 💻 Live Account | 💰 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💵 Average Trading Cost |

| ➡️ Micro | 5,100 RWF or $5 | 1 pip | None | 10 USD |

| ➡️ Premium | 100,000 RWF or $100 | 1 pip | None | 10 USD |

| ➡️ HFCopy | • Follower: 100,000 RWF ($100) • Provider: 300,000 RWF ($300) | 1 pip | None | 10 USD |

| ➡️ Zero Spread | 200,000 RWF or $200 | 0.0 pips | • Forex Major: $3/$6 • Other: $4/$8 | 7 USD |

| ➡️ Auto | 200,000 RWF or $200 | 1 pips | None | 10 USD |

HF Markets Live Trading Accounts

Micro Account

👉 The micro account is meant for novice traders and those who trade smaller quantities. It enables customers to trade smaller transaction amounts and create an account with a smaller initial deposit. Spreads are varied and they start from 1 pip, with zero commissions as HF Markets’ fee for facilitating the trade is already included in the spread.

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 5,100 RWF or an equivalent to $5 or 70 ZAR |

| 📱 Average Spread | 1 pip EUR/USD |

| 💻 Trading Platform | • MetaTrader 4 • MetaTrader 5 |

| 🔨 Trading Instruments | All |

| ➡️ Execution | Market Execution |

| 📊 Maximum Leverage Ratio | 1:1000 |

| 📉 Minimum Trade Size | 0.01 lot |

| 📈 Maximum Trade Size | 7 Standard Lots (100,000 base currency) |

| 💰 Maximum Open Orders | 150 lots (Simultaneous) |

| 📞 Margin Call (%) | 40% |

| 🛑 Stop-Out (%) | 10% |

| 💳 Account Base Currency | USD, ZAR, NGN |

| 🗣 Personal Account Manager | Yes |

| 💰 Commission Charges | None |

| 💸 Bonuses Offered | Flexible bonus offering |

Premium Account

👉 Retail traders with more trading experience can use the premium account. The ability to change the size of a position is an important feature of this account and to register this account, a deposit of 100,000 RWF or an equivalent to $100 is required. Additional features on the Premium Account can be viewed below.

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 100,000 RWF or and equivalent to $100 or R1,400 |

| 📱 Average Spread | From 1 pip EUR/USD |

| 💻 Trading Platform | • MetaTrader 4 • MetaTrader 5 |

| 🔨 Trading Instruments | All |

| ➡️ Execution | Market Execution |

| 📊 Maximum Leverage Ratio | 1:500 |

| 📉 Minimum Trade Size | 0.01 lot |

| 📈 Maximum Trade Size | 60 Standard lots per position |

| 💰 Maximum Open Orders | 300 lots |

| 📞 Margin Call (%) | 50% |

| 🛑 Stop-Out (%) | 20% |

| 💳 Account Base Currency | USD, ZAR, NGN |

| 🗣 Personal Account Manager | Yes |

| 💰 Commission Charges | None |

| 💸 Bonuses Offered | Flexible Bonuses |

HFcopy Account

👉 Traders who want to replicate signals from other traders may use the HFcopy account, which is also available to followers who want to copy signals.

👉 Followers can get automatic trading signals sent straight to their account, while signal providers are eligible to collect a performance fee. Only customers whose qualifications will be considered for participation in this program will be granted access to this account.

👉 Traders must understand that one’s historical performance is in no way indicative of one’s future achievements.

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 100,000 RWF or and equivalent to $100 or R1,400 |

| 📱 Average Spread | From 1 pip EUR/USD |

| 💻 Trading Platform | • MetaTrader 4 |

| 🔨 Trading Instruments | • Forex • Spot Indices • Gold • Spot Energies • BTC/USD • BTC/EUR |

| ➡️ Execution | Market Execution |

| 📊 Maximum Leverage Ratio | 1:400 |

| 📉 Minimum Trade Size | 0.01 lot |

| 📈 Maximum Trade Size | 60 Standard lots per position |

| 💰 Maximum Open Orders | 300 lots |

| 📞 Margin Call (%) | 50% |

| 🛑 Stop-Out (%) | 20% |

| 💳 Account Base Currency | USD |

| 🗣 Personal Account Manager | Yes |

| 💰 Commission Charges | None |

| 💸 Bonuses Offered | None |

Zero Spread Account

👉 The zero spread account is appropriate for all traders, but it is especially helpful for scalpers, high-volume traders, and traders who utilize expert advisers.

👉 The variable spreads begin at 0 pip and are obtained directly from the liquidity providers. There are no hidden markups, and the commission rate is among the most competitive in the industry.

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 200,000 RWF or an equivalent to $200 or R2,800 |

| 📱 Average Spread | 0.0 pips on Forex Major currency pairs |

| 💻 Trading Platform | • MetaTrader 4 • MetaTrader 5 |

| 🔨 Trading Instruments | All |

| ➡️ Execution | Market Execution |

| 📊 Maximum Leverage Ratio | 1:500 |

| 📉 Minimum Trade Size | 0.01 |

| 📈 Maximum Trade Size | 60 Standard lots per position |

| 💰 Maximum Open Orders | 500 lots |

| 📞 Margin Call (%) | 50% |

| 🛑 Stop-Out (%) | 20% |

| 💳 Account Base Currency | USD, ZAR, NGN |

| 🗣 Personal Account Manager | Yes |

| 💰 Commission Charges | From between $3 for Major Forex Pairs and $4 on other instruments per lot traded |

| 💸 Bonuses Offered | None |

Auto Account

👉 The commission-free HF Markets Auto Account is geared toward novice traders who have an interest in subscribing to Trading Signals produced by the MQL5 Community. These traders are the target audience for the account.

👉 These can be entered directly into the HF Markets MT4 trading interface without any further steps being necessary on the trader’s part. Traders can automatically copy trading signals from any Signal Provider; however, purchased Signals are subject to a performance assessment period of one month.

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 200,000 RWF or an equivalent to $200 or R2,800 |

| 📱 Average Spread | From 1 pip EUR/USD |

| 💻 Trading Platform | • MetaTrader 4 |

| 🔨 Trading Instruments | • Forex • Spot Indices • Gold • Spot Energies • BTC/USD • BTC/EUR |

| ➡️ Execution | Market Execution |

| 📊 Maximum Leverage Ratio | 1:500 |

| 📉 Minimum Trade Size | 0.01 |

| 📈 Maximum Trade Size | 60 Standard lots per position |

| 💰 Maximum Open Orders | 300 lots |

| 📞 Margin Call (%) | 50% |

| 🛑 Stop-Out (%) | 20% |

| 💳 Account Base Currency | USD |

| 🗣 Personal Account Manager | Yes |

| 💰 Commission Charges | None |

| 💸 Bonuses Offered | None |

HF Markets Base Account Currencies

👉 When opening a live trading account with HF Markets, Rwandan investors have the choice of selecting either US Dollars or South African Rands as the base currency for their accounts.

HF Markets Demo Account

👉 A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

👉 There is a certain degree of risk involved when trading financial markets and HF Markets offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

👉 A demo account is one of the best methods to learn about any broker, and HF Markets is no exception. Trading on a demo account allows you to experience the same trading circumstances as a real account, but with no risk.

👉 This includes no requirement to deposit actual money when the demo account expires. The HF Markets demo account is unlimited, which means that the trial period never expires.

👉 This is a significant benefit that is not always offered by all brokers. Furthermore, you can have up to three demo accounts open at the same time.

👉 If you are an experienced trader, this is ideal for learning or testing trading strategies before you apply them in a live market setting. In addition, with the HF Markets demo account Rwandan traders can:

➡️ View and interact with charts

➡️ Access newsfeeds

➡️ Carry out comprehensive market analysis

➡️ Access both MetaTrader 4 and 5

➡️ Experience real-time prices and real market volatility on several financial instruments

HF Markets Islamic Account

👉 Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

👉 This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

👉 HF Markets makes the Islamic Account accessible to customers with all their account kinds. Those who follow the teachings of the Quran, which indicate that it is unlawful to either provide or receive interest in any transaction, are the appropriate customers for this kind of account. The Islamic Account is sometimes referred to as the Swap-Free account, particularly in specific quarters.

👉 Traders who use an Islamic account are allowed to engage in all financial markets that are available to traders using any other sort of account, and they have the option of using either NGN, USD, or ZAR as the base currency for their accounts.

👉 In addition, per the precepts of Islam, the trader will not pay or receive interest that has been generated while using the Islamic Account.

How to open an Account with HF Markets in Rwanda

👉 To register an account with HF Markets, Rwandan Traders can follow these steps:

➡️ To establish a live account, go to the website’s upper-right corner and locate the green box labelled “open live account.”

➡️ Establish a password for the myHF section, input personal information such as your name, email address, and phone number, and ensure that the privacy policy box is ticked.

➡️ To verify your account, enter the Personal Identification Number (PIN) that you will receive by text message or email.

➡️ You will be asked a few questions about your aims, the responses to which will help HF Markets better understand your needs.

➡️ Upload the needed papers so that your identity and accounts may be confirmed.

➡️ After depositing funds according to the minimum deposit requirement for your account type, you can start trading.

HF Markets Vs BD Swiss Vs AvaTrade – Broker Comparison

| 🥇 HF Markets | 🥈 BD Swiss | 🥉 AvaTrade | |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions | CySEC, FSC, BaFIN, FSA | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 💻 Trading Platform | • MetaTrader 4 • MetaTrader 5 • HF App | • MetaTrader 4 • MetaTrader 5 • BDSwiss Mobile • BDSwiss Web | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade |

| 💵 Withdrawal Fee | No | Yes, <100 EUR withdrawals | No |

| ✔️ Demo Account | Yes | Yes | Yes |

| 💰 Min Deposit | 5,100 RWF | 102,000 RWF | 102,000 RWF |

| 📊 Leverage | 1:1000 | Up to 1:1000 | • 1:30 (Retail) • 1:400 (Pro) |

| 📈 Spread | From 0.0 pips | From 0.3 pips | Fixed, from 0.9 pips |

| 💸 Commissions | $3 to $4 | $2 to $5 | None |

| 🛑 Margin Call/Stop-Out | • 40%/10% • 50%/20% | 50%/20% | • 25% – 50% (M) • 10% (S/O) |

| 📲 Order Execution | Market | Instant and Market | Instant |

| ✔️ No-Deposit Bonus | No | No | No |

| ✅ Cent Accounts | No | No | Yes |

| 💻 Account Types | • In Progress | • Classic Account • Premium Account • VIP Account • RAW Account | • Standard Live Account • Professional Account Option |

| ⚖️ BNR Regulation | No | No | No |

| 💵 RWF Deposits | Yes | No | No |

| ✔️ Rwandan franc Account | No | No | No |

| 📞 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 🛍 Retail Investor Accounts | 5 | 4 | 1 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 pips | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 60 lots | 50 lots | Unlimited |

| 📊 Minimum Withdrawal Time | 10 Minutes | 10 Minutes | 24 to 48 Hours |

| ⏱ Maximum Estimated Withdrawal Time | 10 business days | Between 7 to 10 days | 10 business days |

| ✔️ Instant Deposits and Instant Withdrawals? | No | No | No |

Min Deposit

USD 5

Regulators

CySEC, FSC, CFTC

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

HF Markets Trading Platforms

👉 HF Markets offers Rwandan Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ HF App

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4 and 5

👉 MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are both excellent trading platforms, but many CFD brokers now provide their own web-based platforms that are often easier to use for inexperienced traders.

👉 If a trader chooses to move brokers, they can simply take their customized version of the platform with them since HF Markets offers access to third-party platforms such as MT4 and MT5. This is one of the numerous benefits of HF Markets providing these platforms.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

👉 MetaTrader 4 is a sophisticated trading platform that includes 24 graphical objects and 30 built-in indicators. Customers that deposit more than 720,000 UGX, 2800 ZAR, or $200 will have access to Premium Trader features, which are exclusively available to customers who invest more.

👉 These unique premium goods interface directly with the MT4 platform, hence enhancing its utility and usage.

MetaTrader 5

👉 In addition to its predecessor, MT4, HF Markets offers MT5, the most current version. When it comes to the backtesting capabilities for automated trading algorithms, Rwandan traders are always advised to use MT5 as their trading platform of choice since it is both more robust and faster than other platforms.

👉 Traders appreciate the web-based version of MT5 because it provides a more comprehensive market representation, more technical indicators, and more analytical tools.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4 and 5

👉 The HF Markets MT4 and MT5 programs are equipped with nine distinct timeframes, thirty distinct indicators, and interactive currency charts, allowing traders to trade from any location.

👉 Rwandan traders can do real-time profit and loss calculations, as well as cancel and modify previously made orders. Compared to the web trader versions of the platforms, this version makes it easier for traders to look for instruments.

HF App

👉 The HF App provides a simplified and easy user experience. With the HF App, traders can easily search for instruments, transfer, withdraw, and deposit funds.

👉 Moreover, Rwandan traders can create and manage personalized watchlists with the program. In addition to an integrated economic calendar, traders may access HF Markets’ educational materials via the app.

HF Markets Range of Markets

👉 Rwandan Traders can expect the following range of markets from HF Markets:

➡️ Forex

➡️ Precious Metals

➡️ Energies

➡️ Indices

➡️ Shares

➡️ Commodities

➡️ Cryptocurrencies

➡️ Bonds

➡️ Stocks DMA

➡️ ETFs

Financial Instruments and Leverage offered by HF Markets

| 🔨 Instrument | ✔️ Number of Assets Offered | 📈 Maximum Leverage Offered |

| ➡️ Forex | 53 | 1:1000 |

| ➡️ Precious Metals | 6 | • Gold: 1:200 • Silver: 1:100 • Platinum: Floating • Palladium: 1:20 |

| ➡️ ETFs | 34 | 1:5 |

| ➡️ Stocks DMA | 901 | 1:5 |

| ➡️ Indices | 24 | 1:200 |

| ➡️ Stocks | 23 | 1:14 |

| Cryptocurrency | 19 | 1:50 |

| ➡️ Energies | 4 | 1:66 |

| ➡️ Bonds | 3 | 1:50 |

| ➡️ Agricultural Commodities | 5 | 1:66 |

Forex

👉 Over 53 different currency trading pairings are available via HF Markets. These trading pairs include majors, minors, and exotics with the benefit that Rwandan traders can use leverage up to 1:1000. Although this is a decent amount, other brokers provide more than sixty different currency pairings to trade.

Precious Metals

👉 In addition to gold and silver futures, as well as palladium and platinum futures, HF Markets offers currency crosses based on the euro and the dollar. When compared to other brokers, this selection of metals is not very impressive.

👉 The maximum leverage for gold futures is 1:200, whereas the maximum leverage for silver futures is 1:100 and the maximum leverage for palladium futures is 1:20.

Energies

👉 HF Markets facilitates trading in both spot and futures contracts for Brent and WTI oil, with a maximum leverage of 1:50 on USOil and 1:66 on UKOil, respectively.

Indices

👉 The NASDAQ, S&P 500, FTSE 100, DAX 30, and Nikkei are just some of the global indices that are included in the broad portfolio that HF Markets maintains. This portfolio also includes futures contracts and spot contracts. When compared to the offerings of other brokers, this index offering is comprehensive.

👉 Trading in indices is available with a maximum leverage of up to 1:200 via HF Markets, apart from the USDIndex and VIX.F Futures Contracts, for which the leverage is restricted at 1:100.

Shares

👉 71 share CFDs are available for trading with HF Markets. These share CFDs include prominent stock exchange members and well-known companies from the technology industry in the United States and throughout the globe.

👉 Although there seems to be a smaller range of share CFDs than other brokers, HF Markets furthermore includes 950 DMA stocks, and the highest leverage that Rwandan traders are allowed to employ is 1:14.

Commodities

👉 HF Markets offers trading in five of the most popular commodity futures, including coffee and sugar, with a maximum leverage ratio of up to 1:66 on cocoa and cotton and floating leverage on coffee, copper, and sugar #11.

Cryptocurrencies

👉 HF Markets offers a total of 19 different trading pairs for cryptocurrencies, some of which include Bitcoin, Ethereum, Dash, and Litecoin.

👉 The maximum leverage that may be used while trading cryptocurrencies is anywhere from 1:5 to 1:50, depending on the cryptocurrency coin being traded. However, investors should proceed with caution when utilizing high leverage levels on a financial product that has a high level of risk.

Bonds

👉 HF Markets offers contracts for difference (CFD) trading on the UK Gilts, Euro Bunds, and US 10-year bonds, with a maximum leverage ratio of up to 1:50. These three bonds are among the most widely held and traded in the world.

Stocks DMA

👉 In addition to the share CFDs in its portfolio, HF Markets offers customers access to 950 DMA stocks. This is a bigger variety than is offered by other brokers, and the highest leverage ratio is restricted at 1:5.

ETFs

👉 During the last few years, there has been a meteoric rise in the popularity of Exchange-Traded Funds (ETFs), and HF Markets offers spot contracts on 34 of the ETFs that are actively traded the most across the globe. HF Markets has a limit of 1:5 on the highest leverage ratio that may be used while trading ETFs.

Broker Comparison for Range of Markets

| 🥇 HF Markets | 🥈 BD Swiss | 🥉 AvaTrade | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | Yes |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

HF Markets Trading and Non-Trading Fees

Spreads

👉 When doing business with HF Markets, the number of spreads that a trader will be required to pay will be dependent not only on the conditions of the market but also on the financial instrument that they select to trade. The following is a list of the typical spreads applicable to each kind of account:

➡️ Micro Account – from 1 pip

➡️ Premium Account – from 1 pip

➡️ HFcopy Account – from 1 pip

➡️ Zero Spread Account – from 0.0 pips

➡️ Auto Account – from 1 pip

👉 Traders may anticipate the following average spreads from the various financial instruments that HF Markets has available for them to pick from:

| 🔨 Instrument | 📊 Average Spread |

| EUR/USD | 1.3 pips |

| NZD/USD | 1.9 pips |

| XAG/USD | 0.03 pips |

| XAU/USD | 0.25 pips |

| US OIL Spot | 0.09 pips |

| US OIL Futures | 0.11 pips |

| US Tech 100 Spot | 2.03 pips |

| US Tech 100 Futures | 3.13 pips |

| Volatility Index SP 500 (VIX.F) | 0.14 pips |

| APPLE (NASDAQ – APPLE) | 0.5 pips |

| Commodities | From 0.008 (Copper) |

| BTC/USD | 26 pips |

| Bonds | From 0.05 pips to 0.06 pips |

Commissions

👉 In comparison to other forex and CFD brokerages, HF Markets charges low commissions. For major currencies and other financial items handled by Rwandan traders, transaction costs would fall somewhere in the region of $3 to $4.

Overnight Fees, Rollovers, or Swaps

👉 Trades lasting longer than 24 hours will subject traders to overnight fees. These fees can either be credited to Rwandan traders or subtracted from their trading accounts when they close the position.

👉 Depending on the instrument, this fee might be shown right away on the site or even before you begin your transaction. Traders in Rwanda who use HF Markets must be aware of the following overnight fees:

➡️ Daily updates are provided considering market conditions and the prices that price providers get for FX, commodities, and individual stock swaps.

➡️ The triple swap occurs every Wednesday and affects all open positions in FX, commodities, and individual stocks.

➡️ Every day, the price of precious metals will be affected by the markets and pricing providers that offer liquidity and pricing.

➡️ In the case of precious metals, a 1 pip exchange rate is applied to both XAG and XAU.

➡️ Market circumstances and particular pricing from liquidity providers will be considered when making energy swap adjustments.

➡️ Traders might anticipate USD-denominated triple swaps on USOil and UKOil.

➡️ Swap costs for Indices, DMA Stocks, ETFs, and Cryptocurrencies may change daily depending on market circumstances. As a result, all holdings might be influenced by the rates obtained from liquidity providers, which is another aspect.

➡️ Lastly, on Fridays, all holdings in Indices, DMA stocks, and ETFs are subject to triple swaps to account for the weekend gap on several markets (excluding Crypto, which trades 24 hours a day, 7 days a week).

Deposit and Withdrawal Fees

👉 HR Markets does not charge any fees for deposits or withdrawals. However, Rwandan traders should be aware that deposits of less than 100,000 RWF (equal to 100 USD) may be subject to a charge.

Inactivity Fees

👉 An additional $5 will be charged each month until the account balance falls to zero, at which point the account will be promptly closed if it has been inactive for a period of six months to a year.

Currency Conversion Fees

👉 RWF deposits and withdrawals may be subject to currency translation fees at HF Markets since the company only accepts deposits and withdrawals in USD and ZAR.

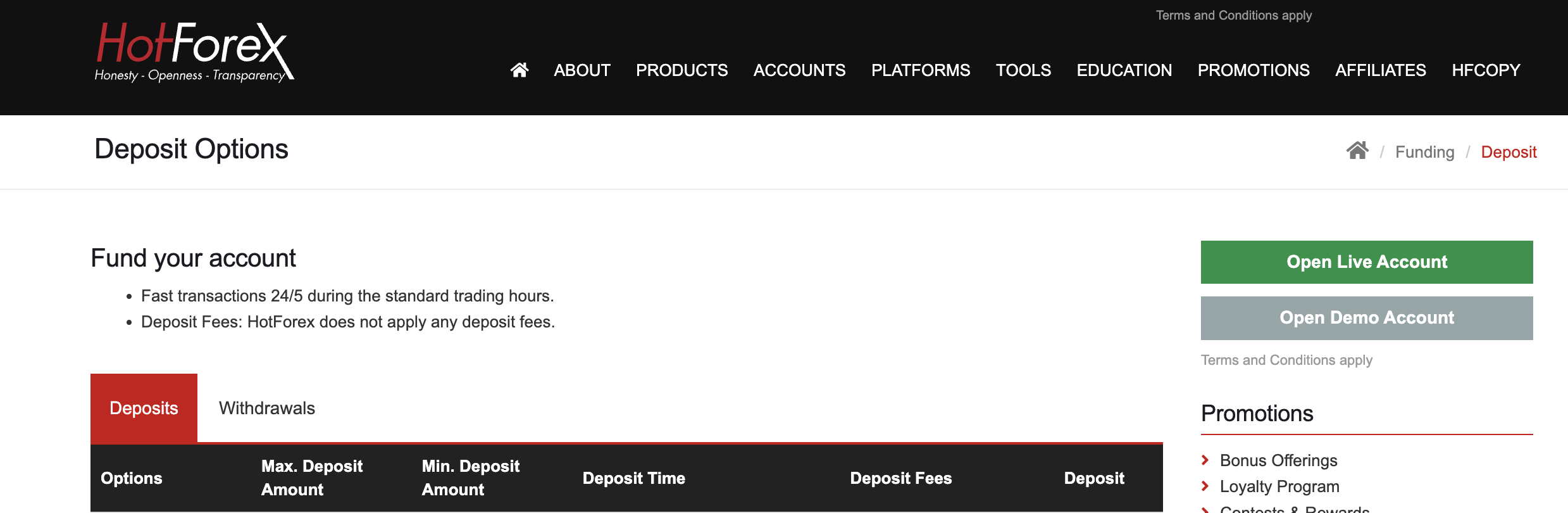

HF Markets Deposits and Withdrawals

👉 HF Markets offers the following deposit and withdrawal methods:

➡️ Bank Wire Transfer

➡️ Electronic Transfer

➡️ Credit Card

➡️ Debit Card

➡️ Skrill

Broker Comparison: Deposit and Withdrawals

| 🥇 HF Markets | 🥈 BDSwiss | 🥉 AvaTrade | |

| Minimum Withdrawal Time | 10 Minutes | 10 Minutes | 24 to 48 Hours |

| Maximum Estimated Withdrawal Time | 10 business days | Between 7 to 10 days | Up to 10 days |

| Instant Deposits and Instant Withdrawals? | No | No | No |

HF Markets Deposit Currencies, Deposit and Withdrawal Processing Times, Minimum Withdrawal Amount and Maximum Deposit Amounts

| 💰 Payment Method | 💵 Deposit Currencies | 💸 Deposit Processing | 💰 Withdrawal Processing | 💵 Max Deposit | 💳 Min Withdrawal |

| Bank Wire Transfer | USD, ZAR | 2 to 7 working days | 2 to 10 working days | Unlimited | 100 USD |

| Electronic Transfer | USD, ZAR | Up to 10 min | Up to 2 working days | 10,000 USD | 10 USD or 70 ZAR |

| Credit Card | USD, ZAR | Up to 10 min | 2 to 10 working days | 10,000 USD | 5 USD |

| Debit Card | USD, ZAR | Up to 10 min | 2 to 10 working days | 10,000 USD | 5 USD |

| Skrill | USD, ZAR | Up to 10 min | Up to 10 Min | 10,000 USD | 5 USD |

How to Deposit Funds with HF Markets

👉 To deposit funds to an account with HF Markets, Rwandan Traders can follow these steps:

➡️ For Rwandan traders to make a deposit, they must first log onto their myHF account.

➡️ Once the deposit amount and currency have been determined, traders may proceed to the next step.

➡️ Finally, traders can provide their payment provider with any further information necessary to validate and verify the deposit.

HF Markets Fund Withdrawal Process

👉 To withdraw funds from an account with HF Markets, Rwandan Traders can follow these steps:

➡️ Log in to your myHF account.

➡️ From the drop-down menu, choose “Fund Withdrawal.”

➡️ The amount you want to withdraw may be selected from the drop-down menu.

➡️ If your chosen payment provider requires more steps, complete and submit the withdrawal request once you’ve completed those steps.

HF Markets Education and Research

Education

👉 HF Markets offers the following Educational Materials:

➡️ HF Markets Educational Videos

➡️ Training Course Videos

➡️ Forex Education

➡️ eCourses

➡️ Live Webinars

➡️ Events

➡️ Podcasts

Research and Trading Tools

| 🥇 HF Markets | 🥈 BD Swiss | 🥉 AvaTrade | |

| Economic Calendar | Yes | Yes | Yes |

| VPS | Yes | Yes | No |

| AutoChartist | Yes | Yes | No |

| Trading View | No | No | No |

| Trading Central | Yes | Yes | Yes |

| Market Analysis | Yes | Yes | Yes |

| News Feed | Yes | Yes | Yes |

| Blog | Yes | Yes | Yes |

👉 HF Markets offers Rwandan Traders the following Research and Trading Tools:

➡️ HF App

➡️ VPS Hosting Services

➡️ Premium Trader Tools

➡️ AutoChartist Tools

➡️ Trading Calculators

➡️ myHF Client Area

➡️ Advanced Insights

➡️ Economic Calendar

➡️ Traders’ Board

➡️ Auto Trading through MQL5

➡️ Forex News presented by FXstreet

➡️ One-Click Trading

➡️ Events

➡️ HF Markets Exclusive Analysis

HF Markets Bonuses and Promotions

👉 HF Markets offers Rwandan Traders the following bonuses and promotions:

➡️ Free Funding

➡️ Contests including Traders Awards, HF Markets Gadget Giveaway, Demo Contest, Trading Contests, Currency Wars Contest

➡️ Loyalty Program

➡️ 50% Welcome Bonus for Micro Accounts

➡️ 100% Supercharged Bonus applied to a range of accounts

➡️ 30% Rescue Bonus

➡️ 100% Credit Bonus

How to open an Affiliate Account with HF Markets

👉 To register an Affiliate Account, Rwandan Traders can follow these steps:

➡️ Visit the HF Markets website.

➡️ Click on “Affiliates” in the main toolbar and choose “About HF Affiliates” to discover more about the Affiliate Program.

➡️ HF Markets accepts a wide variety of Affiliates, and you can sign up by clicking the green “Become an Affiliate” banner.

➡️ Determine if the affiliate is a person or a business.

➡️ Use the space provided to enter your personal details in the applicable fields.

➡️ In the next section, describe your affiliate experience, how many current customers you have, and how much money you expect to earn from those consumers.

➡️ Select “Yes” or “No” under HFM Revenue Share in the Program Information section.

➡️ Finally, read the HF Markets Affiliates Agreement, Terms and Conditions, and Privacy Policy before signing up for the affiliate program.

HF Markets Affiliate Program Features

👉 The HF Markets Affiliates program is open to anybody, no matter where they are in the world. A multi-tier affiliate monitoring system and generous incentive schemes are just two of the ways that HF Markets ensure that its affiliates stick around for the long haul.

👉 In addition, affiliates that join the HF affiliate program get full access to the Affiliates Department. Access to these tools and perks is subsequently provided to HF Markets’ affiliates.

➡️ A revenue share of up to 60%, which amounts to $15 per lot that is traded by a referral

➡️ Programs that pay a commission based on referrals

➡️ Automatic rebates

➡️ Structures with several tiers and reporting capabilities on both MetaTrader 4 and 5

➡️ Detailed information about customers, as well as reliable monitoring of their activities

➡️ When you sign up for an affiliate account, you won’t be required to pay any initial set-up costs

➡️ Frequent pay-outs are made by HF Markets

➡️ You are eligible for an infinite amount of commissions

➡️ There is an assortment of helpful marketing tools, such as widgets, banners, and others offered to Rwandans

HF Markets Customer Support

👉 HF Markets is not only a multi-regulated broker that provides outstanding trading conditions, but it also provides its customers with specialized and quality customer care.

| Customer Support | HF Markets’ Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English, Japanese, Vietnamese, Chinese, Arabic, Hindi |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| 📞 Telephonic Support | Yes |

| ✔️ Local Support in Rwanda? | No |

| 🥇 Overall quality of HF Markets Support | 4.7/5 |

HF Markets Corporate Social Responsibility

👉 Due to the broker’s willingness to provide a hand wherever it is required, HF Markets is participating in a few CSR activities and projects. The projects in which HF Markets has participated include, but are not limited to:

➡️ As a socially responsible company, HF Markets provided substantial cash to the World Health Organization’s battle against the Covid-19 outbreak in the past.

➡️ The Rainforest Alliance, a worldwide non-profit, received a charitable donation from HF Markets Group in support of indigenous efforts to prevent the fires that have ravaged the Amazon rainforest, often known as the “lungs of the Earth.”

➡️ To show their dedication to the community, HF Markets gave a substantial gift to the Larnaca Lions Club, the local branch of Lions Club International.

➡️ In 2017, the HF Markets team provided financial assistance and support to a few young individuals so that they may enjoy the Christmas season.

Min Deposit

USD 5

Regulators

CySEC, FSC, CFTC

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Our Verdict on HF Markets

👉 HF Markets is a broker with a worldwide presence, with a comprehensive website and a multitude of trading tools. The terminology used is straightforward, and the basics of trading Forex and CFDs are explained incredibly effectively.

👉 There are more than enough trading alternatives and various deposit ways to endorse HF Markets without hesitation. Education is an additional strength of HF Markets, since the broker focuses on the Africa and Asia areas, allowing you to enhance your Forex expertise and outcomes.

👉 HF Markets is a well-established, customer-focused broker offering a safe, regulated trading environment that is suited for most traders.

👉 The services and solutions are adapted to unique needs and provide customers with a wide array of accounts, platforms, tools, and instruments from which to pick an appropriate approach.

👉 Therefore, if you want to copy traders, utilize EAs, scalp, become a partner, etc., there is an opportunity for you. In addition, HF Markets’ pricing approach has straightforward rates that are among the lowest in the industry.

HF Markets Pros and Cons

| ✔️ Pros | ❌ Cons |

| HF Markets is well-regulated, and all licenses can be confirmed with the market regulators indicated on the official website | There is no RWF-denominated account offered by HF Markets |

| There are no fees charged on deposits or withdrawals | Rwandan traders who deposit in RWF could face currency conversion fees |

| HF Markets caters for Muslim traders who follow Sharia law by offering an Islamic account option | There are limited options where deposits and withdrawals are concerned |

| HF Markets applies negative balance protection to retail accounts to protect Rwandan traders from negative balances | |

| Rwandan traders can choose between MetaTrader 4, MetaTrader 5, and the HF App | |

| There is a vast selection of educational materials and trading tools | |

| With HF Markets, all client funds are kept in segregated accounts | |

| HF Markets is audited frequently to ensure compliance |

FAQ

Does HF Markets have Volatility 75?

Yes, HF Markets has Volatility 75. If you are interested in trading VIX, you can do so by registering an account with HF Markets and choosing to trade VIX as a futures contract under VIX.F.

What is the Volatility 75 Index on HF Markets?

The Volatility 75 Index, also commonly known as VIX, is an index that gauges and follows the Standard & Poor’s 500’s volatility (S&P 500). You can trade VIX.F as a futures contract with HF Markets with spreads from 0.14 pips per lot with a minimum deposit of 5,100 RWF and leverage up to 1:100.

Can I trade Bitcoin with HF Markets?

Yes, you can trade a wide range of popular cryptocurrencies as derivatives (CFDs) without owning the underlying asset. In addition, with HF Markets, you have access to 24/7 crypto trading, low margin requirements, and the chance to trade both rising and falling markets.

Does HF Markets have Nasdaq?

Yes, HF Markets includes Nasdaq in its impressive portfolio of indices that can be traded on both Spot and Futures markets, providing Rwandan traders with the flexibility they need.

Is HF Markets regulated?

Yes, HF Markets is regulated in South Africa (FSCA – FSP 46632), Cyprus (CySEC – 183/12), Dubai (DFSA – F004885), Seychelles (FSA – SD015), United Kingdom (FCA – 801701), Mauritius – (FSC – 094286/GBL), and Kenya (CMA – 155).

What is the Demo Contest in HF Markets?

The HF Markets ‘Virtual to Real’ Demo Contest is a competition that is run only on demo accounts. Therefore, there is no financial risk for players, but there are actual cash awards for the winners.

How many Forex Pairs does HF Markets have?

HF Markets offers more than 50 currency pairs that can be traded including major pairs, minors, and exotic forex pairs.

Is HF Markets safe or a scam?

HF Markets is a safe broker that is low risk and high trust, with a trust score of 85%. In addition, HF Markets is well-regulated by seven known and trusted market regulators spread across Tier-1, Tier-2, and Tier-3.

What is the withdrawal time for HF Markets?

The withdrawal time is from 10 minutes on Skrill withdrawals up to 10 days on Bank Wire Transfers and Credit/Debit Cards.

Conclusion

👉 Now it is your turn to participate:

➡️ Do you have any prior experience with HF Markets?

➡️ What was the determining factor in your decision to engage with HF Markets?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with HF Markets such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

👉 Regardless, please share your thoughts in the comments below.

Table of Contents