BD Swiss Review

BDSwiss is considered secure and can be summarised as trustworthy. BDSwiss is regulated by the elite CySEC, FSC, BaFIN, and FSA. BDSwiss is currently one of the most reputable platforms, ranked with an overall rating of 9 out of 10.

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

$100

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Yes

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

BD Swiss Review – 23 key points quick overview:

- ✅ BD Swiss Overview

- ✅ BD Swiss at a Glance

- ✅ BDSwiss Regulation and Safety of Funds

- BDSwiss Awards and Recognition

- BDSwiss Account Types and Features

- How to open an Account with BDSwiss in Rwanda

- BD Swiss Vs HF Markets Vs Capital.com – Broker Comparison

- BDSwiss Trading Platforms

- BDSwiss Range of Markets

- Broker Comparison for Range of Markets

- BDSwiss Trading and Non-Trading Fees

- BDSwiss Deposits and Withdrawals

- How to Deposit Funds with BDSwiss

- BDSwiss Fund Withdrawal Process

- BDSwiss Education and Research

- BDSwiss Bonuses and Promotions

- How to open an Affiliate Account with BDSwiss

- BDSwiss Affiliate Program Features

- BDSwiss Customer Support

- BDSwiss Corporate Social Responsibility

- Our Verdict on BDSwiss

- BD Swiss Pros and Cons

- FAQ

BD Swiss Overview

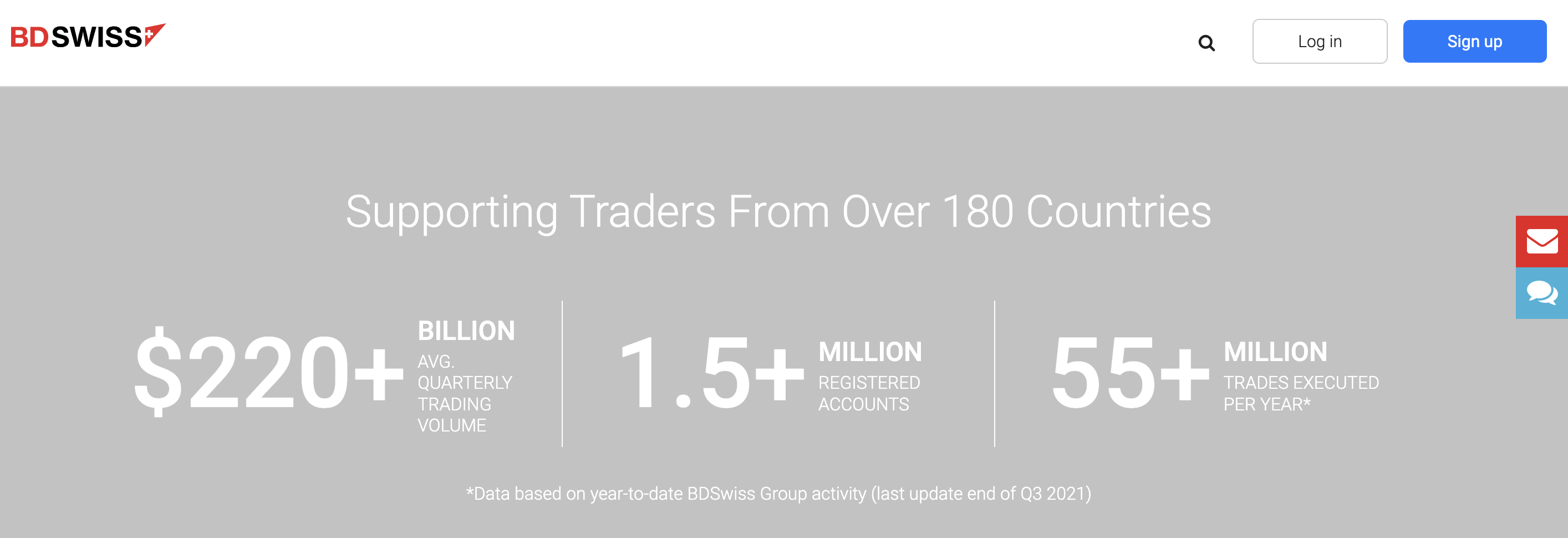

👉 Overall, BDSwiss is considered low-risk, with an overall Trust Score of 83 out of 100. BDSwiss is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). BDSwiss offers four different retail trading accounts namely a Classic Account, Premium Account, VIP Account, and a RAW Account.

👉 BDSwiss Accepts Rwandan Clients and has an average spread from 0.3 pips with commission from 0.15%. BDSwiss has a maximum leverage ratio up to 1:1000 and there is a demo and Islamic account available. MT4, MT5, and BDSwiss platforms are supported. BDSwiss is headquartered in Seychelles and is regulated by CySEC, FSC, BaFIN, and FSA.

👉 BDSwiss was founded in 2012 and has expanded to over a million customers globally since then. BDSwiss is a well-known broker that has grown rapidly to become one of the world’s largest online trading providers.

👉 BDSwiss provides professional traders and institutional customers with the sophisticated tools they need. Additionally, the addition of AutoChartist, professional fund management solutions, real-time notifications, and VPS connection assures that all its customers enter the market well-equipped.

👉 This BDSwiss review for Rwanda will provide local retail traders with the details that they need to consider whether BDSwiss is suited to their unique trading objectives and needs.

BDSwiss Distribution of Traders

👉 BDSwiss currently has the largest market share in these countries:

➡️ Germany – 16.9%

➡️ Italy – 10.3%

➡️ Mexico – 7.2%

➡️ Malaysia – 5.8%

➡️ Brazil – 5.1%

Popularity among traders who choose BDSwiss

🥇 BDSwiss is a globally recognized broker that welcomes traders from all around the world. Although BDSwiss does not have a big market share in Rwanda, the broker is nonetheless in the Top 100 brokers for Rwandan traders.

BD Swiss at a Glance

| 🏙 Headquartered | Seychelles |

| 🏛 Global Offices | Cyprus, Mauritius |

| 💻 Local Market Regulator in Rwanda | The National Bank of Rwanda (BNR) |

| 💸 Foreign Direct Investment in Rwanda | 99.92 USD Million in 2020 |

| 🔄 Foreign Exchange Reserves in Rwanda | 1,806 million US dollars in 2020 |

| 🏛 Local office in Kigali? | No |

| 👨⚖️ Governor of SEC in Rwanda | None, John Rwangombwa is the Governor of the National Bank of Rwanda |

| ✔️ Accepts Rwandan Traders? | Yes |

| 🗓 Year Founded | 2012 |

| ☎️ Rwandan Traders Office Contact Number | None |

| 📲 Social Media Platforms | • Facebook • YouTube • Blog • Telegram |

| ⚖️ Regulation | CySEC, FSC, BaFIN, FSA |

| 1️⃣ Tier-1 Licenses | • Federal Financial Supervisory Authority (BaFIN) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) Seychelles • Financial Services Commission (FSC) Mauritius |

| 🪪 License Number | • Cyprus – 199/13 • Mauritius – C116016172 • Germany – 10134687 • Seychelles – SD047 |

| ⚖️ BNR Regulation | No |

| 🏛 Regional Restrictions | The United States, Belgium, and other OFAC sanctioned regions |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 4 |

| ✔️ PAMM Accounts | No |

| 💵 Liquidity Providers | None indicated |

| 💰 Affiliate Program | Yes |

| ➡️ Order Execution | Instant, Market |

| 📊 Starting spread | From 0.3 pips |

| 💸 Minimum Commission per Trade | From 0.15% |

| 💵 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 50% |

| 🛑 Stop-Out | 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 50 lots |

| 💰 Crypto trading offered? | Yes |

| ✔️ Offers an RWF Account? | No |

| 👥 Dedicated Rwandan Traders Account Manager? | No |

| 📊 Maximum Leverage | 1:1000 |

| 📈 Leverage Restrictions for Rwanda? | None |

| 💵 Minimum Deposit (RWF) | 102,000 RWF or an equivalent to $100 |

| ✔️ Rwandan franc Deposits Allowed? | No, only USD, GBP, EUR |

| 📊 Active Rwandan Traders Trader Stats | 50,000+ |

| 👥 Active Rwandan Traders-based BD Swiss customers | Unknown |

| 🔄 Rwanda Daily Forex Turnover | Unknown, the overall trading volume of over $6.6 trillion |

| 💰 Deposit and Withdrawal Options | • Bank wire transfer • Debit Cards • Credit Cards • Skrill • Neteller |

| 📉 Minimum Withdrawal Time | 10 minutes |

| 📈 Maximum Estimated Withdrawal Time | 7 to 10 working days |

| 💰 Instant Deposits and Instant Withdrawals? | No |

| 🤝 Segregated Accounts with Rwandan Traders Banks? | No |

| 💻 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • BDSwiss Mobile • BDSwiss Web |

| 💵 Tradable Assets | • Forex • Commodities • Shares • Indices • Cryptocurrencies |

| 💸 Offers USD/RWF currency pair? | No |

| 📊 USD/RWF Average Spread | N/A |

| ✅ Offers Rwandan Traders Stocks and CFDs | No |

| 📖 Languages supported on the Website | English, Czech, German, Italian, Spanish, Korean, French, Norwegian, Polish, Danish, Arabic, Malaysian, Thai, Vietnamese, Filipino, Hindi, Indonesian, Chinese, Portuguese, Romanian, Turkish, Russian |

| 📘 Customer Support Languages | Multilingual |

| 🗣 Copy Trading Support | Yes, only for Partners |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Rwandan Traders-based customer support? | None |

| 💰 Bonuses and Promotions for Rwandan Traders | None |

| 📚 Education for Rwanda beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🏅 Most Successful Rwandan Trader | Unknown |

| ✔️ Is BD Swiss a safe broker for Rwandan Traders? | Yes |

| 🎖 Rating for BD Swiss Rwanda | 9/10 |

| 🥇 Trust score for BD Swiss Rwanda | 83% |

| 👉 Open An Account | 👉 Open Account |

BDSwiss Regulation and Safety of Funds

BDSwiss Regulation in Rwanda

👉 While BDSwiss is not regulated by the National Bank of Rwanda (BNR) to offer services to Rwandan traders, it is supervised by other trustworthy agencies.

BDSwiss Global Regulations

👉 BDSwiss is a part of the BDSwiss Group and a global leader in foreign exchange and contracts for difference (CFD) trading across a wide range of asset classes. BDSwiss is a well-known brand, noted for its award-winning conditions, industry-leading trading technologies, and competitive pricing.

👉 BDSwiss is a subsidiary of a Swiss-based global company and is regulated by the following market regulators:

➡️ In Cyprus, the Cyprus Securities and Exchange Commission (CySEC) regulates BDSwiss Holding Ltd under license number 199/13.

➡️ In Mauritius, the Financial Services Commission (FSC) regulates BDS Markets under license number C116016172.

➡️ In Germany, the Federal Financial Supervisory Authority (BaFIN) regulates BDSwiss GmbH under registration number HRB 160749B.

➡️ In Seychelles, Financial Services Authority (FSA) regulates and oversees BDS Ltd under license number SD047.

BDSwiss Client Fund Security and Safety Features

👉 BDSwiss, as a regulated investment business, must comply with all European and local rules and regulations governing the provision of investment services, the conduct of investing activities, and the operation of regulated markets.

👉 BDSwiss does not maintain customer cash in its own bank accounts. They are separated into top-tier banks to prevent their use for other purposes, such as operating expenditures. The client’s cash must be withdrawable immediately and efficiently.

👉 All customer information is secured using modern and robust security methods and is never shared with third parties.

BDSwiss Awards and Recognition

👉 During its time in business, BDSwiss has been recognized with several prestigious accolades in its field, the most recent of which are as follows:

➡️ In 2021, the World Finance Awards granted the “Best FX Education & Research Provider” title to BDSwiss.

➡️ In 2021, the Global Banking and Finance Awards recognized BDSwiss with the “Best Mobile Trading Platform in Europe” award.

➡️ In the year 2020, BDSwiss received the “Best FX & CFD Provider” award at the International Investor Awards.

BDSwiss Account Types and Features

👉 BDSwiss’ four retail investor accounts provide more than 250 financial products in total. These are the presently accessible user accounts:

➡️ Classic Account

➡️ Premium Account

➡️ VIP Account

➡️ RAW Account

| 💻 Live Account | 💰 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💵 Average Trading Cost |

| ➡️ Classic | 102,000 RWF or $100 | 1.5 pips | 0.15% Indices | 15 USD |

| ➡️ VIP | 3,000,000 RWF or $3,000 | 1.1 pips | 0.15% Shares | 11 USD |

| ➡️ RAW | 5,100,000 RWF or $5,000 | 0.3 pips | From 0.15% | 8 USD |

| ➡️ Premium | 102,000 RWF or $100 | 1.1 pips | None | 11 USD |

BDSwiss Live Trading Accounts

Classic Account

👉 Rwandan traders of all levels of experience and trading styles use this account, which is a basic trading account. The commission-free Classic Account requires a minimum deposit of 102,000 Rwandan francs (or ten US Dollars) and spreads on the EUR/USD start at 1.5 pips (which is wider than the industry average).

👉 Only a limited number of built-in trend analysis tools are available to traders, including the trading school and live webinars. AutoChartist can be accessed by traders with a $500 account balance. Other features of the Classic Account are indicated below.

| Account Features | Value |

| 📊 Average Spread on EUR/USD | 1.5 pips |

| 📈 Maximum Leverage | 1:500 |

| 🔨 Tradable Instruments | Over 250 |

| ✔️ Available Assets | • Forex CFDs • Stocks CFDs • Indices CFDs • Commodities CFDs • Cryptocurrencies • CFDs |

| 💵 Commissions per round lot | • $2 on Indices • 0.15% on Shares |

| 📞 Margin Call | 50% |

| 🛑 Stop-out level | 20% |

| 💰 Instant Withdrawals offered? | Yes, only on credit cards up to 2,000 €/$/£ |

| 💸 0% fees on Deposits and CC Withdrawal? | Yes |

| 💻 Platforms available | All |

| 🚨 Are trading alerts offered? | Limited Access granted |

| ✅ AutoChartist Performance Stats offered? | Yes, with a 500,000 RWF minimum deposit ($500) |

| 👥 Personal Account Manager | Yes, with a 1,000,000 RWF minimum deposit ($1,000) |

| ✔️ Priority Service | No |

| 🔨 AutoChartist Standard Tools | Yes |

| ✔️ Access to Trading Central? | Yes |

| 💻 Trading Academy and Live Webinars | Yes |

| 👥 Trade Companion offered? | No |

| ☪️ Islamic Account option? | Yes |

| ✔️ VIP Webinars | No |

| ⏰ 24/5 Customer Service and Support? | Yes |

| 💰 Minimum deposit requirement | 102,000 RWF or an equivalent to $100 |

Premium Account

👉 The Premium Account is the next account tier up from the Classic Account, and it comes with more features and perks for Rwandan traders.

👉 This account’s minimum deposit is also $100, like with the Classic Account. Leverage is up to 1000:1 for main Forex pairings and spreads start at 1.1 pips on EUR/USD, a little wider than other comparable brokers.

| Account Features | Value |

| 📊 Average Spread on EUR/USD | 1.1 pips |

| 📈 Maximum Leverage | 1:1000 |

| 🔨 Tradable Instruments | Over 70 |

| ✔️ Available Assets | • Forex CFDs • Commodities CFD’s |

| 💵 Commissions per round lot | None |

| 📞 Margin Call | 50% |

| 🛑 Stop-out level | 20% |

| 💰 Instant Withdrawals offered? | Yes, only Credit Cards up to 2,000 €/$/£ |

| 💸 0% fees on Deposits and CC Withdrawal? | Yes |

| 💻 Platforms available | BDSwiss Web, BDSwiss Mobile, MetaTrader 4 |

| 🚨 Are trading alerts offered? | Limited Access granted |

| ✅ AutoChartist Performance Stats offered? | Yes, with a 500,000 RWF minimum deposit ($500) |

| 👥 Personal Account Manager | Yes, with a 1,000,000 RWF minimum deposit ($1,000) |

| ✔️ Priority Service | No |

| 🔨 AutoChartist Standard Tools | Yes |

| ✔️ Access to Trading Central? | Yes |

| 💻 Trading Academy and Live Webinars | Yes |

| 👥 Trade Companion offered? | No |

| ☪️ Islamic Account option? | Yes |

| ✔️ VIP Webinars | No |

| ⏰ 24/5 Customer Service and Support? | Yes |

| 💰 Minimum deposit requirement | 102,000 RWF or an equivalent to $100 |

VIP Account

👉 The BDSwiss VIP Account is specifically designed for professional traders and investors who are looking for the best trading conditions and additional features on the market.

👉 Spreads on the EUR/USD start at 1.1 pips, and the minimum deposit on the VIP Account is 3,000 USD. There are various trading and instructional tools included with the VIP Account, including AutoChartist, a dedicated account manager, and VIP access to trend analysis.

| Account Features | Value |

| 📊 Average Spread on EUR/USD | 1.1 pips |

| 📈 Maximum Leverage | 1:500 |

| 🔨 Tradable Instruments | Over 250 |

| ✔️ Available Assets | • Forex CFDs • Stocks CFDs • Indices CFDs • Commodities CFDs • Cryptocurrencies CFDs |

| 💵 Commissions per round lot | 0.15% on Shares |

| 📞 Margin Call | 50% |

| 🛑 Stop-out level | 20% |

| 💰 Instant Withdrawals offered? | Yes |

| 💸 0% fees on Deposits and CC Withdrawal? | All |

| 💻 Platforms available | VIP Access |

| 🚨 Are trading alerts offered? | Limited Access granted |

| ✅ AutoChartist Performance Stats offered? | Yes, with a 500,000 RWF minimum deposit ($500) |

| 👥 Personal Account Manager | Yes, with a 1,000,000 RWF minimum deposit ($1,000) |

| ✔️ Priority Service | Yes |

| 🔨 AutoChartist Standard Tools | Yes |

| ✔️ Access to Trading Central? | Yes |

| 💻 Trading Academy and Live Webinars | Yes |

| 👥 Trade Companion offered? | Yes |

| ☪️ Islamic Account option? | Yes |

| ✔️ VIP Webinars | No |

| ⏰ 24/5 Customer Service and Support? | Yes |

| 💰 Minimum deposit requirement | 3,000,000 RWF or an equivalent to $3,000 |

Raw Account

👉 The Raw Account offers raw spreads in exchange for a higher minimum deposit of 5000 USD and is geared for professional traders such as day traders, scalpers, high-frequency, and high-volume traders.

👉 Spreads on major currency pairings could fall to zero pips at times, although the EUR/USD averages at 0.3 pips. Forex pairings impose a modest fee of USD 5 every round turn. In addition, this account does not have an Islamic (swap-free) option because of its nature and unique conditions.

| Account Features | Value |

| 📊 Average Spread on EUR/USD | 0.3 pips |

| 📈 Maximum Leverage | 1:500 |

| 🔨 Tradable Instruments | Over 250 |

| ✔️ Available Assets | • Forex CFDs • Stocks CFDs • Indices CFDs • Commodities CFDs • Cryptocurrencies CFDs |

| 💵 Commissions per round lot | • $2 on Indices • $5 on all forex currency pairs • 0.15% on Shares |

| 📞 Margin Call | 50% |

| 🛑 Stop-out level | 20% |

| 💰 Instant Withdrawals offered? | Yes, only Credit Cards up to 2,000 €/$/£ |

| 💸 0% fees on Deposits and CC Withdrawal? | Yes |

| 💻 Platforms available | BDSwiss Mobile, BDSwiss Web, MetaTrader 4 |

| 🚨 Are trading alerts offered? | VIP Access |

| ✅ AutoChartist Performance Stats offered? | Yes |

| 👥 Personal Account Manager | Yes |

| ✔️ Priority Service | Yes |

| 🔨 AutoChartist Standard Tools | Yes |

| ✔️ Access to Trading Central? | Yes |

| 💻 Trading Academy and Live Webinars | Yes |

| 👥 Trade Companion offered? | Yes |

| ☪️ Islamic Account option? | No |

| ✔️ VIP Webinars | Yes |

| ⏰ 24/5 Customer Service and Support? | Yes |

| 💰 Minimum deposit requirement | 5,100,000 RWF or an equivalent to $5,000 |

BDSwiss Base Account Currencies

👉 With BDSwiss, Rwandan traders can only register a trading account with USD, GBP, or EUR as their base account currency.

BDSwiss Demo Account

👉 A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

👉 There is a certain degree of risk involved when trading financial markets and BDSwiss offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

👉 BDSwiss provides a risk-free Forex or CFD trial account that enables you to learn and practice trading methods as well as analyse trading conditions before opening a live account with the broker.

👉 After creating your BDSwiss account, you may open a demo account with a $10,000 initial virtual deposit to test the WebTrader platform, MetaTrader4/MetaTrader5, or mobile app. Additionally, by resetting your demo account, you can restore its original amount of $10,000.

BDSwiss Islamic Account

👉 Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

👉 This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

👉 Retail Muslim traders who use the Classic, Premium, or VIP account options can convert their accounts to an Islamic account, whereas Raw Account holders are unable to convert their accounts to an Islamic account.

How to open an Account with BDSwiss in Rwanda

👉 BDSwiss features a straightforward application form that can be completed in a matter of minutes.

➡️ Traders are required to supply some basic information as well as verify their email addresses.

➡️ To complete the Know Your Customer (KYC) procedure, traders must give evidence of their identification as well as their residence address after they have finished the application process.

➡️ Once the papers have been verified against the details provided, the account will be authorized, and Rwandan traders will be able to fund the trading account to begin trading immediately.

BD Swiss Vs HF Markets Vs Capital.com – Broker Comparison

| 🥇 BD Swiss | 🥈 HF Markets | 🥉 Capital.com | |

| ⚖️ Regulation | CySEC, FSC, BaFIN, FSA | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA | FCA, ASIC, CySEC, NBRB, FSA |

| 💻 Trading Platform | • MetaTrader 4 • MetaTrader 5 • BDSwiss Mobile • BDSwiss Web | • MetaTrader 4 • MetaTrader 5 | • Capital.com • MetaTrader 4 • TradingView |

| 💵 Withdrawal Fee | Yes, <100 EUR withdrawals | No | No |

| ✔️ Demo Account | Yes | Yes | Yes |

| 💰 Min Deposit | 102,000 RWF | 5,100 RWF | 20,500 RWF |

| 📊 Leverage | Up to 1:1000 | 1:1000 | • NBRB – 1:100 • FCA – 1:30 • ASIC/CySEC – 1:30 |

| 📈 Spread | From 0.3 pips | 0.0 pips | Variable, from 0.6 pips |

| 💸 Commissions | $2 to $5 | $3 to $4 | None |

| 🛑 Margin Call/Stop-Out | 50%/20% | • 40%/10% • 50%/20% | 100%/50% |

| 📲 Order Execution | Instant/Market | Market | Market |

| ✔️ No-Deposit Bonus | No | No | No |

| ✅ Cent Accounts | In Progress | No | No |

| 💻 Account Types | • Classic Account • Premium Account • VIP Account • RAW Account | • Micro Account • Premium Account • HFcopy Account • Zero Spread Account • Auto Account | • Live Account (Retail or Professional) |

| ⚖️ BNR Regulation | No | Yes | No |

| 💵 RWF Deposits | No | Yes | Yes |

| ✔️ Rwandan franc Account | No | No | No |

| 📞 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 🛍 Retail Investor Accounts | 4 | 5 | 1 |

| ☪️ Islamic Account | Yes | Yes | No |

| 📉 Minimum Trade Size | 0.01 pips | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 50 lots | 60 lots | Depends on the account balance |

| 📊 Minimum Withdrawal Time | 10 Minutes | 10 minutes | Instant |

| ⏱ Maximum Estimated Withdrawal Time | Between 7 to 10 days | Up to 10 days | Up to 3 Working Days |

| ✔️ Instant Deposits and Instant Withdrawals? | No | No | Yes |

Min Deposit

$100

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Yes

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

BDSwiss Trading Platforms

👉 BDSwiss offers Rwandan Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ BDSwiss Mobile

➡️ BDSwiss Web

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

👉 As a well-known and uncomplicated trading platform in the financial industry, MT4 enables traders to trade from any location and at any time while using strong charting tools and indicators to help them manage risk while increasing their chances of properly anticipating price direction.

👉 Users of a BDSwiss account in Rwanda can easily make use of some of the most comprehensive features and trading tools available through this platform

MetaTrader 5

👉 A few new features, such as more complex trading tools and indicators, were added to MetaTrader 5 at launch, which is the successor to MetaTrader 4. However, the basic design of MetaTrader 4, which Rwanda traders are familiar with, is retained. MetaTrader 5 is a powerful trading platform that can be used to conduct market research and trade.

👉 Advanced order kinds, over 80 technical indicators, over 40 analytical objects, a variety of charting and analytic options, and a variety of periods are just a few of the extra features available.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ BDSwiss Web

MetaTrader 4

👉 MetaTrader 4 and MetaTrader 5 both have web-based systems that do not need any further software to be installed. Many traders use MT4 because of its excellent charting capabilities, as well as its tools and, most importantly, the add-ons that may assist traders in refining and improving their trading methods across a wide range of financial markets.

MetaTrader 5

👉 In addition, due to its enhanced features and numerous analytical choices, MT5, a newer version of the MetaTrader program, is highly popular. Rwandan traders would also have access to a variety of trading tactics to select from, including manual and automated trading employing expert advisors (EAs).

BDSwiss Web

👉 The patented BDSwiss WebTrader is web-based, which means that there are no downloads or installations required, and you may trade directly from your browser at any time.

👉 With a straightforward user interface and a robust set of analytical functions, including technical analysis and risk management tools, the platform is easy to use.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ BDSwiss Mobile

MetaTrader 4

👉 Rwandan traders have unfettered access to a broad variety of financial goods via the BDSwiss app for MetaTrader 4, which is available through the MetaTrader 4 platform. There have been updates to certain MetaTrader 4 operations and features to accommodate mobile trading throughout the globe.

MetaTrader 5

👉 With the MT5 mobile app, BDSwiss customers can trade a wide range of CFD instruments across a wide range of asset classes. The app is designed to provide a better trading experience than the web-based trading platform due to its customizable settings, the absence of strategy limits, reduced slippage, and lightning-fast order execution.

BDSwiss Mobile

👉 BDSwiss has created a smartphone application that has received positive feedback from both retail traders in Rwanda and members of the media across the globe. All the essential activities are accessible from one location, allowing you to carry out in-depth analysis, check on open positions, manage them, and access your account administration either on the road or at home.

BDSwiss Range of Markets

👉 Rwandan Traders can expect the following range of markets from BDSwiss:

➡️ Forex

➡️ Commodities

➡️ Shares

➡️ Indices

➡️ Cryptocurrencies

Financial Instruments and Leverage offered by BDSwiss

| 🔨 Instrument | ✔️ Number of Assets Offered | 📈 Maximum Leverage Offered |

| ➡️ Forex | 50 | 1:1000 |

| ➡️ Commodities | 6 | 1:200 |

| ➡️ ETFs | 0 | – |

| ➡️ Indices | 10 | 1:100 |

| ➡️ Stocks | 141 | 1:5 |

| ➡️ Cryptocurrency | 27 | 1:5 |

| ➡️ Options | 0 | – |

| ➡️ Bonds | 0 | – |

Broker Comparison for Range of Markets

| 🥇 BD Swiss | 🥈 HF Markets | 🥉 Capital.com | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | No |

BDSwiss Trading and Non-Trading Fees

Spreads

👉 BDSwiss provides its clients with tight spreads on a wide range of products, regardless of the kind of account they use. The following are the varied spreads that Rwandan traders might anticipate from BDSwiss:

➡️ Classic Account – 1.5 pips

➡️ Premium Account – 1.1 pips

➡️ VIP Account – 1.1 pips

➡️ RAW Account – 0.3 pips

Commissions

👉 BDSwiss charges a fee for trading facilitation on certain accounts and financial instruments, which helps to cover the costs of facilitating the trade. Different kinds of trading accounts are subject to commissions, which are as follows:

➡️ Classic Account – $2 on indices and 0.15% on shares

➡️ VIP Account – 0.15% on shares

➡️ RAW Account – $2 on indices, $5 on forex pairs, 0.15% on shares

Overnight Fees, Rollovers, or Swaps

👉 Positions that are held for longer than 24 hours will be subject to the exchange rates charged by BDSwiss, indicated as a separate fee. Interest can either be accrued for each night that a position is held, or it can be paid out (or earned), depending on the position that is held.

👉 If you trade Forex instruments, the amount you are charged or that you receive is decided by the positions you take (whether long or short) and the rate differentials between the two currencies that are being exchanged. Some typical overnight fees that Rwandan traders can expect are as follows:

| 🔨 Instrument | 📈 Short Swap | 📉 Long Swap |

| GBP/USD | -0.7 pips | -6.7 pips |

| USD/JPY | -10.8 pips | 0.05 pips |

| USD/HKD | -8.5 pips | -20.0 pips |

| USOIL | -23.0 pips | -39.0 pips |

| XAU/USD | -3.5 pips | -8.2 pips |

| XAG/USD | -0.05 pips | -0.25 pips |

| Stocks | -2.0 pips | -4.0 pips |

| NAS100 | -4.1706 pips | -3.2694 pips |

| Crypto | -100% | -100% |

Deposit and Withdrawal Fees

👉 Deposits to BDSwiss are completely free regardless of the payment method that Rwandan traders choose. However, any withdrawals of less than 100 EUR, GBP, or USD made using a bank wire will incur a fee of ten euros (or equivalent).

Inactivity Fees

👉 BDSwiss charges a 10% inactivity fee after three months that there is no trading activity.

Currency Conversion Fees

👉 Deposits made in any currency other than the British pound, the euro, or the dollar are subject to currency conversion fees for Rwandan traders.

BDSwiss Deposits and Withdrawals

👉 BDSwiss offers the following deposit and withdrawal methods:

➡️ Bank wire transfer

➡️ Debit Card

➡️ Credit Card

➡️ Skrill

➡️ Neteller

Broker Comparison: Deposit and Withdrawals

| 🥇 BD Swiss | 🥈 HF Markets | 🥉 Capital.com | |

| Minimum Withdrawal Time | 10 Minutes | 10 minutes | Instant |

| Maximum Estimated Withdrawal Time | Between 7 to 10 days | Up to 10 days | Up to 3 Working Days |

| Instant Deposits and Instant Withdrawals? | No | No | Yes |

BDSwiss Deposit and Withdrawal Processing time, Minimum Withdrawal Amount

| 💰 Payment Method | 💵 Deposit Processing | 💸 Withdrawal Processing | 💰 Min Withdrawal |

| Bank wire transfer | 2 to 5 days | 7 to 10 days | 100 EUR |

| Debit Card | 10 minutes | 2 to 7 days | None |

| Credit Card | 10 minutes | 2 to 7 days | None |

| Skrill | 10 minutes | 10 minutes | None |

| Neteller | 10 minutes | 10 minutes | None |

How to Deposit Funds with BDSwiss

👉 To deposit funds to an account with BDSwiss, Rwandan Traders can follow these steps:

➡️ Log in to your BDSwiss profile and choose “Payments” followed by “Deposits.”

➡️ Then, from the navigation bar, choose the account that needs to be financed.

➡️ Enter the amount of the deposit.

➡️ If you have chosen a payment option, go to the payment page by clicking “Proceed to Payment.”

➡️ Before the deposit can be validated and processed, you must complete any further steps necessary by the payment provider after confirming the deposit details on the next page.

BDSwiss Fund Withdrawal Process

👉 To withdraw funds from an account with BDSwiss, Rwandan Traders can follow these steps:

➡️ Log into your account from the BDSwiss website or the proprietary trading platform.

➡️ Complete a withdrawal request by choosing the account from where funds will be withdrawn, the withdrawal method, and the withdrawal amount.

➡️ Follow any additional instructions as per your payment provider and submit the withdrawal request.

BDSwiss Education and Research

Education

👉BDSwiss offers the following Educational Materials:

➡️ Educational Videos

➡️ Seminars

➡️ Live Education

➡️ Forex Basic Lessons

➡️ Forex Glossary

➡️ A learning centre with an introduction to trading

➡️ Forex eBooks

Research and Trading Tool Comparison

| 🥇 BD Swiss | 🥈 HF Markets | 🥉 Capital.com | |

| Economic Calendar | Yes | Yes | Yes |

| VPS | Yes | Yes | No |

| AutoChartist | No | No | No |

| Trading View | Yes | No | No |

| Trading Central | No | Yes | No |

| Market Analysis | Yes | Yes | Yes |

| News Feed | Yes | Yes | Yes |

| Blog | Yes | Yes | Yes |

👉 BDSwiss offers Rwandan Traders the following Research and Trading Tools:

➡️ Daily Market Analysis

➡️ Analyst financial commentary and insights

➡️ Technical Analysis

➡️ Daily Videos

➡️ Weekly Outlook

➡️ Market Insights

➡️ Special Reports

➡️ Live Daily Webinars

➡️ Economic Calendar

➡️ VPS Service

➡️ Trade Comparison

➡️ Trend Analysis

➡️ Trading Central

➡️ AutoChartist

➡️ Real-Time Trading Alerts

➡️ Currency Heatmap

➡️ Trading Calculators

BDSwiss Bonuses and Promotions

👉 BDSwiss does not indicate any bonuses or promotions on the official website.

Min Deposit

$100

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Yes

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

How to open an Affiliate Account with BDSwiss

👉 To register an Affiliate Account, Rwandan Traders can follow these steps:

➡️ Go to the official BDSwiss website and choose “Partners” from the drop-down menu.

➡️ Review the affiliate and partner possibilities and pick one by clicking “Start Now” under the appropriate option on the left side of the screen.

➡️ BDSwiss will review your registration when you have completed the online application form and sent it to them.

➡️ Rwandans will be able to begin exploring the advantages of being a BDSwiss affiliate as soon as their application has been granted, and they will have access to a complete partner package.

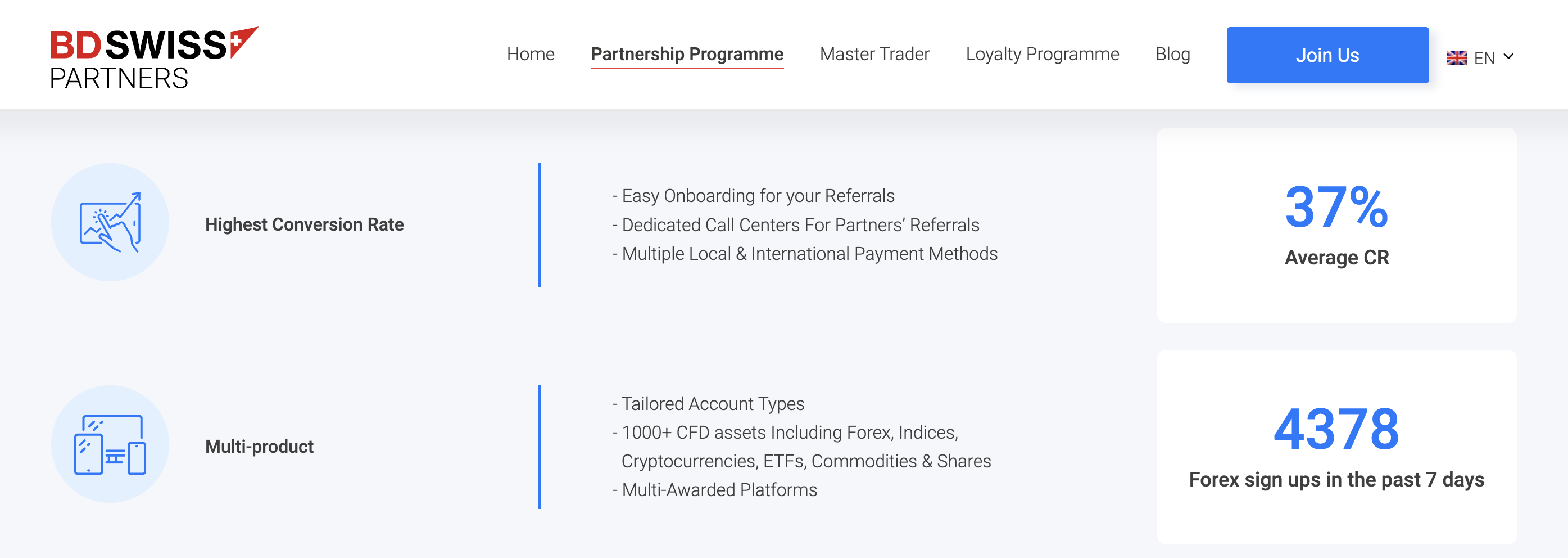

BDSwiss Affiliate Program Features

👉 You must have a significant online presence, such as a website or social media accounts, to be accepted into the BDSwiss affiliate program. While promoting BDSwiss goods and services, the affiliate can earn money on the transactions that are generated by the referral.

👉 Affiliates can make use of a variety of marketing and tracking options provided by BDSwiss. The affiliate program informs partners about the affiliate commission options available via BDSwiss and offers them the following features and advantages:

➡️ A very high conversion rate and simple referral onboarding.

➡️ Dedicated contact centre and a variety of local and international payment options with regular pay-outs.

➡️ Many customized account types, a diverse choice of CFD instruments, and multiple award-winning trading platforms comprise our multi-product solutions.

➡️ A response rate of 100% within 13 seconds, has been tried and tested by several different partners.

➡️ Effective tracking solutions that apply to tracking, administration, and ad serving are required.

➡️ More features include independent mobile traffic monitoring, comprehensive report performance, and more.

BDSwiss Customer Support

👉 BDSwiss is well-known for its award-winning customer support that can be reached over several communication channels.

| Customer Support | BD Swiss’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English, French, Italian, Spanish, German, Portuguese |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| 📞 Telephonic Support | Yes |

| ✔️ Local Support in Rwanda? | No |

| 🥇 Overall quality of BD Swiss Support | 4/5 |

BDSwiss Corporate Social Responsibility

👉 Employees at BDSwiss are instilled with philanthropic ideas, and the company fosters both a global and local engagement culture.

👉 “Elpida” Foundation for Children with Cancer & Leukaemia received a donation of €5,000 from BDSwiss once again. Children with cancer and their families benefited from this kind of effort on both a material and an emotional level.

👉 A blood donation drive in Limassol was organized by BDSwiss on December 10, 2021, as part of its corporate social responsibility. BDSwiss workers, friends, and family members volunteered their time and resources to help with the camp’s blood drive.

Our Verdict on BDSwiss

👉 A BDSwiss review reveals a corporation that has grown its customer base to more than a million. Global customers may take advantage of steady trading conditions and a global proposal.

👉 Because they are regulated in the European Union and have extra registrations, BDSwiss depends on Swiss financial competence and offers trading opportunities to most traders around the world.

👉 BDSwiss Group works on a near-global scale under multiple companies and agencies. Trades can be executed in less than a second on each of the three primary trading platforms, with an average execution time of 0.01s.

👉 The greatest advantages supplied by BDSwiss are the large asset variety and the company’s research services and the fact that a renowned fundamental analyst directs the research team. In addition to daily and weekly evaluations, BDSwiss also offers quarterly outlooks, video briefings, and special reports, all of which are available around the clock.

BD Swiss Pros and Cons

| ✔️ Pros | ❌ Cons |

| BDSwiss is multi-regulated and offers more than 250 financial instruments | There are many non-trading fees charged including an inactivity fee, withdrawal fee, and currency conversion fee |

| BDSwiss gives beginners access to a plethora of educational materials | There is no RWF-denominated account or deposit options |

| There is a demo account offered for an unlimited time | The BDSwiss platform is not offered on desktop computers |

| Muslim traders can convert their live trading account into an Islamic Account (all except the Raw Account) | The spreads charged are not the tightest |

| BDSwiss supports all trading strategies | There are no fixed spread accounts offered to Rwandan traders |

| There are advanced trading tools and resources offered to traders | |

| There is a high leverage ratio of up to 1:1000 offered | |

| There are three powerful trading platforms offered across devices |

FAQ

Is BDSwiss good for beginners?

Yes, BDSwiss is a beginner-friendly broker that offers simple-to-use platforms as well as comprehensive teaching and research tools.

Does BDSwiss have Volatility 75?

No, BDSwiss does not currently offer Rwandan traders access to Volatility 75 (VIX) but offers several other popular indices including Nasdaq.

Does BDSwiss have Nasdaq?

Yes, BDSwiss offers Nasdaq. Nasdaq can be traded through three platforms using the competitive trading conditions supplied by BDSwiss.

Is BDSwiss regulated?

Yes, BDSwiss is multi-regulated by CySEC in Cyprus, FSA in Seychelles, BaFIN in Germany, and FSC in Mauritius.

Does BDSwiss allow scalping?

Yes, BDSwiss accepts and allows different trading strategies including hedging, scalping, and copy trading.

What is the withdrawal time for BDSwiss?

BDSwiss processes all withdrawals within 48 hours. The withdrawal processing time will depend on the payment method used for withdrawals and the processing time averages between 10 minutes and 10 days.

Does BDSwiss have CopyTrade?

Yes, Copytrading is offered to Affiliates and partners but not retail traders.

Conclusion

👉 Now it is your turn to participate:

➡️ Do you have any prior experience with BDSwiss?

➡️ What was the determining factor in your decision to engage with BDSwiss?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with BDSwiss such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

👉 Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

👉 No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Table of Contents