10 Best FSCA Regulated Forex Brokers in Rwanda

The 10 Best FSCA Regulated Forex Brokers operating in Rwanda were revealed. We tested and verified the best FSCA-Regulated in South Africa for Rwandan Traders.

This is a complete list of FSCA-Regulated forex brokers within Rwanda.

In this in-depth guide you’ll learn:

- What is the Financial Sector Conduct Authority (FSCA)?

- Why traders in Rwanda should sign up with an FSCA-regulated broker?

- Who are the best FSCA-regulated forex brokers for Rwandans in 2024?

- How to choose a forex broker – Compare them side by side, by, low minimum deposit, high leverage, best MetaTrader 5 platforms, low spreads, and much more.

- Which brokers on the list offers a 1st-time welcome sign-up bonus?

- Best FSCA-broker with MetaTrader 4 and MetaTrader 5 accounts?

And lots more…

So if you’re ready to go “all in” with the best-regulated FSCA forex brokers for Rwandans…

Let’s dive right in…

10 Best Forex Brokers in South Africa for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

- Louis Schoeman

Best FSCA Regulated Forex Brokers in Rwanda – Comparison

| 🥇 Broker | ✔️ FSCA Broker? | ⚖️ Regulation | 🏛 BNR Regulation? | 💸 RWF Deposits Allowed? | 👉 Open An Account |

| 1. Exness | Yes | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA | No | Yes | 👉 Open Account |

| 2. AvaTrade | Yes | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA | No | No | 👉 Open Account |

| 3. HFM | Yes | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA | No | Yes | 👉 Open Account |

| 4. Tickmill | Yes | ASIC, FMA, FSCA, FCA, CySEC, FSA, MAS | No | No | 👉 Open Account |

| 5. XM | Yes | FSCA, IFSC, ASIC, CySEC, DFSA | No | Yes | 👉 Open Account |

| 6. Alpari | Yes | Financial Services Commission Mauritius (FSC), FSCA | Yes | Yes | 👉 Open Account |

| 7. Pepperstone | Yes | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB | No | Yes | 👉 Open Account |

| 8. Trade Nation | Yes | FCA, ASIC, FSCA, SCB | No | No | 👉 Open Account |

| 9. FXTM | Yes | CySEC, FSCA, FCA, FSC Mauritius | No | Yes | 👉 Open Account |

| 10. FxPro | Yes | FCA, CySEC, FSCA, DFSA, SCB | No | No | 👉 Open Account |

What is an FSCA-Regulated broker?

The FSCA is the market conduct regulator of financial institutions, that provide financial products and financial services, financial institutions that are licensed in terms of a financial sector law.

10 Best FSCA Regulated Forex Brokers in Rwanda (2024)

1. Exness

Min Deposit

USD 10

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Exness, equipped with the necessary licenses and authorization, offers a comprehensive range of trading solutions and services to traders in Rwanda.

Traders in Rwanda have the flexibility to select from a variety of account types at Exness, and the company provides specialized customer service throughout the week.

Exness is known for having some of the tightest spreads and lowest commissions in the industry, ensuring a secure, fair, and transparent trading environment for its users.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📲 Social Media Platforms | • Facebook • YouTube |

| 🏛 BNR Regulation? | No |

| 💻 Trading Accounts | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💸 Minimum Deposit (RWF) | 61,837 |

| 💵 Trading Assets | Forex, Metals, Crypto, Energies, Indices, Stocks |

| 💰 Rwandan Franc-based Account? | Yes |

| 💳 RWF Deposits Allowed? | Yes |

| 💸 Bonuses for Rwandan traders? | Yes |

| 📊 Minimum spread | From 0.0 pips EUR/USD |

| 💻 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✔️ Pros | ❌ Cons |

| Exness is well-regulated and keeps all client funds in segregated accounts with top-tier institutions | There is a limited portfolio of financial instruments offered |

| Rwandan traders can choose between several retail investor accounts | Exness offers a limited number of payment methods that can be used for deposits and withdrawals |

| Exness offers an Islamic account conversion with no additional fees charged | |

| Instant deposits and withdrawals are offered | |

| Exness has customer support available 24 hours a day, 7 days a week |

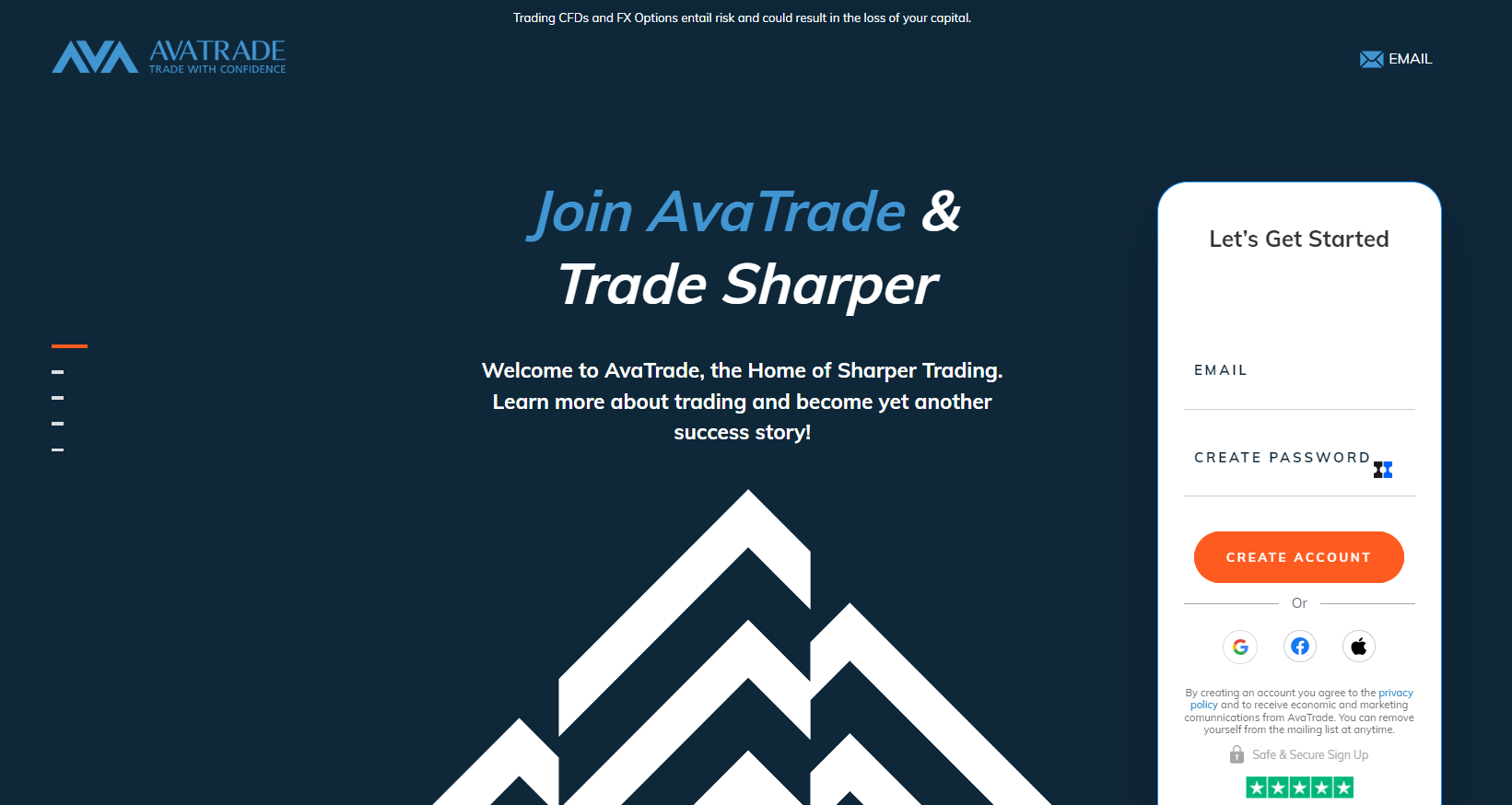

2. AvaTrade

Min Deposit

USD 100

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

AvaTrade, one of the largest and most popular CFD and forex brokers in Rwanda, offers an extensive selection of over 1,250 tradable financial products spanning various asset classes.

Despite having only two account types, AvaTrade’s accounts boast versatile and dynamic features that cater to both novice and experienced traders in Rwanda.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| 📲 Social Media Platforms | • Instagram • YouTube |

| 🏛 BNR Regulation? | No |

| 💻 Trading Accounts | Retail Account, Professional Account |

| 📱 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💸 Minimum Deposit (RWF) | 62,591 |

| 💵 Trading Assets | Forex, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 💰 Rwandan Franc-based Account? | No |

| 💳 RWF Deposits Allowed? | No |

| 💸 Bonuses for Rwandan traders? | Yes |

| 📊 Minimum spread | From 0.9 pips EUR/USD |

| 💻 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✔️ Pros | ❌ Cons |

| AvaTrade caters specifically to the unique needs of Muslim traders | There are no variable spreads offered |

| There is a dedicated selection of financial markets that Muslim traders can trade | There are inactivity fees applied as well as currency conversion fees |

| There is a demo account that can be used to test strategies, and practice trading | |

| There are no additional charges on the Islamic Account | |

| Professional traders can employ advanced technical indicators and access powerful research tools and resources | |

| There is a large range of financial instruments offered |

3. HFM

Min Deposit

USD 5

Regulators

CySEC, FSC, CFTC

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

👉 HFM was founded in 2010 and is a well-regulated and internationally recognized brokerage firm. With HFM, traders in Nigeria have access to hundreds of worldwide financial markets, all while trading in a fair and transparent manner.

👉 HFM has more than 1.5 million registered customers and has earned more than 25 industry accolades since its start.

Unique Features

| ✔️ Pros | ❌ Cons |

| CopyTrade social trading offered | Spreads on some accounts are very high |

| Dedicated customer support team available 24/7 | Limited virtual trading account |

| Quick and easy deposits and withdrawals | Withdrawal fees and deposit fees are charged |

| User-friendly trading apps | Limited selection of deposit and withdrawal options |

| Ultra-low minimum deposit requirement |

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📱 Social Media Platforms | • Facebook • YouTube |

| ⚖️ CBN Regulation? | No |

| 📱 Trading Accounts | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| 💻 Trading Platform | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💸 Minimum Deposit | 100,68 Franc |

| 📱 Trading Assets | Forex, Metals, Crypto, Energies, Indices, Stocks |

| 💳 Rwandan Franc-based Account? | Yes |

| 💰 RWF Deposits Allowed? | Yes |

| 💵 Bonuses for Rwandan traders? | Yes |

| 📊 Minimum spread | From 0.0 pips EUR/USD |

| 📱 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| 📉 Minimum trade size | 0.01 lot |

| 📈 Maximum trade size | 200 lots |

Trust Score and Nigerian Market Share

👉 HFM has a trust score of 83% and a Nigerian market share of 2.5%.

4. Tickmill

Min Deposit

USD 100

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

👉 Retail and institutional traders from Nigeria can take advantage of Tickmill, a well-established and award-winning broker founded in 2015.

👉 More than 80 tradable instruments, ranging across many financial markets, are available to Nigerian traders through Tickmill. These include currency and commodity trading as well as stock market and index trading, as well as CFDs and other derivatives.

Unique Features

| Feature | Information |

| 🏛️ Associated Broker | Alpari International (Rwandan) |

| 📱 iOS compatible | Only Alpari Invest, not Alpari Trading |

| 📱 Android Compatible | Yes |

| 💰 Assets offered | Forex Majors, Forex Minors, Forex Exotics, Forex RUB, Spot Metals, Spot Commodities, Stock Trading, Spot Indices |

| 💰 Fees Charged | Spreads, Commissions, Overnight Fees, Withdrawal Fees |

| ✴️ Crypto trading offered | No |

| ✔️ User-friendly | Yes |

| 👍 Reviews | Google Play – 1,800 Votes |

| ✔️ Ratings | Google Play – 4/5 |

| 💳 Minimum deposit | 2,42 Rwandan Franc or 5 USD, EUR, GBP |

| 💳 Demo Account | Yes |

| 💰 Rwandan Market Share | 14% |

| ✔️ PROS | ❌ CONS |

| Well-regulated by the FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, Exness is a broker with a high trust score | Exness does not offer a range of educational materials |

| Exness caters for both beginner and professional traders in Rwandan | There are only 200 tradable instruments offered |

| Rwandan traders can register a Franc-denominated account with Exness | |

| The broker offers a range of trading accounts including a cent account, which is dedicated to traders who want to trade micro-lots |

Trust Score and Nigerian Market Share

👉 Tickmill has a trust score of 81% and an overall market share of <5% in Nigeria.

5. XM

Min Deposit

USD 10

Regulators

IFSC, CySec, ASIC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

55

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overview

👉 Nigerian beginners and experts alike like XM’s user-friendly interface and powerful trading tools.

👉 Aside from offering services such as auto trading and having no hidden fees or commissions, XM’s order executions are lightning quick, with 99.35 percent of all trades being completed in less than one second.

Unique Features

| ✔️ Pros | ❌ Cons |

| Dedicated trading app offered for Android devices | Fixed Spreads are not offered |

| Alpari streams all newsfeeds from FxWirePro while trading signals are obtained from AutoChartist | No Financial Conduct Authority regulation, or any other popular market regulators |

| Customer support is offered in more than 30 languages | Limited selection of tradable instruments |

| There are regulatory restrictions on some regions |

| Feature | Information |

| ⚖️ Regulation | CySEC, FSCA, FCA, FSC Mauritius |

| 📱 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ CBN Regulation? | No |

| 📱 Trading Accounts | Micro Account, Advantage Account, Advantage Plus Account |

| 💻 Trading Platform | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💸 Minimum Deposit | 24,56 Franc |

| 📱 Trading Assets | Precious Metals, Stock Trading, Stock CFDs, Indices, Forex Indices, Forex Currency Pairs, Commodities, Stock Baskets |

| 💳 Rwandan Franc-based Account? | Yes |

| 💰 RWF Deposits Allowed? | Yes |

| 💵 Bonuses for Rwandan traders? | Yes |

| 📊 Minimum spread | From 0.0 pips |

| 📱 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| 📉 Minimum trade size | 0.01 lot |

| 📈 Maximum trade size | Unlimited |

Trust Score and Nigerian Market Share

👉 XM has a trust score of 84% and a market share of <5% in Nigeria.

6. Alpari

Min Deposit

USD 100

Regulators

FSC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

👉 In business since 1998, Alpari is a well-established and well-respected broker with more than 2 million customers hailing from more than 150 countries around the world.

👉 With Alpari, Nigerian traders have access to a wide variety of FX and CFD instruments with low spreads, fast execution, and cutting-edge trading tools.

Unique Features

| Feature | Information |

| 🏛️ Associated Broker | eToro |

| 📱 iOS compatible | Yes |

| 📱 Android Compatible | Yes |

| 💰 Assets offered | Forex, Commodities, Exchange-Traded Funds (ETFs), Indices, Cryptocurrencies, Stocks |

| 💰 Fees Charged | Spreads, Overnight Fees, Withdrawal Fee, Currency Conversion Fee, Inactivity Fee |

| ✴️ Crypto trading offered | Yes |

| ✔️ User-friendly | Yes |

| 👍 Reviews | Google Play – 110,200 Votes App Store – 1,600 Reviews |

| ✔️ Ratings | Google Play – 4/5 App Store – 4.3/5 |

| 💳 Minimum deposit | 201,69 Rwandan Franc or equivalent to $200 |

| 💳 Demo Account | Yes |

| 💰 Rwandan Market Share | <5% |

| ✔️ PROS | ❌ CONS |

| FXTM offers a dedicated Micro Account to Rwandan traders | There are inactivity fees charged on dormant accounts |

| There are low minimum deposit requirements | |

| There are several convenient funding options offered | |

| Deposit fees are not charged by FXTM | |

| Educational tools are offered to beginner Rwandan traders | |

| Rwandan traders have access to local support | |

| There is a dedicated Franc account offered |

Trust Score and Nigerian Market Share

👉 Alpari has a trust score of 95% and an overall market share of more than 14%.

7. Pepperstone

6 Best Day Trading Strategies in Rwanda

The 6 Best Day Trading Strategies in Rwanda revealed. We tested and verified the best day trading strategies for Rwandan Traders.

This is a complete list of day trading strategies in Rwanda.

In this in-depth guide you’ll learn:

- What is a day trading strategy?

- Which brokers offer day trading strategies to Rwandan traders?

- Our six recommended day trading strategies for Rwandan Beginner Traders?

- How to compare day trading strategies against each other?

- What are forex day trading strategy patterns in Rwanda?

- A cheat sheet for day trading strategies.

- What are day trading pattern rules?

- Which broker offers a low minimum deposit on Franc Accounts?

- Which brokers offer a signup bonus for first-time traders?

And lots more…

So if you’re ready to go “all in” with the best day trading strategies for Rwandans…

Let’s dive right in…

10 Best Forex Brokers in South Africa for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

- Louis Schoeman

What is a Day Trading Strategy?

A day trading strategy is a set of rules and techniques that a trader follows to engage in short-term trades within a single trading day. Below, I will provide an explanation of a simple day trading strategy suitable for beginners:

Choose a Trading Style: Determine the trading style that aligns with your personality and schedule. Common styles include scalping (short-term trades lasting seconds to minutes), momentum trading (capitalizing on strong price movements), or breakout trading (entering trades when prices break key levels).

Identify Tradable Instruments: Decide which financial instruments you want to trade, such as stocks, foreign exchange (forex) pairs, commodities, or indices. Ensure that your preferred platform or broker offers access to these instruments.

Conduct Technical Analysis: Utilize technical analysis to identify potential entry and exit points. Study price charts, patterns, and indicators to make informed trading decisions. Look for trends, support and resistance levels, and other technical signals.

Set up Trading Tools: Set up a reliable trading platform with real-time market data and charting capabilities. Ensure it provides access to your preferred instruments and offers essential analysis tools, such as candlestick charts, moving averages, and oscillators.

Define Entry and Exit Criteria: Establish clear criteria for entering and exiting trades. For instance, you may enter a trade when a stock breaks above a specific resistance level or when an indicator generates a buy signal. Determine profit targets and stop-loss levels to manage risk.

Implement Risk Management: Develop a risk management plan to protect your trading capital. Set appropriate position sizes, determine the maximum amount you’re willing to risk per trade and use stop-loss orders. Proper risk management is crucial for long-term success.

Practice and Refine: Practice your strategy using a demo account before trading with real money. Familiarize yourself with the platform, test your strategy in real-time market conditions, and make necessary adjustments. Monitor your performance and refine your approach.

Stay Informed: Continuously educate yourself about the markets and stay updated on relevant news and events that may impact your trading instruments. Economic reports, earnings announcements, and geopolitical developments can influence market volatility.

Remember the Risks: Day trading involves risks, and no strategy guarantees profits. Approach it with discipline, manage your emotions, and be prepared for both wins and losses. Seek guidance from experienced traders or professionals, and comply with local trading regulations.

Please note that trading and investing involve financial risks, and it’s advisable to consult with a qualified financial advisor before making any investment decisions.

6 Best Day Trading Strategies in Botswana (Updated 2024) – Comparison

| 🥇 Broker | ✔️ Day Trading Strategies Offered? | 💸 Minimum Deposit | ✔️ Rwanda Franc-based Account? | 💰 RWF Deposits Allowed? | 👉 Open An Account |

| 1. Admirals | Yes | 977,97 Franc | No | Yes | Open Account |

| 2. Tickmill | Yes | 101,46 Franc | No | No, only USD, GBP, EUR, IDR, CNY, VND, or RUB | Open Account |

| 3. HFM | Yes | 4,89 Franc | Yes | Yes | Open Account |

6 Best Day Trading Strategies in Botswana(Updated 2024)

1. Breakout Strategy

This strategy entails identifying key support and resistance levels on a chart. Traders search for price breakouts above resistance or breakdowns below support levels. When a breakout occurs, traders enter positions with the expectation that the price will continue moving in the direction of the breakout.

2. Trend Following

In this strategy, traders aim to identify and trade in line with an established trend. They seek stocks or other instruments exhibiting clear and sustained upward or downward movements. Trend followers use technical indicators or moving averages to confirm the trend and enter trades aligned with it.

3. Scalping

Scalping focuses on making quick trades and profiting from small price movements. Traders take advantage of short-term volatility, often entering and exiting trades within seconds or minutes. This strategy requires prompt decision-making, tight spreads, and a focus on liquid instruments.

4. Range Trading

Range trading involves identifying price ranges within which an instrument typically trades. Traders look for opportunities to buy near support levels and sell near resistance levels. This strategy assumes that the price will continue oscillating within the range, allowing traders to profit from multiple trades.

5. Reversal Strategy

Reversal traders aim to identify points where a trend is likely to reverse. They search for signs of exhaustion in the prevailing trend, such as overbought or oversold conditions, or the formation of chart patterns like double tops or bottoms. Traders enter trades anticipating a reversal and aim to profit from the subsequent price movement.

6. News Trading

News trading involves capitalizing on significant news events that can cause sudden price fluctuations. Traders monitor economic releases, company earnings announcements, or geopolitical developments to identify opportunities. They enter trades based on the expected impact of the news on the instrument’s price.

Best Trading Platforms for Day Trading Strategies

1. Admirals

Min Deposit

$1 / 1119 RWF

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

• MetaTrader 4

• MetaTrader 5

• Admirals Mobile App

Crypto

Yes

Total Pairs

35 Forex Currency Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Admirals offers Rwandan traders a variety of 47 currency pairs to choose from. Alongside its social trading platform, the company provides a wide range of additional trading opportunities. The all-in costs for EUR/USD trades are typically average 0.6, with an average spread of 0.06.

Day trading does not necessarily require a substantial initial investment, and Rwandan traders have the option to start with as little as $100 when trading with Admirals.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FCA, ASIC, CySEC, EFSA, JSC |

| 📲 Social Media Platforms | • YouTube • Telegram |

| ⚖️ CBN Regulation? | No |

| 💻 Trading Accounts | Trade.MT5, Invest.MT5, Zero.MT5, Bets.MT5, Trade.MT4, Zero.MT4 |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5, Admirals Mobile App |

| 💵 Minimum Deposit | 977,97 Franc |

| 💳 Trading Assets | ESG Trading Instruments, Forex, Cryptocurrency CFDs, Commodities, Indices, Stocks, ETFs, Bonds, Spread Betting |

| ✔️ Rwanda Franc-based Account? | No |

| 💸 RWFP Deposits Allowed? | Yes |

| 💰 Bonuses for Rwandan traders? | No |

| 📊 Minimum spread | From 0.0 pips EUR/USD |

| ✔️ Demo Account | Yes |

| ☪️ Islamic Account | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Admirals is well-regulated in several regions globally | There is an inactivity fee charged |

| Admirals offers commission-free options | Rwandan traders are subject to currency conversion fees |

| The broker accepts Rwandan traders despite their trading skills or trading strategies | There are deposit and withdrawal fees charged |

| There are user-friendly platforms available across devices | There are admin fees charged on the Islamic account |

| There is a wide range of tradable markets, complex instruments, and leveraged products | There is only one account type that can be converted to an Islamic Account |

| Admirals offers the MetaTrader Supreme Edition | |

| Traders are given access to premium analytics | |

| There are several educational materials, resources, and tools offered |

2. Tickmill

Min Deposit

USD 100

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Tickmill has gained a strong reputation among Rwandan investors and traders, despite being relatively new in the Forex markets. The broker offers a wide range of tools and features, including options for forex day trading.

Tickmill supports third-party solutions in addition to its own web platform. Traders using MetaTrader 5 can still access their Tickmill accounts through MetaTrader 4, even though direct support for MetaTrader 5 is not provided. Rwandan traders also have access to ZuluTrade assistance and Tickmill’s own desktop program.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA |

| 📲 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ CBN Regulation? | No |

| 💻 Trading Accounts | Pro Account, Classic Account, VIP Account |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5 |

| 💳 Minimum Deposit | 101,46 Franc |

| 💵 Trading Assets | Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies |

| 📱 Rwanda Franc-based Account? | No |

| ✔️ RWF Deposits Allowed? | No, only USD, GBP, EUR, IDR, CNY, VND, or RUB |

| 💸 Bonuses for Rwandan traders? | Yes |

| 📊 Minimum spread | 0.8 pips |

| 💻 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Tickmill offers robust trading platforms and innovative mobile trading | Currency conversion fees will apply for Franc deposits |

| Tickmill has a very high trust score and is known for its competitive trading conditions | There are no fixed spread accounts offered |

| There are several convenient funding options available including Skrill, Neteller, and others | The spreads are not the tightest |

| Advanced traders can use a range of tools including FIX API, AutoChartist, VPS, and others |

3. HFM

Min Deposit

USD 5

Regulators

CySEC, FSC, CFTC

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

HFM offers Rwandan traders a selection of six different trading accounts to choose from. This allows traders to select an account that aligns with their specific trading preferences and needs. Additionally, HFM provides a leverage of 1:1000, enabling traders to amplify their trading positions. However, it’s crucial to note that leverage carries both potential rewards and risks, and traders should exercise caution when utilizing high leverage. It is advisable for traders to carefully consider their risk tolerance and employ proper risk management strategies when trading with leverage.

Unique Features

| Feature | Value |

| 💰 Minimum Deposit | 4,89 Franc or an equivalent to $5 |

| 💵 Maximum Deposit | Unlimited |

| 💳 Account Base Currencies | USD, ZAR, RWF |

| 📊 Max Leverage Ratio | 1:1000 |

| ✔️ Franc Deposits Allowed? | Yes |

| 💸 Offers a Franc Account? | Yes |

| 📞Rwandan Customer Support? | Yes |

| 💻 Account Types | Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account |

| 📱 Trading Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| ✔️ Negative Balance Protection? | Yes |

| 💰 Margin Call | Between 40% to 50% |

| 🛑 Stop-Out | Between 10% to 20% |

| 📉 Minimum Trade Size | 0.01 lots |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There are tight, competitive spreads from 0.0 pips on EUR/USD | HFM only offers a few deposit and withdrawal methods to Rwandan |

| There is a demo account for beginners who are learning to trade and professional traders who are testing strategies | |

| Rwandan traders can register a trading account in either USD, ZAR, or RWF | |

| Several asset classes can be traded through HFM | |

| Rwandan traders have access to MetaTrader 4 and 5 across desktops, mobile apps, and web-based platforms |

Things to consider when day trading

Day trading success is influenced by various factors that traders should carefully consider. These factors include:

Volatility: Volatility refers to the extent of price movements in the market. Higher volatility can provide more trading opportunities, but it also increases risk. Day traders often prefer markets with sufficient volatility to capitalize on price fluctuations.

Liquidity: Liquidity indicates the ease of buying or selling a financial instrument without causing significant price changes. Trading in liquid markets ensures quick trade execution at desired prices, minimizing slippage. It is crucial to choose liquid markets to facilitate efficient trading.

Timeframe: Day traders focus on short-term timeframes, such as minutes, hours, or intraday charts. Their objective is to take advantage of price movements within a single trading day, typically avoiding overnight positions. Understanding and analyzing price patterns within the chosen timeframe is essential for day trading.

Risk Management: Effective risk management is vital for day traders. Establishing risk-reward ratios, setting stop-loss orders, and adhering to position sizing rules help protect capital. Sound risk management limits potential losses and safeguards the trading account.

Trading Volume: Trading volume represents the number of shares or contracts traded within a specified period. Higher trading volume indicates increased liquidity and active market participation. Day traders seek instruments with sufficient trading volume to ensure smooth trade execution.

News and Market Events: News releases, economic data, earnings reports, and geopolitical events significantly impact financial markets. Day traders must stay informed about relevant news that may affect the instruments they trade. Unexpected news events can lead to increased volatility, presenting both opportunities and risks.

Technical Analysis: Day traders rely heavily on technical analysis to make trading decisions. They utilize various indicators, chart patterns, and tools to identify trends, support and resistance levels, and potential entry and exit points. Understanding and applying technical analysis techniques are crucial for day trading.

Trading Costs: Evaluating trading costs, such as commissions, spreads, and fees charged by the broker, is important. Costs can vary between brokers and affect overall profitability. Comparing trading costs helps in selecting a broker that suits your trading strategy.

Trading Tools and Technology: Using trading platforms and tools that offer real-time market data, advanced charting features, fast order execution, and other functionalities enhances the trading experience. Reliable and efficient trading technology enables traders to respond effectively to market conditions.

Trading Education and Experience: Continuous learning and gaining experience are essential for day traders. Enhance trading skills through educational resources, books, online courses, and trade analysis. Practicing with a demo account allows traders to gain confidence and test strategies without risking real money.

Remember that day trading involves risks, and profits are not guaranteed. It requires discipline, knowledge, experience, and adaptability to changing market conditions. By considering these factors and developing a well-defined trading approach, traders can improve their chances of success in day trading.

Understanding the day trader

To understand day traders, it is crucial to consider their motivations, characteristics, and the challenges they face. Here are key aspects to consider when seeking to understand day traders:

Time Horizon: Day traders operate within a short-term time horizon, buying and selling financial instruments within a single trading day. Their goal is to capitalize on intraday price movements and close all positions before the market closes.

Profit Generation: Day traders aim to generate profits through frequent buying and selling of financial instruments. They seek to take advantage of short-term price fluctuations, aiming to make small gains on each trade that accumulate over time.

Market Monitoring: Day traders actively monitor price movements, news, and market data. They use technical analysis tools and indicators to identify patterns and trends, making quick trading decisions based on their analysis.

Risk Management: Effective risk management is essential for day traders. They carefully assess potential risks and employ techniques such as setting stop-loss orders to limit losses. Risk management protects their trading capital and ensures they can continue trading despite occasional losses.

Trading Psychology: Day trading involves a significant psychological aspect. Traders need discipline, emotional control, and the ability to avoid impulsive decisions driven by fear or greed. They often develop strategies to manage stress and psychological challenges that arise in fast-paced trading.

Continuous Learning: Day traders recognize the importance of ongoing education and improvement. They constantly seek to enhance their knowledge of market dynamics, trading strategies, and risk management techniques. They engage in research, read market-related literature, and learn from their own trading experiences.

Technological Proficiency: Day traders heavily rely on trading platforms, real-time market data, and advanced trading tools. They are proficient in using trading software, charting tools, and execution platforms to enter and exit trades swiftly.

Regulatory Compliance: Day traders adhere to relevant regulations and legal requirements imposed by regulatory authorities. They are familiar with rules regarding margin trading, pattern day trading, tax obligations, and licensing, ensuring their trading activities are within the boundaries of the law.

How to start out with day trading

Day trading, a form of trading where individuals engage in buying and selling various financial instruments, such as stocks, within a single trading day, holds the objective of capitalizing on short-term price fluctuations and reaping profits from these swift transactions. Let’s delve into an elucidation of the mechanics behind day trading:

Capital Requirement: Day trading, as a rule, necessitates a significant amount of capital. The precise sum may vary depending on your specific trading strategy; however, it is vital to possess sufficient funds to meet your broker’s minimum requirements and to endure potential losses.

Trading Tools: To partake in day trading, one must have access to real-time market data, charting software, and a dependable trading platform. These tools enable you to monitor price movements, scrutinize charts, and execute trades promptly.

Trading Strategies: Day traders employ diverse strategies to identify profitable trading opportunities. Popular strategies encompass trend following, momentum trading, breakout trading, and scalping. Each strategy abides by its own set of rules and indicators, dictating when to enter and exit trades.

Technical Analysis: Technical analysis often serves as the backbone of day traders’ decision-making processes. By studying price charts, patterns, and indicators, traders can discern trends, support, and resistance levels, as well as potential entry and exit points. The technical analysis aids in anticipating price movements based on historical data.

Risk Management: Managing risk assumes paramount importance in day trading. Traders establish stop-loss orders to restrict potential losses and implement sound position-sizing techniques to control the amount of capital at stake per trade. Risk management strategies ensure that losses remain manageable and do not detrimentally affect overall trading performance.

Trading Discipline: Day trading demands unwavering discipline and emotional composure. It is crucial to adhere to your trading plan, follow your strategies diligently, and abstain from impulsive decisions driven by emotions. Greed and fear can lead to irrational trading choices; therefore, maintaining a rational approach is essential.

Continuous Learning: Day trading is a skill that necessitates time and practice to develop. It is imperative to continually acquire knowledge and refine your strategies. Stay informed about market news, study accomplished traders, and analyze your own trades to identify areas for improvement.

Remember that day trading carries inherent risks, including the potential for substantial financial losses. It is advisable to commence with a modest amount of capital, gain experience gradually, and then consider committing larger sums. Moreover, be cognizant of any regulations or legal requirements pertaining to day trading in your jurisdiction.

How to Choose a Forex Broker

When choosing a forex broker for Rwandans, it’s important to consider several factors to ensure a reliable and suitable trading experience. Here are some key points to consider:

Regulation: Select a forex broker that is regulated by a reputable financial authority. Regulation helps ensure the broker follows certain standards and provides a level of protection for traders. Look for brokers regulated by well-known authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

Security: Verify the broker’s security measures to safeguard your funds and personal information. Choose a broker that implements strong data encryption, segregated client accounts, and other security protocols. This helps protect your funds from unauthorized access or misuse.

Trading Platform: Evaluate the broker’s trading platform to ensure it meets your requirements. The platform should be user-friendly, stable, and offer fast execution of trades. Popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) are widely used and provide access to a range of trading tools and indicators.

Instrument Availability: Check if the broker offers a wide range of forex currency pairs to trade. Ensure they provide access to major currency pairs as well as minor and exotic pairs, giving you ample trading opportunities.

Competitive Spreads and Fees: Compare the spreads and trading fees charged by different brokers. Lower spreads can reduce trading costs and enhance profitability. Additionally, consider other fees such as deposit/withdrawal charges, inactivity fees, or account maintenance fees.

Deposit and Withdrawal Options: Assess the available deposit and withdrawal methods offered by the broker. Look for options that are convenient and secure for Rwandan traders. Popular methods may include bank transfers, credit/debit cards, or electronic payment systems like Skrill or Neteller.

Customer Support: Evaluate the quality and responsiveness of the broker’s customer support. It’s important to choose a broker that offers reliable customer service, preferably with multilingual support, to address any issues or inquiries promptly.

Educational Resources: Consider brokers that provide educational resources, such as trading tutorials, webinars, or market analysis, to help you improve your trading skills and knowledge.

Local Regulations and Support: Ensure the broker complies with local regulations in Rwanda and provides support tailored to Rwandan traders. This can include localized customer support, language options, and an understanding of any specific requirements or restrictions for traders from Rwanda.

Before finalizing your choice, it’s recommended to research and compare multiple brokers, read reviews from other traders, and consider seeking advice from experienced traders or financial professionals.

The Best Forex Brokers in Botswana

In this comprehensive analysis, we have listed the best Forex brokers or Botswana day traders. Of these brokers, we have further identified the forex brokers that offer additional services and solutions to Botswana traders.

Best Forex Broker for beginner day traders in Botswana

Min Deposit

$1 / 1119 RWF

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

• MetaTrader 4

• MetaTrader 5

• Admirals Mobile App

Crypto

Yes

Total Pairs

35 Forex Currency Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Admirals is considered a low-risk broker and can be summarised as a trustworthy and reliable ECN broker for day trading in Botswana. Regarding spread and security, Admirals guarantees fast trading speeds from a few milliseconds when day trading in Botswana. In terms of users, Admirals has over 7 million registered traders.

Best Forex broker with BWP-based accounts for Botswana day traders

Min Deposit

USD 5

Regulators

CySEC, FSC, CFTC

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, HFM is considered a low-risk broker and can be summarised as a trustworthy and reliable ECN broker for day trading in Botswana. Regarding spread and security, HFM guarantees fast trading speeds from a few milliseconds when day trading in Botswana. In terms of users, HFM has over 2.5 million registered clients around the world.

Best MT4 Forex broker for Botswana day traders

Min Deposit

USD 100

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Tickmill is considered a low-risk broker and can be summarised as a trustworthy and reliable ECN broker for day trading in Botswana. Regarding spread and security, Tickmill guarantees fast trading speeds from a few milliseconds when day trading in Botswana. In terms of users, Tickmill has over 38 000 registered clients in the UK.

FAQ

What is day trading in Forex?

The foundation of this widely employed strategy lies in the act of trading currencies on the foreign exchange market within the confines of a single trading day. With this approach, positions are opened and closed by the end of each day, with new ones initiated in the subsequent session. Forex day traders engage in the frequent buying and selling of currency pairs throughout the day, aiming to capitalize on minor market fluctuations.

What is the difference between day trading and Forex trading?

Day trading is a specific trading technique employed within the broader domain of Forex trading. While Forex trading encompasses a range of strategies and timeframes, day trading focuses specifically on capitalizing on short-term price fluctuations that occur within a single trading day. Day traders aim to generate profits by swiftly entering and exiting trades within a shorter timeframe, typically within the same day. In contrast, other Forex traders may hold positions for longer periods, spanning from a few days to weeks or even months. Each approach carries its own unique characteristics and caters to different trading styles and individual preferences.

Does Forex allow day trading?

Yes, Forex trading permits day trading, and it is a popular strategy among Forex traders. The Forex market operates continuously for 24 hours a day, five days a week, offering abundant opportunities for day traders to capitalize on short-term price movements. Day traders in Forex concentrate on exploiting intraday volatility by entering and exiting positions within the same trading day. Their objective is to capture small price fluctuations and accumulate profits through multiple trades. The Forex market’s high liquidity and easy accessibility make it suitable for day trading, enabling traders to actively participate and respond to market conditions throughout the day.

Which type of trading is most profitable?

Any type of trading can be profitable, as long as traders ensure that they have enough market knowledge, use a disciplined approach, adopt a sound trading strategy, and sign up with a reputable broker that offers them competitive trading conditions.

What is the most successful Forex Day strategy?

There is no single Forex day trading strategy that guarantees consistent success, as trading outcomes are influenced by various factors such as market conditions, risk management, and individual trader preferences. However, one popular and widely used Forex day trading strategy is trend following.

Overview

👉 For over 65 countries across the world, Pepperstone connects traders to domestic and international financial markets and is one of the leading trading brokers according to daily trading volumes. Pepperstone was founded in 2010.

👉 MetaTrader 4, MetaTrader 5, and cTrader are used by Nigerian traders to trade more than 80 financial instruments distributed over currency, commodity markets, bond markets and ETFs.

Unique Features

| ✔️ Pros | ❌ Cons |

| eToro is the leading online social trading platform | Scalping and hedging is not allowed |

| Popular Investor Program offered | There is a limit on the maximum leverage that retail traders may use |

| Free access granted to TipRanks’ expert stock analysis | Spreads are not the tightest |

| Traders can receive push notifications on market volatility, exchange rates, and market events | There is an inactivity fee charged |

| Feature | Information |

| ⚖️ Regulation | Financial Services Commission Mauritius (FSC) |

| 📱 Social Media Platforms | • Facebook |

| ⚖️ CBN Regulation? | No |

| 📱 Trading Accounts | Forex Standard Account (MT4), Forex Micro Account (MT4), Forex ECN Account (MT4/5), Forex Pro Account (MT4) |

| 💻 Trading Platform | MetaTrader 4 and 5 |

| 💸 Minimum Deposit | 2,46 Franc |

| 📱 Trading Assets | Forex Majors, Forex Minors, Forex Exotics, Forex RUB, Spot Metals, Spot Commodities, Stock Trading, Spot Indices |

| 💳 Rwandan Franc-based Account? | Yes |

| 💰 RWF Deposits Allowed? | Yes |

| 💵 Bonuses for Rwandan traders? | Yes |

| 📊 Minimum spread | From 0.4 pips |

| 📱 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| 📉 Minimum trade size | 0.01 lot |

| 📈 Maximum trade size | 250 lots |

Trust Score and Nigerian Market Share

👉 Pepperstone has a very high trust score of 92% and a market share of <5% in Nigeria.

8. Trade Nation

6 Best Day Trading Strategies in Rwanda

The 6 Best Day Trading Strategies in Rwanda revealed. We tested and verified the best day trading strategies for Rwandan Traders.

This is a complete list of day trading strategies in Rwanda.

In this in-depth guide you’ll learn:

- What is a day trading strategy?

- Which brokers offer day trading strategies to Rwandan traders?

- Our six recommended day trading strategies for Rwandan Beginner Traders?

- How to compare day trading strategies against each other?

- What are forex day trading strategy patterns in Rwanda?

- A cheat sheet for day trading strategies.

- What are day trading pattern rules?

- Which broker offers a low minimum deposit on Franc Accounts?

- Which brokers offer a signup bonus for first-time traders?

And lots more…

So if you’re ready to go “all in” with the best day trading strategies for Rwandans…

Let’s dive right in…

10 Best Forex Brokers in South Africa for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

- Louis Schoeman

What is a Day Trading Strategy?

A day trading strategy is a set of rules and techniques that a trader follows to engage in short-term trades within a single trading day. Below, I will provide an explanation of a simple day trading strategy suitable for beginners:

Choose a Trading Style: Determine the trading style that aligns with your personality and schedule. Common styles include scalping (short-term trades lasting seconds to minutes), momentum trading (capitalizing on strong price movements), or breakout trading (entering trades when prices break key levels).

Identify Tradable Instruments: Decide which financial instruments you want to trade, such as stocks, foreign exchange (forex) pairs, commodities, or indices. Ensure that your preferred platform or broker offers access to these instruments.

Conduct Technical Analysis: Utilize technical analysis to identify potential entry and exit points. Study price charts, patterns, and indicators to make informed trading decisions. Look for trends, support and resistance levels, and other technical signals.

Set up Trading Tools: Set up a reliable trading platform with real-time market data and charting capabilities. Ensure it provides access to your preferred instruments and offers essential analysis tools, such as candlestick charts, moving averages, and oscillators.

Define Entry and Exit Criteria: Establish clear criteria for entering and exiting trades. For instance, you may enter a trade when a stock breaks above a specific resistance level or when an indicator generates a buy signal. Determine profit targets and stop-loss levels to manage risk.

Implement Risk Management: Develop a risk management plan to protect your trading capital. Set appropriate position sizes, determine the maximum amount you’re willing to risk per trade and use stop-loss orders. Proper risk management is crucial for long-term success.

Practice and Refine: Practice your strategy using a demo account before trading with real money. Familiarize yourself with the platform, test your strategy in real-time market conditions, and make necessary adjustments. Monitor your performance and refine your approach.

Stay Informed: Continuously educate yourself about the markets and stay updated on relevant news and events that may impact your trading instruments. Economic reports, earnings announcements, and geopolitical developments can influence market volatility.

Remember the Risks: Day trading involves risks, and no strategy guarantees profits. Approach it with discipline, manage your emotions, and be prepared for both wins and losses. Seek guidance from experienced traders or professionals, and comply with local trading regulations.

Please note that trading and investing involve financial risks, and it’s advisable to consult with a qualified financial advisor before making any investment decisions.

6 Best Day Trading Strategies in Botswana (Updated 2024) – Comparison

| 🥇 Broker | ✔️ Day Trading Strategies Offered? | 💸 Minimum Deposit | ✔️ Rwanda Franc-based Account? | 💰 RWF Deposits Allowed? | 👉 Open An Account |

| 1. Admirals | Yes | 977,97 Franc | No | Yes | Open Account |

| 2. Tickmill | Yes | 101,46 Franc | No | No, only USD, GBP, EUR, IDR, CNY, VND, or RUB | Open Account |

| 3. HFM | Yes | 4,89 Franc | Yes | Yes | Open Account |

6 Best Day Trading Strategies in Botswana(Updated 2024)

1. Breakout Strategy

This strategy entails identifying key support and resistance levels on a chart. Traders search for price breakouts above resistance or breakdowns below support levels. When a breakout occurs, traders enter positions with the expectation that the price will continue moving in the direction of the breakout.

2. Trend Following

In this strategy, traders aim to identify and trade in line with an established trend. They seek stocks or other instruments exhibiting clear and sustained upward or downward movements. Trend followers use technical indicators or moving averages to confirm the trend and enter trades aligned with it.

3. Scalping

Scalping focuses on making quick trades and profiting from small price movements. Traders take advantage of short-term volatility, often entering and exiting trades within seconds or minutes. This strategy requires prompt decision-making, tight spreads, and a focus on liquid instruments.

4. Range Trading

Range trading involves identifying price ranges within which an instrument typically trades. Traders look for opportunities to buy near support levels and sell near resistance levels. This strategy assumes that the price will continue oscillating within the range, allowing traders to profit from multiple trades.

5. Reversal Strategy

Reversal traders aim to identify points where a trend is likely to reverse. They search for signs of exhaustion in the prevailing trend, such as overbought or oversold conditions, or the formation of chart patterns like double tops or bottoms. Traders enter trades anticipating a reversal and aim to profit from the subsequent price movement.

6. News Trading

News trading involves capitalizing on significant news events that can cause sudden price fluctuations. Traders monitor economic releases, company earnings announcements, or geopolitical developments to identify opportunities. They enter trades based on the expected impact of the news on the instrument’s price.

Best Trading Platforms for Day Trading Strategies

1. Admirals

Min Deposit

$1 / 1119 RWF

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

• MetaTrader 4

• MetaTrader 5

• Admirals Mobile App

Crypto

Yes

Total Pairs

35 Forex Currency Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Admirals offers Rwandan traders a variety of 47 currency pairs to choose from. Alongside its social trading platform, the company provides a wide range of additional trading opportunities. The all-in costs for EUR/USD trades are typically average 0.6, with an average spread of 0.06.

Day trading does not necessarily require a substantial initial investment, and Rwandan traders have the option to start with as little as $100 when trading with Admirals.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FCA, ASIC, CySEC, EFSA, JSC |

| 📲 Social Media Platforms | • YouTube • Telegram |

| ⚖️ CBN Regulation? | No |

| 💻 Trading Accounts | Trade.MT5, Invest.MT5, Zero.MT5, Bets.MT5, Trade.MT4, Zero.MT4 |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5, Admirals Mobile App |

| 💵 Minimum Deposit | 977,97 Franc |

| 💳 Trading Assets | ESG Trading Instruments, Forex, Cryptocurrency CFDs, Commodities, Indices, Stocks, ETFs, Bonds, Spread Betting |

| ✔️ Rwanda Franc-based Account? | No |

| 💸 RWFP Deposits Allowed? | Yes |

| 💰 Bonuses for Rwandan traders? | No |

| 📊 Minimum spread | From 0.0 pips EUR/USD |

| ✔️ Demo Account | Yes |

| ☪️ Islamic Account | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Admirals is well-regulated in several regions globally | There is an inactivity fee charged |

| Admirals offers commission-free options | Rwandan traders are subject to currency conversion fees |

| The broker accepts Rwandan traders despite their trading skills or trading strategies | There are deposit and withdrawal fees charged |

| There are user-friendly platforms available across devices | There are admin fees charged on the Islamic account |

| There is a wide range of tradable markets, complex instruments, and leveraged products | There is only one account type that can be converted to an Islamic Account |

| Admirals offers the MetaTrader Supreme Edition | |

| Traders are given access to premium analytics | |

| There are several educational materials, resources, and tools offered |

2. Tickmill

Min Deposit

USD 100

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Tickmill has gained a strong reputation among Rwandan investors and traders, despite being relatively new in the Forex markets. The broker offers a wide range of tools and features, including options for forex day trading.

Tickmill supports third-party solutions in addition to its own web platform. Traders using MetaTrader 5 can still access their Tickmill accounts through MetaTrader 4, even though direct support for MetaTrader 5 is not provided. Rwandan traders also have access to ZuluTrade assistance and Tickmill’s own desktop program.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA |

| 📲 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ CBN Regulation? | No |

| 💻 Trading Accounts | Pro Account, Classic Account, VIP Account |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5 |

| 💳 Minimum Deposit | 101,46 Franc |

| 💵 Trading Assets | Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies |

| 📱 Rwanda Franc-based Account? | No |

| ✔️ RWF Deposits Allowed? | No, only USD, GBP, EUR, IDR, CNY, VND, or RUB |

| 💸 Bonuses for Rwandan traders? | Yes |

| 📊 Minimum spread | 0.8 pips |

| 💻 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Tickmill offers robust trading platforms and innovative mobile trading | Currency conversion fees will apply for Franc deposits |

| Tickmill has a very high trust score and is known for its competitive trading conditions | There are no fixed spread accounts offered |

| There are several convenient funding options available including Skrill, Neteller, and others | The spreads are not the tightest |

| Advanced traders can use a range of tools including FIX API, AutoChartist, VPS, and others |

3. HFM

Min Deposit

USD 5

Regulators

CySEC, FSC, CFTC

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

HFM offers Rwandan traders a selection of six different trading accounts to choose from. This allows traders to select an account that aligns with their specific trading preferences and needs. Additionally, HFM provides a leverage of 1:1000, enabling traders to amplify their trading positions. However, it’s crucial to note that leverage carries both potential rewards and risks, and traders should exercise caution when utilizing high leverage. It is advisable for traders to carefully consider their risk tolerance and employ proper risk management strategies when trading with leverage.

Unique Features

| Feature | Value |

| 💰 Minimum Deposit | 4,89 Franc or an equivalent to $5 |

| 💵 Maximum Deposit | Unlimited |

| 💳 Account Base Currencies | USD, ZAR, RWF |

| 📊 Max Leverage Ratio | 1:1000 |

| ✔️ Franc Deposits Allowed? | Yes |

| 💸 Offers a Franc Account? | Yes |

| 📞Rwandan Customer Support? | Yes |

| 💻 Account Types | Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account |

| 📱 Trading Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| ✔️ Negative Balance Protection? | Yes |

| 💰 Margin Call | Between 40% to 50% |

| 🛑 Stop-Out | Between 10% to 20% |

| 📉 Minimum Trade Size | 0.01 lots |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There are tight, competitive spreads from 0.0 pips on EUR/USD | HFM only offers a few deposit and withdrawal methods to Rwandan |

| There is a demo account for beginners who are learning to trade and professional traders who are testing strategies | |

| Rwandan traders can register a trading account in either USD, ZAR, or RWF | |

| Several asset classes can be traded through HFM | |

| Rwandan traders have access to MetaTrader 4 and 5 across desktops, mobile apps, and web-based platforms |

Things to consider when day trading

Day trading success is influenced by various factors that traders should carefully consider. These factors include:

Volatility: Volatility refers to the extent of price movements in the market. Higher volatility can provide more trading opportunities, but it also increases risk. Day traders often prefer markets with sufficient volatility to capitalize on price fluctuations.

Liquidity: Liquidity indicates the ease of buying or selling a financial instrument without causing significant price changes. Trading in liquid markets ensures quick trade execution at desired prices, minimizing slippage. It is crucial to choose liquid markets to facilitate efficient trading.

Timeframe: Day traders focus on short-term timeframes, such as minutes, hours, or intraday charts. Their objective is to take advantage of price movements within a single trading day, typically avoiding overnight positions. Understanding and analyzing price patterns within the chosen timeframe is essential for day trading.

Risk Management: Effective risk management is vital for day traders. Establishing risk-reward ratios, setting stop-loss orders, and adhering to position sizing rules help protect capital. Sound risk management limits potential losses and safeguards the trading account.

Trading Volume: Trading volume represents the number of shares or contracts traded within a specified period. Higher trading volume indicates increased liquidity and active market participation. Day traders seek instruments with sufficient trading volume to ensure smooth trade execution.

News and Market Events: News releases, economic data, earnings reports, and geopolitical events significantly impact financial markets. Day traders must stay informed about relevant news that may affect the instruments they trade. Unexpected news events can lead to increased volatility, presenting both opportunities and risks.

Technical Analysis: Day traders rely heavily on technical analysis to make trading decisions. They utilize various indicators, chart patterns, and tools to identify trends, support and resistance levels, and potential entry and exit points. Understanding and applying technical analysis techniques are crucial for day trading.

Trading Costs: Evaluating trading costs, such as commissions, spreads, and fees charged by the broker, is important. Costs can vary between brokers and affect overall profitability. Comparing trading costs helps in selecting a broker that suits your trading strategy.

Trading Tools and Technology: Using trading platforms and tools that offer real-time market data, advanced charting features, fast order execution, and other functionalities enhances the trading experience. Reliable and efficient trading technology enables traders to respond effectively to market conditions.

Trading Education and Experience: Continuous learning and gaining experience are essential for day traders. Enhance trading skills through educational resources, books, online courses, and trade analysis. Practicing with a demo account allows traders to gain confidence and test strategies without risking real money.

Remember that day trading involves risks, and profits are not guaranteed. It requires discipline, knowledge, experience, and adaptability to changing market conditions. By considering these factors and developing a well-defined trading approach, traders can improve their chances of success in day trading.

Understanding the day trader

To understand day traders, it is crucial to consider their motivations, characteristics, and the challenges they face. Here are key aspects to consider when seeking to understand day traders:

Time Horizon: Day traders operate within a short-term time horizon, buying and selling financial instruments within a single trading day. Their goal is to capitalize on intraday price movements and close all positions before the market closes.

Profit Generation: Day traders aim to generate profits through frequent buying and selling of financial instruments. They seek to take advantage of short-term price fluctuations, aiming to make small gains on each trade that accumulate over time.

Market Monitoring: Day traders actively monitor price movements, news, and market data. They use technical analysis tools and indicators to identify patterns and trends, making quick trading decisions based on their analysis.

Risk Management: Effective risk management is essential for day traders. They carefully assess potential risks and employ techniques such as setting stop-loss orders to limit losses. Risk management protects their trading capital and ensures they can continue trading despite occasional losses.

Trading Psychology: Day trading involves a significant psychological aspect. Traders need discipline, emotional control, and the ability to avoid impulsive decisions driven by fear or greed. They often develop strategies to manage stress and psychological challenges that arise in fast-paced trading.

Continuous Learning: Day traders recognize the importance of ongoing education and improvement. They constantly seek to enhance their knowledge of market dynamics, trading strategies, and risk management techniques. They engage in research, read market-related literature, and learn from their own trading experiences.

Technological Proficiency: Day traders heavily rely on trading platforms, real-time market data, and advanced trading tools. They are proficient in using trading software, charting tools, and execution platforms to enter and exit trades swiftly.

Regulatory Compliance: Day traders adhere to relevant regulations and legal requirements imposed by regulatory authorities. They are familiar with rules regarding margin trading, pattern day trading, tax obligations, and licensing, ensuring their trading activities are within the boundaries of the law.

How to start out with day trading

Day trading, a form of trading where individuals engage in buying and selling various financial instruments, such as stocks, within a single trading day, holds the objective of capitalizing on short-term price fluctuations and reaping profits from these swift transactions. Let’s delve into an elucidation of the mechanics behind day trading:

Capital Requirement: Day trading, as a rule, necessitates a significant amount of capital. The precise sum may vary depending on your specific trading strategy; however, it is vital to possess sufficient funds to meet your broker’s minimum requirements and to endure potential losses.

Trading Tools: To partake in day trading, one must have access to real-time market data, charting software, and a dependable trading platform. These tools enable you to monitor price movements, scrutinize charts, and execute trades promptly.

Trading Strategies: Day traders employ diverse strategies to identify profitable trading opportunities. Popular strategies encompass trend following, momentum trading, breakout trading, and scalping. Each strategy abides by its own set of rules and indicators, dictating when to enter and exit trades.

Technical Analysis: Technical analysis often serves as the backbone of day traders’ decision-making processes. By studying price charts, patterns, and indicators, traders can discern trends, support, and resistance levels, as well as potential entry and exit points. The technical analysis aids in anticipating price movements based on historical data.

Risk Management: Managing risk assumes paramount importance in day trading. Traders establish stop-loss orders to restrict potential losses and implement sound position-sizing techniques to control the amount of capital at stake per trade. Risk management strategies ensure that losses remain manageable and do not detrimentally affect overall trading performance.

Trading Discipline: Day trading demands unwavering discipline and emotional composure. It is crucial to adhere to your trading plan, follow your strategies diligently, and abstain from impulsive decisions driven by emotions. Greed and fear can lead to irrational trading choices; therefore, maintaining a rational approach is essential.

Continuous Learning: Day trading is a skill that necessitates time and practice to develop. It is imperative to continually acquire knowledge and refine your strategies. Stay informed about market news, study accomplished traders, and analyze your own trades to identify areas for improvement.

Remember that day trading carries inherent risks, including the potential for substantial financial losses. It is advisable to commence with a modest amount of capital, gain experience gradually, and then consider committing larger sums. Moreover, be cognizant of any regulations or legal requirements pertaining to day trading in your jurisdiction.

How to Choose a Forex Broker

When choosing a forex broker for Rwandans, it’s important to consider several factors to ensure a reliable and suitable trading experience. Here are some key points to consider:

Regulation: Select a forex broker that is regulated by a reputable financial authority. Regulation helps ensure the broker follows certain standards and provides a level of protection for traders. Look for brokers regulated by well-known authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

Security: Verify the broker’s security measures to safeguard your funds and personal information. Choose a broker that implements strong data encryption, segregated client accounts, and other security protocols. This helps protect your funds from unauthorized access or misuse.

Trading Platform: Evaluate the broker’s trading platform to ensure it meets your requirements. The platform should be user-friendly, stable, and offer fast execution of trades. Popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) are widely used and provide access to a range of trading tools and indicators.

Instrument Availability: Check if the broker offers a wide range of forex currency pairs to trade. Ensure they provide access to major currency pairs as well as minor and exotic pairs, giving you ample trading opportunities.

Competitive Spreads and Fees: Compare the spreads and trading fees charged by different brokers. Lower spreads can reduce trading costs and enhance profitability. Additionally, consider other fees such as deposit/withdrawal charges, inactivity fees, or account maintenance fees.

Deposit and Withdrawal Options: Assess the available deposit and withdrawal methods offered by the broker. Look for options that are convenient and secure for Rwandan traders. Popular methods may include bank transfers, credit/debit cards, or electronic payment systems like Skrill or Neteller.

Customer Support: Evaluate the quality and responsiveness of the broker’s customer support. It’s important to choose a broker that offers reliable customer service, preferably with multilingual support, to address any issues or inquiries promptly.

Educational Resources: Consider brokers that provide educational resources, such as trading tutorials, webinars, or market analysis, to help you improve your trading skills and knowledge.

Local Regulations and Support: Ensure the broker complies with local regulations in Rwanda and provides support tailored to Rwandan traders. This can include localized customer support, language options, and an understanding of any specific requirements or restrictions for traders from Rwanda.

Before finalizing your choice, it’s recommended to research and compare multiple brokers, read reviews from other traders, and consider seeking advice from experienced traders or financial professionals.

The Best Forex Brokers in Botswana

In this comprehensive analysis, we have listed the best Forex brokers or Botswana day traders. Of these brokers, we have further identified the forex brokers that offer additional services and solutions to Botswana traders.

Best Forex Broker for beginner day traders in Botswana

Min Deposit

$1 / 1119 RWF

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

• MetaTrader 4

• MetaTrader 5

• Admirals Mobile App

Crypto

Yes

Total Pairs

35 Forex Currency Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Admirals is considered a low-risk broker and can be summarised as a trustworthy and reliable ECN broker for day trading in Botswana. Regarding spread and security, Admirals guarantees fast trading speeds from a few milliseconds when day trading in Botswana. In terms of users, Admirals has over 7 million registered traders.

Best Forex broker with BWP-based accounts for Botswana day traders

Min Deposit

USD 5

Regulators

CySEC, FSC, CFTC

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

No

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, HFM is considered a low-risk broker and can be summarised as a trustworthy and reliable ECN broker for day trading in Botswana. Regarding spread and security, HFM guarantees fast trading speeds from a few milliseconds when day trading in Botswana. In terms of users, HFM has over 2.5 million registered clients around the world.

Best MT4 Forex broker for Botswana day traders

Min Deposit

USD 100

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Tickmill is considered a low-risk broker and can be summarised as a trustworthy and reliable ECN broker for day trading in Botswana. Regarding spread and security, Tickmill guarantees fast trading speeds from a few milliseconds when day trading in Botswana. In terms of users, Tickmill has over 38 000 registered clients in the UK.

FAQ

What is day trading in Forex?

The foundation of this widely employed strategy lies in the act of trading currencies on the foreign exchange market within the confines of a single trading day. With this approach, positions are opened and closed by the end of each day, with new ones initiated in the subsequent session. Forex day traders engage in the frequent buying and selling of currency pairs throughout the day, aiming to capitalize on minor market fluctuations.

What is the difference between day trading and Forex trading?

Day trading is a specific trading technique employed within the broader domain of Forex trading. While Forex trading encompasses a range of strategies and timeframes, day trading focuses specifically on capitalizing on short-term price fluctuations that occur within a single trading day. Day traders aim to generate profits by swiftly entering and exiting trades within a shorter timeframe, typically within the same day. In contrast, other Forex traders may hold positions for longer periods, spanning from a few days to weeks or even months. Each approach carries its own unique characteristics and caters to different trading styles and individual preferences.

Does Forex allow day trading?

Yes, Forex trading permits day trading, and it is a popular strategy among Forex traders. The Forex market operates continuously for 24 hours a day, five days a week, offering abundant opportunities for day traders to capitalize on short-term price movements. Day traders in Forex concentrate on exploiting intraday volatility by entering and exiting positions within the same trading day. Their objective is to capture small price fluctuations and accumulate profits through multiple trades. The Forex market’s high liquidity and easy accessibility make it suitable for day trading, enabling traders to actively participate and respond to market conditions throughout the day.

Which type of trading is most profitable?

Any type of trading can be profitable, as long as traders ensure that they have enough market knowledge, use a disciplined approach, adopt a sound trading strategy, and sign up with a reputable broker that offers them competitive trading conditions.

What is the most successful Forex Day strategy?

There is no single Forex day trading strategy that guarantees consistent success, as trading outcomes are influenced by various factors such as market conditions, risk management, and individual trader preferences. However, one popular and widely used Forex day trading strategy is trend following.

Overview

👉 Nigerian traders can purchase and sell various financial products with Trade Nation, an authorized online trading broker. It is possible to trade on MetaTrader 4 as well as Trade Nation’s own trading platform, all while performing a variety of analytical tasks.

Unique Features

| Feature | Information |

| 🏛️ Associated Broker | IC Markets |

| 📱 iOS compatible | Yes |

| 📱 Android Compatible | Yes |

| 💰 Assets offered | Forex, Commodities, Indices, Bonds, Cryptocurrencies, Stocks, Futures |

| 💰 Fees Charged | Spreads, Commissions, Overnight Fees, Currency Conversion Fee |

| ✴️ Crypto trading offered | Yes |

| ✔️ User-friendly | Yes |

| 👍 Reviews | Google Play – 3,900 App Store – None |

| ✔️ Ratings | Google Play – 4.3/5 App Store – None |

| 💳 Minimum deposit | 201,20 Rwandan Franc equivalent to $200 |

| 💳 Demo Account | Yes |

| 💰 Rwandan Market Share | 3.7%+ |

| ✔️ PROS | ❌ CONS |